Key Notes

- Whales sold 90,000 ETH in 48 hours, briefly pushing price below $4,500.

- Citi set a conservative 2025 ETH target of $4,300 despite bullish fundamentals.

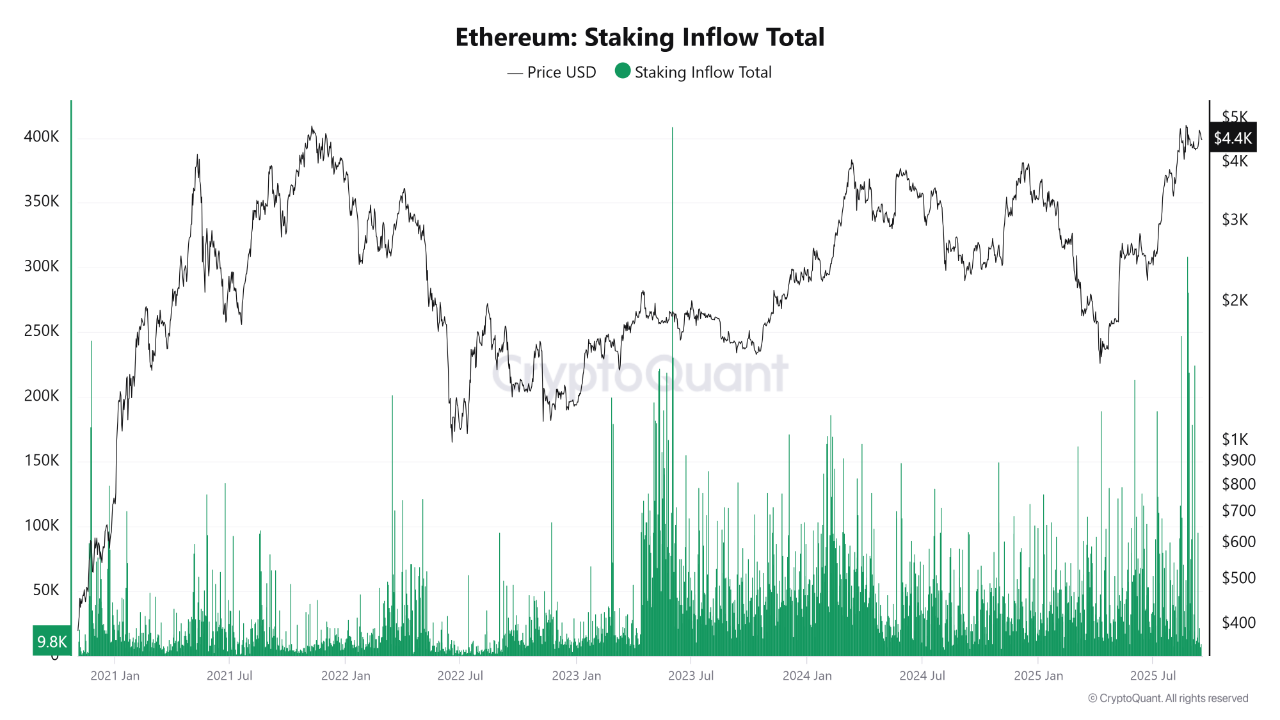

- Staking inflows hit highs not seen since 2023, showing strong validator confidence.

Ethereum ETH $4 495 24h volatility: 0.2% Market cap: $542.45 B Vol. 24h: $32.63 B whales have offloaded 90,000 ETH in just 48 hours, according to prominent crypto analyst and trader Ali Martinez, indicating that bearish clouds are hovering over the second-largest digital asset.

The sudden sell-off briefly pushed ETH below the $4,500 mark before it rebounded and stabilized around $4,543.85, printing more than 5% gain over the past week, according to CoinMarketCap data .

Whales sold 90,000 Ethereum $ETH in the last 48 hours! pic.twitter.com/YqFfmqs38Z

— Ali (@ali_charts) September 17, 2025

Citi’s Conservative Forecast vs Market Reality

Reuters reported that Citigroup has issued a year-end 2025 price target of $4,300 for Ethereum, a cautious stance given ETH’s recent all-time high of $4,955.

Citi’s target took into account macroeconomic risks, potential regulatory setbacks, and the likelihood of corrections after ETH’s strong rally.

However, on-chain fundamentals suggest a much stronger outlook. According to CryptoQuant , Citi’s $4,300 may represent more of a downside support than a fair projection of Ethereum’s price trajectory.

Bullish Factors Align

CryptoQuant data shows that Ethereum staking inflows have surged to their highest levels since mid-2023. Between Aug. 14 and Sept. 4, inflows rose steadily, peaking at 308,000 ETH on Aug. 25.

A seven-day moving average of 150,000 ETH by Aug. 30 further established optimism, indicating reduced circulating supply and strengthened validator confidence, with investors locking up ETH at elevated prices.

Ethereum staking inflow total | Source: CryptoQuant

Another bullish factor is the continuous decline of ETH balances on centralized exchanges, recently hitting multi-year lows.

With less ETH available for immediate sale, the market is less exposed to sudden supply shocks, which potentially makes Ethereum as the next crypto to explode in 2025.

ETH Price: Pullback Over, Rally Ahead?

After reaching a target of $4,811.71, Ethereum entered a healthy pullback, but analysts like Javon Marks now see renewed bullish strength.

After meeting the $4,811.71 target, prices of $ETH (Ethereum) pulled back but bull signal(s) have confirmed, suggesting movement back to and above this target level!

With a break above this target, we could see an additional +77% run to $8,557.68… https://t.co/sDDNVSijoi pic.twitter.com/4uPpJHDsgS

— JAVON⚡️MARKS (@JavonTM1) September 15, 2025

Marks argues that reclaiming and breaking above the $4,811 level could act as a springboard toward $8,557.68, a 77% potential upside.

Ethereum’s resilience above $4,500 suggests the correction phase may be complete, setting the stage for the next leg higher.