GSR ETF: Focusing on Companies Involved in Cryptocurrency Rather Than Direct Coin Investment

- GSR Markets proposes an ETF investing in public companies holding crypto assets like Bitcoin, diverging from direct crypto ownership. - The fund targets firms such as MicroStrategy, aggregating equity stakes in entities with significant crypto reserves across 5-10 companies. - Regulatory approval for commodity-based ETFs in late 2024 enables this product, aligning with 90+ pending crypto-themed fund applications. - Market challenges include declining stock valuations of crypto treasury companies and debt

GSR Markets, a prominent player in crypto trading and market making, has submitted a proposal to introduce an innovative exchange-traded fund (ETF) centered on businesses that hold digital assets within their corporate treasuries. The planned GSR Digital Asset Treasury Companies ETF is designed to combine shares of companies—such as MicroStrategy and

The ETF’s framework mirrors a larger trend in which public companies raise funds through equity sales and reinvest those proceeds into digital assets. This method has contributed to rising share prices for companies like Strategy Inc. (MSTR) and CEA Industries (BNC), whose valuations have climbed alongside the value of their crypto holdings Wall Street wraps the stock market’s crypto hype … [ 2 ]. GSR’s proposal features a 15% allocation to private investments in public equity (PIPEs), aiming to enhance liquidity for institutional participants while complying with the Investment Company Act of 1940 GSR Seeks ETF Backed by Crypto Treasury Firms in Bold Wall … [ 5 ]. However, the ETF’s returns may not move in lockstep with crypto prices, as its performance is tied to the stock prices of these companies rather than the direct value of the tokens GSR Seeks ETF Backed by Crypto Treasury Firms in Bold Wall … [ 5 ].

Regulatory changes have made such offerings more viable. In late 2024, the U.S. Securities and Exchange Commission (SEC) approved broad listing rules for commodity-based ETFs, simplifying the process for crypto-related fund approvals GSR Proposes Crypto-Treasury ETF and Multiple Altcoin Funds to … [ 4 ]. This regulatory update has already paved the way for products like Grayscale’s Digital Large Cap Fund (GDLC), which tracks a basket of cryptocurrencies. GSR’s ETF application comes amid a wave of new crypto fund filings, with more than 90 awaiting review as of August 2025 GSR Seeks ETF Backed by Crypto Treasury Firms in Bold Wall … [ 5 ]. The company’s move into ETFs represents a strategic shift from its traditional market-making business, using its liquidity expertise to meet institutional demand for structured crypto investment options Wall Street wraps the stock market’s crypto hype … [ 2 ].

Nonetheless, market conditions pose obstacles. Although crypto treasury firms collectively held over $117 billion in tokens by mid-2025 An ETF For Crypto Treasury Firms—Like … [ 1 ], many have seen their stock prices fall as investor interest has cooled. Companies such as ETHZilla have turned to debt-financed share repurchases to support their stock prices, raising questions about the long-term viability of this approach GSR Seeks ETF Backed by Crypto Treasury Firms in Bold Wall … [ 5 ]. GSR’s ETF will need to manage this volatility, as its performance could be affected by both fluctuations in crypto prices and the financial strategies of its constituent companies. The fund’s prospects will depend on whether investors perceive these firms as innovative stewards of capital or as risky bets facing mounting pressure.

GSR’s ETF ambitions extend beyond the crypto treasury space. The company has also put forward four additional funds targeting Ethereum staking, altcoin diversification, and core crypto holdings. These include the Ethereum Staking Opportunity ETF, which would use offshore entities to stake Ether, and the Crypto Core3 ETF, which plans to directly hold Bitcoin, Ethereum, and

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

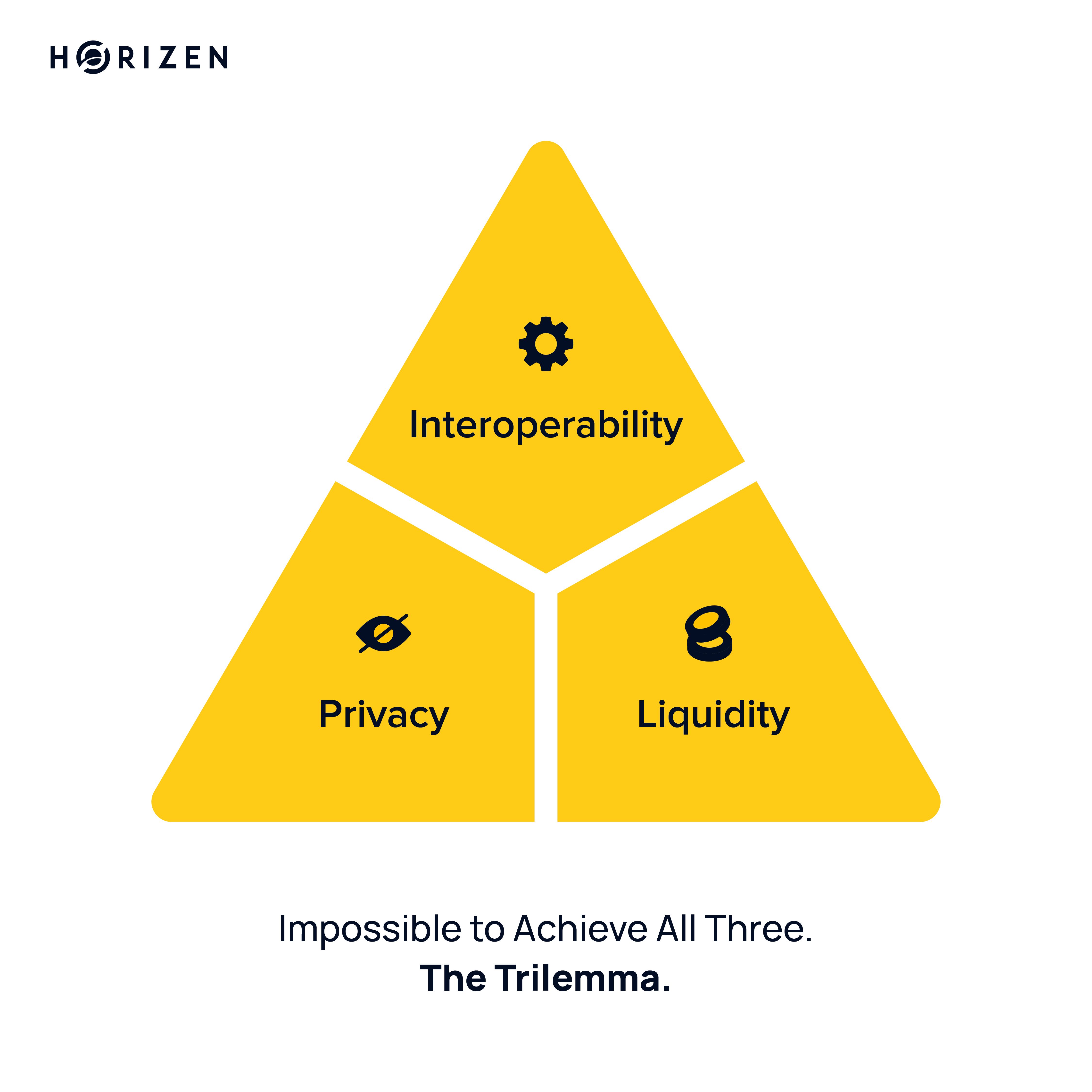

The Institutional Blockchain Trilemma

Visa Now Lets You Get Paid in Stablecoins

BNB News Today: BNB Surges Back to $1,000—Is This a Genuine Breakout or Just a Temporary Rally?

- Binance Coin (BNB) rebounds above $1,000 after hitting $900 lows, sparking debate over sustained recovery or bearish reversal. - BNB Chain upgrades security by migrating multi-signature wallets to Safe Global, aiming to boost user confidence and EVM compatibility. - Nano Labs repays bonds early to mitigate risk, reflecting institutional focus on liquidity amid crypto market volatility. - AI models predict $1,600 BNB by 2026 if on-chain activity and institutional demand persist, but key resistance at $1,1

Bipartisan Agreement Concludes 43-Day Government Shutdown, Delaying Healthcare Dispute

- U.S. House to vote on bipartisan deal ending 43-day government shutdown, with short-term funding extending through January 30. - Agreement includes three-year appropriations bills but fails to extend Affordable Care Act subsidies, sparking Democratic criticism over unmet healthcare demands. - Economic fallout includes 1.5% GDP growth drop, unpaid federal workers, and disrupted SNAP programs affecting 42 million Americans. - Market rebounded with Bitcoin surging past $106,000, but partisan tensions persis