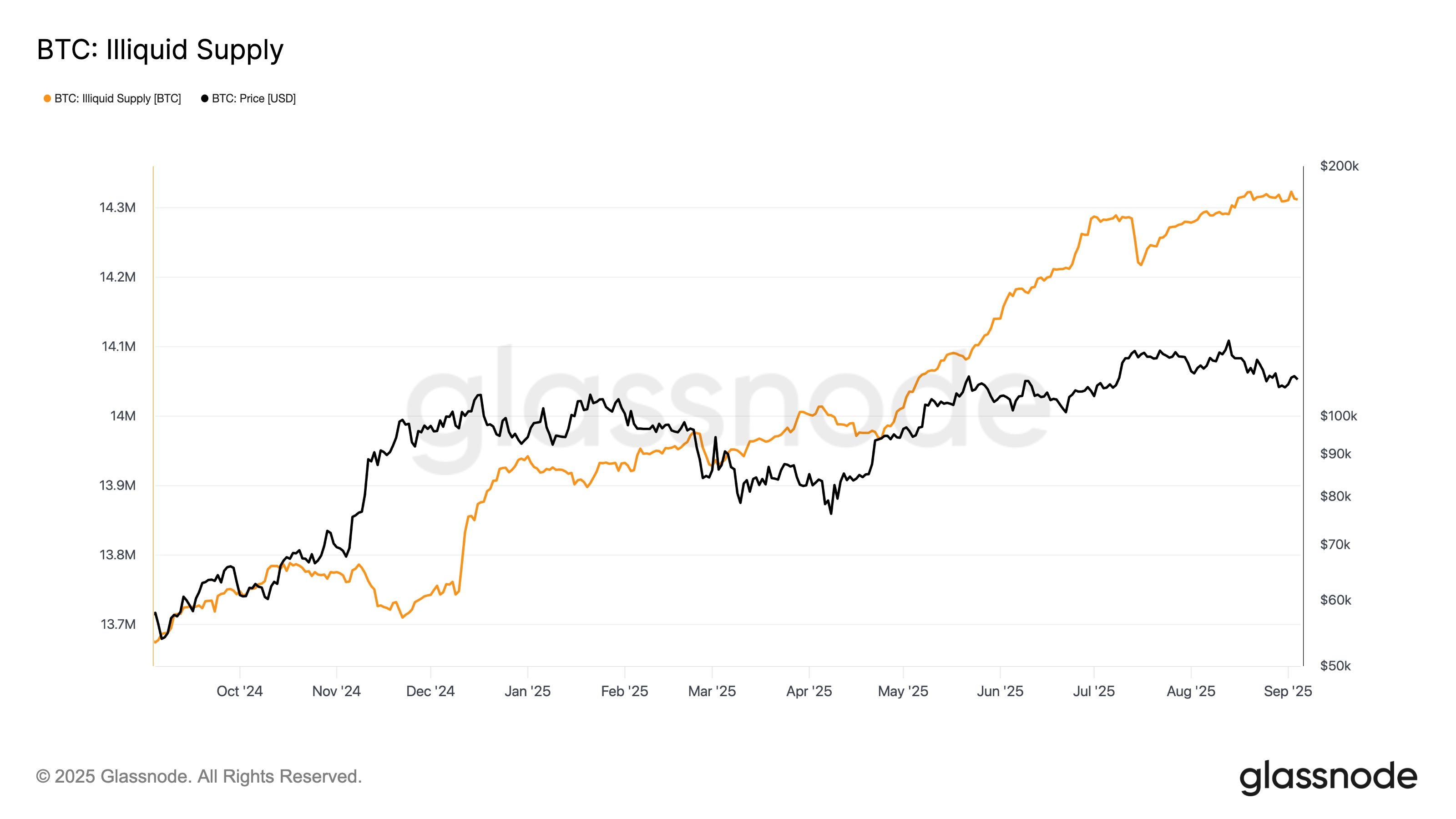

Bitcoin Illiquid Supply Hits Record 14.3M as Long-Term Holders Continue to Accumulate

Bitcoin’s illiquid supply—the portion of coins held by entities with little history of spending—has climbed to a new record high, surpassing 14.3 million BTC in late August, according to Glassnode.

With 19.9 million BTC currently in circulation, around 72% of the total supply is now illiquid, held by entities such as long-term holders and cold storage investors. This growth highlights a sustained accumulation trend, even during recent market volatility.

In mid-August, bitcoin hit an all-time high of $124,000 before retreating roughly 15%. Despite the price pullback, the illiquid supply continued to rise, showing that holders remain undeterred by short-term corrections.

Over the past 30 days alone, the net change in illiquid supply has increased by 20,000 BTC, underscoring persistent investor conviction.

The ongoing increase in this category suggests tightening supply dynamics that could set the stage for renewed momentum once sentiment recovers. For now, the trend reflects growing confidence in bitcoin as a long-term store of value.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stripe and SUI Coin Launch a Next-Generation Stablecoin

In Brief SUI partners with Stripe to launch the USDsui stablecoin. Stablecoins could achieve a $3 trillion market by 2030, according to Bessent. USDsui enhances Sui's network liquidity, promoting institutional collaboration.

SoFi Becomes First U.S. National Bank to Offer Crypto Trading Amid Regulatory Shift

JPMorgan Pilots JPMD Deposit Token on Base, Accelerating Institutional On-Chain Finance

Ethereum Price At Crossroads: $3,532 Support Or $3,326 Slide?