Michael Saylor’s Bitcoin Profit Tops $1.77 Billion

Michael Saylor, the executive chairman of MicroStrategy, has demonstrated yet again why he continues to be one of Bitcoin’s most passionate advocates. His own Bitcoin investment of 17,732 BTC has now risen to an unrealized gain of $1.77 billion, testifying to his long-standing belief in the value of the asset.

Saylor, unlike most business executives, has bet exclusively on BTC. This is a store of value asset, rather than diversifying across asset classes. Saylor has continually reiterated the virtues of digital scarcity and decentralization, often referring to Bitcoin as “digital gold.” His personal net worth being heavily tied to the crypto market illustrates the merits of investing based singularly on conviction.

How Saylor’s Holdings Reflect Bitcoin’s Strength

Saylor’s Bitcoin holdings highlight the resilience and performance of the cryptocurrency over time. Despite multiple bear markets, his investment continues to grow in value. With BTC currently trading near record highs, his unrealized profit surpasses $1.77 billion , a figure that not only reflects personal success but also validates his faith in Bitcoin’s deflationary design.

Every market correction has only strengthened his belief in holding rather than selling. For Saylor, Bitcoin profit is not merely about gains; it represents a fundamental change in how individuals and corporations store value. His stance has helped normalize the concept of holding crypto as a treasury reserve asset , something unimaginable just five years ago.

The Broader Impact on Corporate Treasury Models

Saylor’s accomplishments have not been limited to individual wealth. As an early adopter of Bitcoin for his firm MicroStrategy, he led the way for companies to add BTC to their vaults. Following Saylor, many additional firms began to find ways to add Bitcoin to their treasury management plans. This is because inflation hedge and a hedge against currency depreciation.

This wider phenomenon has made organizations rethink liquidity, risk, and long-term value. Although traditional assets, such as gold and bonds, are still being used, Bitcoin has now outperformed these alternatives. Saylor’s approach, both personally and at a corporate level, continues to influence financial leaders looking to strategize on Bitcoin investment.

Final Thoughts

The $1.77 billion unrealized profit realized by Michael Saylor is not merely a personal victory in his life, it is also a reflection of the changing nature of Bitcoin as an asset class. His evolution as a capitalist, from skeptic to proponent, exemplifies Bitcoin’s growing position in the finance of today.

BTC continues to change the landscape of investing globally. People like Saylor will remind the world that conviction and long-term thinking can reconstitute capital in the digital age. Saylor’s Bitcoin holdings are much more than just numbers showing profit. They illustrate that there is a growing movement of thinking that will change how people think about money, value, and finance going forward.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Enthusiasts React Strongly as ECB’s Digital Euro Project Progresses Further

Concerns Rise Over Privacy Protections and Democratic Oversight as ECB's Digital Euro Enters Pilot Phase

From LRT Protocol to Decentralized Infrastructure Provider: How Does Puffer Align with the Ethereum Ecosystem?

Puffer has consistently adhered to principles aligned with Ethereum in its design and product evolution, demonstrating support for Ethereum's long-term vision.

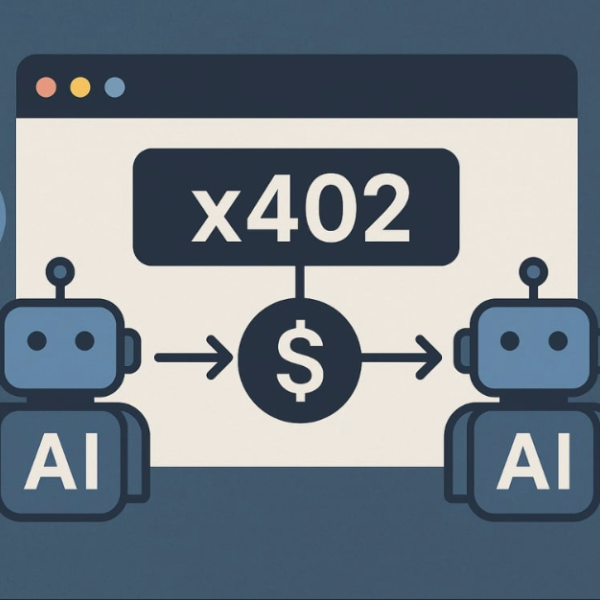

Awakening 26-Year-Old Dormant Code: Is x402 a Bridge Between Web2 and Web3, a Technological Singularity or a Meme Frenzy?

This "reactivation" of the underlying internet protocol standards—can it become the key to bridging the gap between "convenience" and "openness"?

Bitget Wallet Lite quickly surpasses 3 million users after launch, becoming the fastest-growing multi-chain wallet on Telegram

Bitget Wallet has released a Lite version, a seamlessly integrated Telegram multi-chain wallet, which surpassed 3 million users within just a few days of launch.