Syndicate to launch 1b SYND tokens this September

Application chain infrastructure Syndicate is preparing to release its native token SYND this month. Around 2% of the token supply had already been distributed via airdrop.

- Syndicate is preparing to launch its native token, SYND, into the market this September 2025.

- More than 50% of the tokens are allocated to the community, with 2% distributed through an airdrop event on August 15.

In a recent X post , the on-chain infrastructure network Syndicate announced that it will be launching its native token SYND. The token will be deployed on Ethereum ( ETH ), with more than 50% allocated for the community or approximately 501.2 million tokens.

This 50.12% does not include the initial 2% distributed through the airdrop event on August 15. The airdrop was meant to attract appchains, appchain users and developers, as well as ecosystem participants who may have been interested in building and staking on Syndicate.

Syndicate is known for granting developers the ability to create custom transaction sorting rules, empower protocols, and economic systems. This mechanism allows for value to flow directly back to their tokenized communities on-chain.

According to the whitepaper, or dubbed Litepaper in this network’s case, SYND will serve as a gas token for the network and its commons chain. It is also meant to be used for staking and network incentives, rewarding community members that utilize the token within the ecosystem.

“[SYND] puts real ownership and control of the network in the hands of the community via its Wyoming-based DUNA,” wrote the network in its recent post.

Although no specific launch date has been set yet, the tokens received through the airdrop event last August are non-transferable until the official token launch day.

Back in late August, Syndicate was launched; claiming itself as one of the “first decentralized networks to be built and launched in America.” This is due to the fact that it was formed under the Wyoming -based legal framework: Decentralized Unincorporated Nonprofit Association or DUNA.

The DUNA framework grants legal status to blockchain-based organizations or DAOs, allowing them to operate within the bounds of the law without needing to sacrifice their decentralized nature.

Syndicate gained recognition in web3 back in 2021 when it received $20 million in a Series A funding round led by major venture firm a16z, followed by other prominent firms like IDEO CoLab Ventures, Coinbase Ventures, Robot Ventures, Variant Fund, and Alliance DAO.

Syndicate’s SYND tokenomics

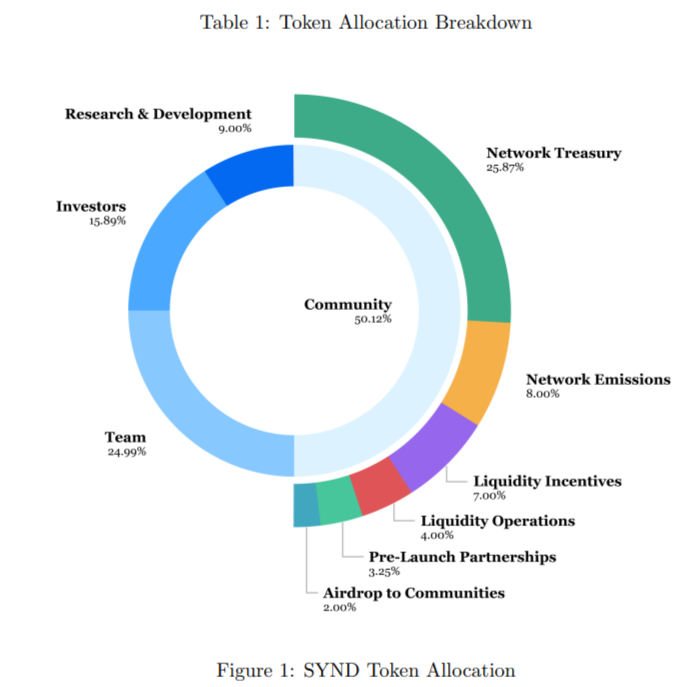

According to the Litepaper , SYND will be launched with a total supply of 1 billion token on the Ethereum mainnet. Approximately 92% had already been minted, while the remaining 8% will be minted automatically as emissions by the token contract.

The project’s structure allows for what it calls “emissions” in which the network will issue tokens every 30-day for a period of four years as a way to support the network’s growth and incentivize community participation. This means that 80 million tokens will be issued gradually during a four-year period.

Syndicate’s native token SYND tokenomics on the litepaper | Source: Syndicate

Syndicate’s native token SYND tokenomics on the litepaper | Source: Syndicate

On the other hand, the community will receive 50.12% of the total token supply, not including the 2% allocated for its airdrop event. The Treasury will hold approximately 25.87% of the tokens, investors will get 15.89% of the supply, while the team behind the project will hold 24.99% of the total tokens.

All tokens allocated to team members will be subjected to a 48-month unlocking period with a year-long cliff. Investor tokens are subject to the same terms of unlocking.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

As economic cracks deepen, bitcoin may become the next liquidity "release valve"

The US economy is showing a divided state, with financial markets booming while the real economy is declining. The manufacturing PMI continues to contract, yet the stock market is rising due to concentrated profits in technology and financial companies, resulting in balance sheet inflation. Monetary policy struggles to benefit the real economy, and fiscal policy faces difficulties. The market structure leads to low capital efficiency, widening the gap between rich and poor and increasing social discontent. Cryptocurrency is seen as a relief valve, offering open financial opportunities. The economic cycle oscillates between policy adjustments and market reactions, lacking substantial recovery. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

The wave of cryptocurrency liquidations continues! US Bitcoin ETF sees second highest single-day outflow in history

Due to the reassessment of Federal Reserve rate cut expectations and the fading rebound of the U.S. stock market, the crypto market continues to experience liquidations, with significant ETF capital outflows and options traders increasing bets on volatility. Institutions warn that technical support for bitcoin above $90,000 is weak.

When traditional financial markets fail, will the crypto industry become a "pressure relief valve" for liquidity?

As long as the system continues to recycle debt into asset bubbles, we will not see a true recovery—only a slow stagnation masked by rising nominal figures.

A Quiet End to 2025 Could Prime Crypto for a 2026 Breakout, Analysts Say