Bank of Korea Mulls Gold Purchases After 12-Year Pause

After more than a decade, South Korea’s central bank may resume gold buying amid record global accumulation and dollar weakness, with analysts predicting a renewed gold bull market despite recent price volatility.

South Korea’s central bank is contemplating a return to gold buying for the first time since 2013, signaling a potential shift in its reserve management strategy.

The move comes amid growing demand for the precious metal, as investors seek protection from inflation and currency weakness.

Bank of Korea Weighs Buying Gold Again

According to the latest data by the World Gold Council (WGC), as of October, the Bank of Korea held 104.4 tons of gold, ranking 41st globally. It last added to its gold reserves in 2013, concluding a three-year buying spree that began in 2011.

During that period, the central bank purchased 40 tons in 2011, 30 tons in 2012, and 20 tons in 2013. Nonetheless, the decision drew domestic criticism, as gold entered a prolonged price slump. The bank’s timing led to significant backlash, contributing to its hesitance to re-enter the market.

Nonetheless, as macroeconomic conditions deteriorate, inflation accelerates, and currencies weaken, the bank is reconsidering its earlier stance.

Heung-Soon Jung, director of the Reserve Investment Division at the Bank of Korea’s Reserve Management Group, announced the decision on Tuesday during the London Bullion Market Association and London Precious Metals Markets event in Kyoto.

“The Bank of Korea plans to consider additional gold purchases from a medium- to long-term perspective,” he said.

Jung noted that the bank will monitor the market before deciding when and how much gold to purchase. He added that any move would depend on how the country’s reserves evolve and on the direction of gold prices and the Korean won.

Global Central Banks Lead Gold Accumulation

The Bank of Korea’s renewed interest in gold comes amid a significant redeployment of global reserves. During the first half of 2025, 23 countries increased their gold holdings.

In the second quarter, Poland acquired 18.66 tonnes, Kazakhstan 15.65 tonnes, Turkey 10.83 tonnes, China 6.22 tonnes, and the Czech Republic 5.73 tonnes. Furthermore, BeInCrypto recently highlighted that for the first time since the mid-1990s, central banks hold more gold than US Treasuries.

Notably, banks are expected to buy 900 tonnes of gold in 2025. The shift highlights eroding confidence in dollar-denominated assets amid US fiscal deficits and trade tensions. Retail investors also mirrored this trend, queuing at dealers to hedge against currency debasement.

Gold Price Volatility Tests Market Sentiment

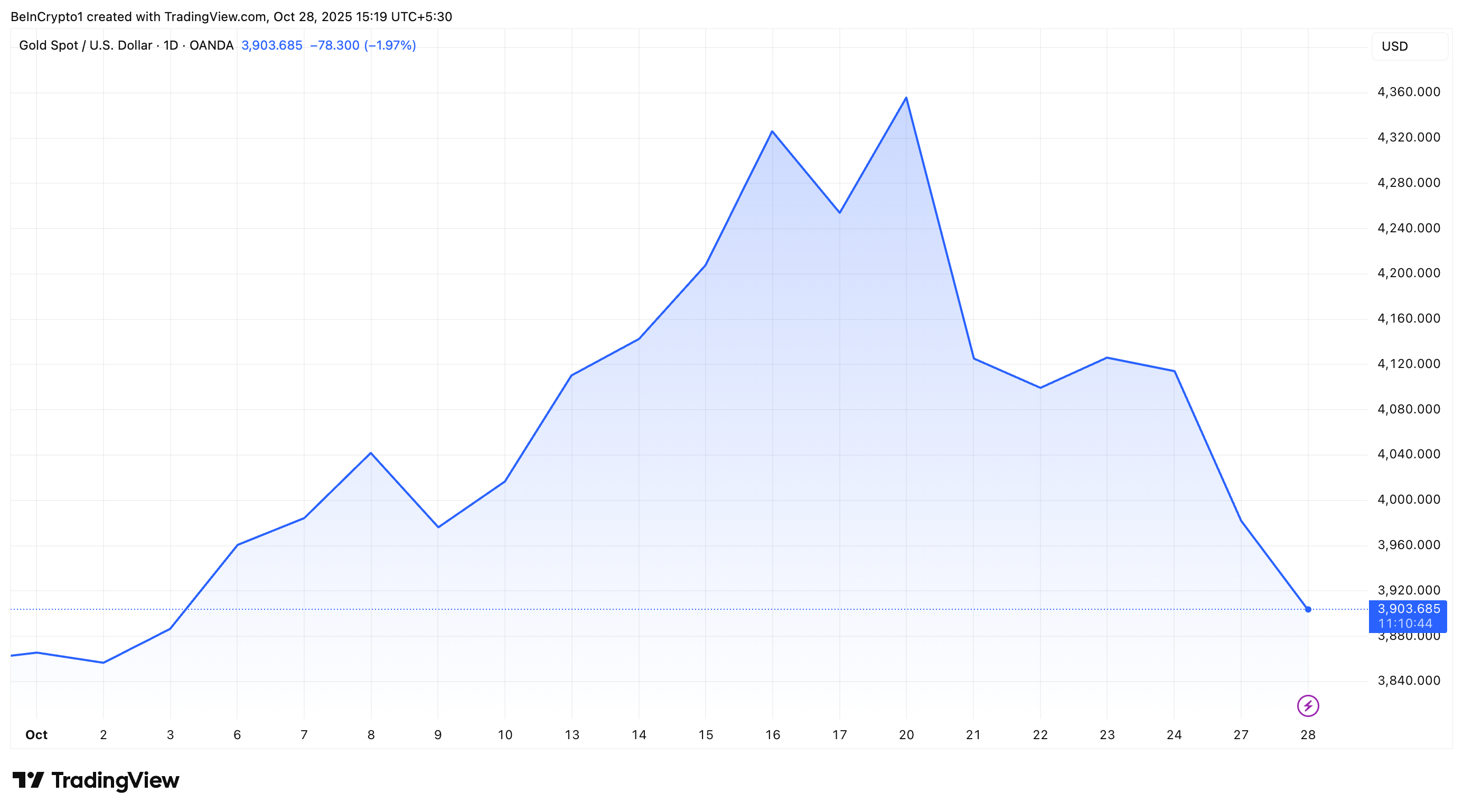

Meanwhile, the high global demand pushed gold upwards, reaching an all-time high of $4,381 per ounce last week. However, a correction followed.

BeInCrypto reported that after the record high, gold plunged 6% in its worst one-day drop in 12 years, erasing around $2.1 trillion in market value.

The decline has continued, with the gold losing 8.4% of its value in the past week. Furthermore, yesterday the downtrend even pushed prices below $4,000 per ounce for the first time since October 13.

Gold Price Performance. Source:

TradingView

Gold Price Performance. Source:

TradingView

Despite this, some market experts remain optimistic about gold’s comeback. Steve Hanke, an economist, described the decline as a buying opportunity and forecasted a bull market peak at $6,000 per ounce.

Analyst Rashad Hajiyev suggested that the current drop in gold prices is “needed” before another major rally. He views the sell-off as a way to flush out weak traders and set the stage for a powerful move toward $5,500–$6,000.

“Gold is a great buy below $4,000, and silver is an even better buy below $47. Remember, it was just a week ago that gold almost hit $4,400 and silver traded above $54.40. Those highs will likely not even be close to the peaks of this bull market,” Peter Schiff added.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Health Tech Secures $2.5M in Seed Funding to Address Systemic Healthcare Gaps Through AI-Powered Solutions

- HEALTH, a health tech startup, raised $2.5M in seed funding led by Gemhead and Castrum Capital amid rising AI-driven healthcare innovation. - The investment aligns with global trends like WebMD's AI marketing tools, Denmark's FOB mental health platform, and India's VitaLyfe cardiometabolic risk app. - Innovations focus on AI diagnostics, remote monitoring, and scalable solutions to address systemic gaps in care delivery and patient engagement. - Growing VC interest in digital therapeutics and mental heal

SUI News Today: SUI Challenges $1.80 Support—Pathway to $20 or Headed for More Losses?

- SUI cryptocurrency faces short-term correction to $1–$1.50 before potential $10–$20 rebound, driven by ecosystem growth and institutional adoption. - Key support at $1.80–$2.10 could trigger $3.50–$4.80 rally if defended, with $20+ long-term targets supported by $2B+ TVL and DeFi partnerships. - Upcoming token unlocks (92M SUI) add short-term pressure, but strong liquidity and institutional buying historically offset selling shocks. - Technical analyses suggest $5–$8 mid-term targets, with $20+ long-term

Fed's Shift in Liquidity: Market Stabilization or Threat to Inflation Management?

- Fed abruptly ends 3-year QT and cuts rates in 2025 to address liquidity strains, prioritizing market stability over inflation control. - Corporate sectors like real estate face pressure as firms revise strategies, with AvalonBay cutting guidance amid soft demand and Insight securing debt to fund growth. - Policy shift mirrors 2008 and pandemic-era interventions, reigniting debates over "ample reserves" framework amid balance sheet reduction challenges. - Banks benefit from lower funding costs, but prolon

Romania Restricts Polymarket: Legal Regulations Clash with Blockchain in Gambling Discussion

- Romania's ONJN blacklisted Polymarket for unlicensed gambling amid $600M election wagers. - Regulators cited legal requirements for state licensing, blocking access via ISPs. - The ban aligns with global restrictions, including a $1.4M U.S. fine, as Polymarket expands with $2B ICE investment. - Despite regulatory challenges, Polymarket plans a U.S. relaunch via a licensed derivatives exchange. - The case highlights tensions between blockchain innovation and gambling laws, with ONJN warning of dangerous p