For years, Ethereum (ETH) has dominated the headlines as a pioneer of decentralized finance. Yet, Wall Street investors are increasingly shifting their attention to PayDax Protocol (PDP) , an Ethereum Token that bridges traditional banking and DeFi lending on-chain.

Keep reading to discover why experts say PDP will grow 5000% in the coming months, and why it will likely outperform Ethereum in the upcoming bull cycle.

Borrowing Without Selling

PayDax Protocol (PDP) is building a future where you can access liquidity without selling off your assets. Many investors struggle with the decision of selling their holdings for quick cash or holding them long-term and potentially missing out on price movements. PayDax addresses this challenge, enabling users to borrow stablecoins using their crypto assets like ETH as collateral.

On top of that, collaterization on the PayDax Protocol (PDP) does not stop at your crypto assets. Users on the platform can borrow stablecoins against their high-value real-world assets (RWAs) such as luxury watches or real estate, unlocking liquidity without selling possessions.

PayDax offers loan-to-value ratios of 50%, 75%, 80% and 97%, ensuring users can find as much liquidity as they need. Through this model, with a $100,000 Richard Mille watch, Jane can get up to $97,000 USDC without having to sell the watch.

High-Yield Opportunities for Lenders and Stakers

On the lending side, PayDax Protocol (PDP) offers numerous high-yield opportunities that far surpass anything a traditional bank can offer. For instance, lenders can earn up to 15.2% APY for funding collateralized loans.

Furthermore, members can earn up to 15.2% APY if they underwrite loans through the Redemption Pool. This fully decentralized pool serves as a safety net, protecting lenders in case the borrower defaults on the loan.

Lastly, the more experienced users can leverage advanced yield farming strategies to farm greater crypto rewards. For example, Jane has $1000 and she wants to enter a new position. PayDax allows her to access 5x leverage or an additional $4000 to earn greater crypto returns, potentially reaching 41.25%.

Infrastructure That Builds Trust

The PayDax Protocol (PDP) establishes a high level of trust and transparency through the infrastructure and partnerships supporting it.

-

Chainlink: PayDax secures every loan valuation using Chainlink oracles, ensuring no mispriced P2P deals.

-

Brinks: All collateralized RWAs on the PayDax Protocol are safeguarded by Brinks.

-

Sotheby’s: Sotheby’s authenticates all luxury possessions or art before they can be tokenized on Paydax.

-

Jumio: Borrowers on PayDax must undergo thorough identity checks through Jumio. This measure helps keep the system compliant and control the quality of borrowers that can access the PayDax Protocol (PDP).

-

Audited: The PayDax Protocol is independently audited by Assure DeFi .

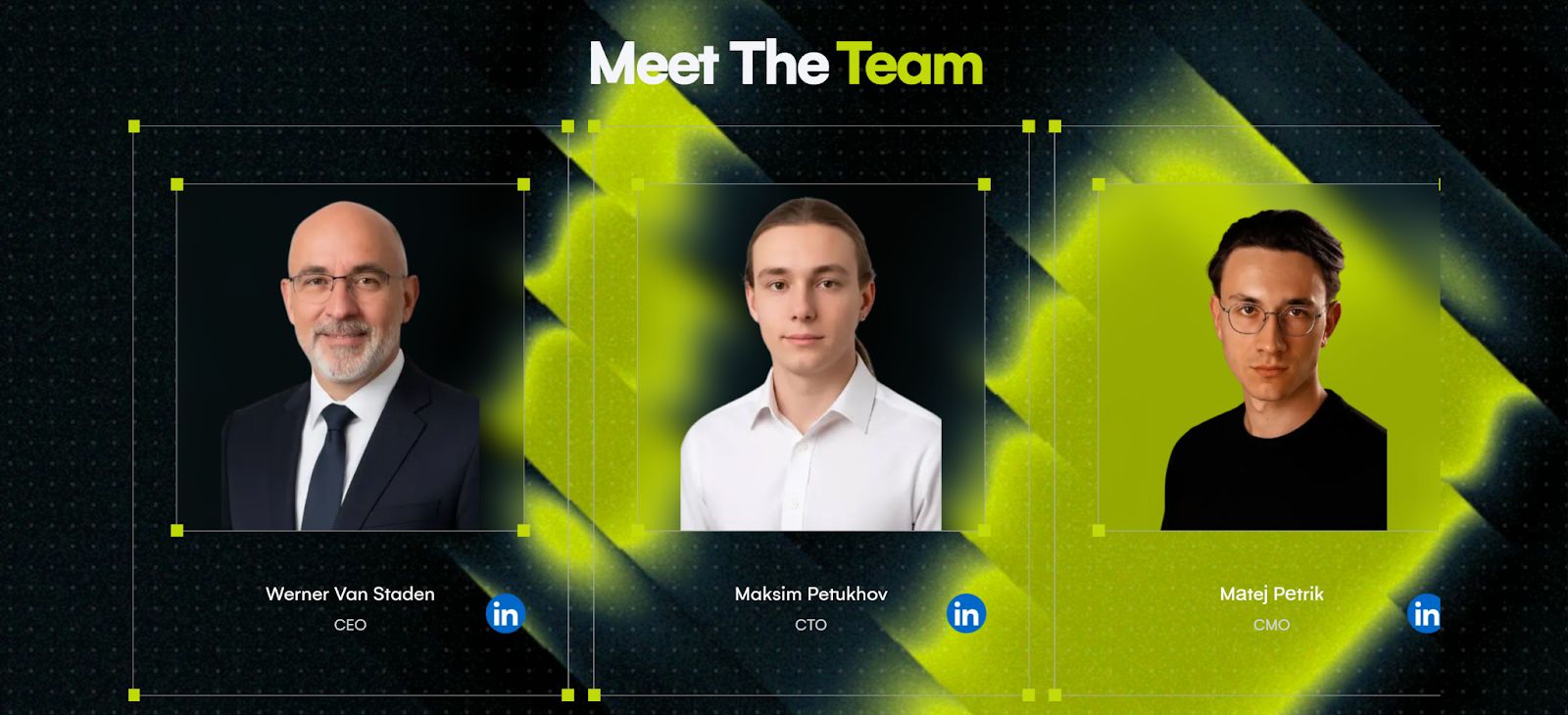

Leadership That Builds Confidence

The executives at Paydax are dedicated to building a fully-transparent DeFi bank. They demonstrate this by hosting open AMAs and being vocal about their vision to bridge the gap between traditional finance and DeFi lending.

-

Paydax’s Chief Executive Officer, Werner Van Staden, states: “Our mission is to build the first true People’s DeFi Bank. With partners like Brinks, Sotheby’s, and Chainlink backing our infrastructure, we’re bridging DeFi and traditional finance with security and scale.”

-

The Chief Technology Officer, Maksim Petukhov, adds: “Smart contract safety is non-negotiable. With multiple audits complete and partnerships expanding, we’re ensuring Paydax is positioned to lead the next wave of RWA lending.”

-

The Chief Marketing Officer, Matej Petrik, notes: “We’re fully doxxed, hosting AMAs and live video updates every month. Investors should know exactly who we are, what we’re building, and how their capital is being put to work.”

The People’s DeFi Bank

The rapid growth of ETH and Ethereum tokens has been a major narrative in the crypto space. Similar to ETH, Paydax is changing the DeFi landscape. As the people's DeFi bank, Paydax is merging traditional banking services and crypto while keeping them on-chain and transparent.