Bitcoin News Update: Earn Passive Income While Surfing the Web as Lolli Purchases Slice

- Lolli acquires Slice to unify Bitcoin rewards platforms, accelerating Lightning Network integration for faster, cheaper transactions. - Users can now earn Bitcoin passively via web browsing and social media, lowering adoption barriers beyond e-commerce purchases. - Thesis' acquisition strategy faces criticism over Mezo sidechain integration, with calls for clearer onchain withdrawal options. - The $28M-funded entity aims to streamline earning mechanisms while addressing technical limitations from Lolli's

Lolli, a

By bringing Slice into Lolli’s ecosystem, users now have more ways to earn beyond just shopping online. Previously, Lolli users earned Bitcoin through purchases at affiliated merchants, but with Slice’s integration, they can now accumulate Bitcoin by simply browsing, viewing videos, or scrolling through social platforms. This transition from active to passive earning makes it easier for newcomers to get involved with cryptocurrency, especially those hesitant to invest directly, according to

A central motivation for the acquisition is to speed up Lightning Network support for withdrawals. This Layer 2 solution helps Bitcoin scale by allowing transactions to occur off-chain, which are then finalized on the main blockchain. For frequent, smaller rewards, this approach cuts down both costs and wait times compared to on-chain transfers. "Lightning enables small withdrawals to be cost-effective in ways that Layer-1 never could," Lolli’s team explained in a blog update. This strategy fits with the wider industry push to make Bitcoin suitable for daily transactions, such as micro-payments and direct transfers between users.

Yet, the collaboration between Lolli and Thesis has sparked some debate. Thesis recently faced criticism after adding Mezo, a Bitcoin sidechain compatible with EVM, as a withdrawal method. Some, including Bitcoin advocate Jason Don (Brekkie von Bitcoin), argued that the company failed to properly inform users about the withdrawal changes. "Apparently, we can still 'withdraw' our bitcoin, but now we must join a stablecoin walled garden to do so? Ridiculous," Don posted on X. In reply, Thesis founder Matt Luongo admitted the importance of offering on-chain withdrawal options, but stressed that the company is "beginning with L2s and sidechains" based on insights from Fold’s journey, as detailed by The Block.

This acquisition also reflects Thesis’s larger goal of bringing Bitcoin rewards platforms together. By merging services like Lolli and Slice, the company seeks to simplify the user journey and boost earning possibilities. Luongo shared that overhauling Lolli’s system after the acquisition has been a key focus, with the team gradually rolling out improved app versions to fix technical issues dating back to Lolli’s 2018 launch, according to The Block’s reporting.

Lolli, which secured $8 million in a Series B funding round in 2023 led by Bitkraft Ventures, has raised more than $28 million overall, according to The Block. While the financial terms of the Slice deal remain private, the merger positions the combined company to better compete in a fast-changing sector. Experts believe that combining passive earning features with Lightning Network’s scalability could drive wider adoption, especially as institutional interest in Bitcoin continues to rise.

As Slice’s new features are introduced, users should see more ways to earn Bitcoin in the near future. This partnership highlights a broader trend in crypto, moving from speculative trading toward practical use cases, making Bitcoin rewards increasingly available for everyday online activities.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

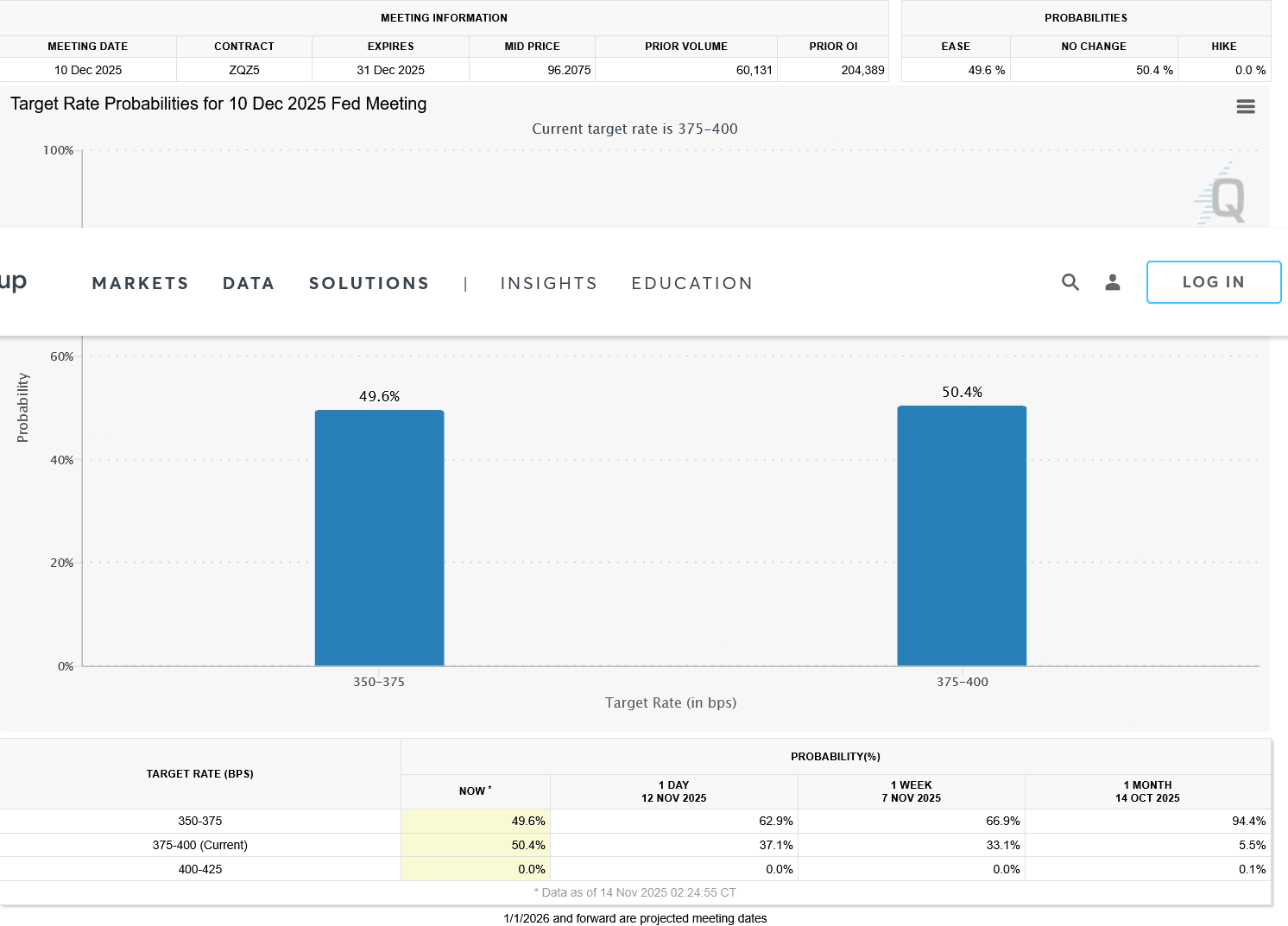

VIPBitget VIP Weekly Research Insights

Global markets are experiencing multiple transformative catalysts supporting the recovery of risk assets. For instance, Trump has revived his proposal to distribute $2000 "tariff dividend" checks to every American using tariff revenues. While the plan faces hurdles such as congressional approval and inflationary concerns, it has already boosted consumer confidence and is expected to inject trillions of dollars in liquidity, benefitting high-growth technology sectors. Meanwhile, the U.S. government shutdown has reached a record 41 days. With the Senate having reached an agreement, it's expected to end on November 11—potentially triggering a renewed fiscal injection of tens of billions of dollars and a V-shaped rebound similar to past shutdown recoveries. Market expectations for a rate cut at the Federal Reserve's December FOMC meeting are also rising, with a 62.6% probability priced in for a 25-basis-point cut. Some Trump-backed officials even advocate for a 50-basis-point reduction, which would extend the easing cycle and further stimulate investment in crypto and AI infrastructure. Together, these factors may drive a 5–10% rebound in total crypto market capitalization, creating a window of opportunity for allocation to high-quality projects.

Massive $869M Outflow Slams Bitcoin. Is a Crash Coming?

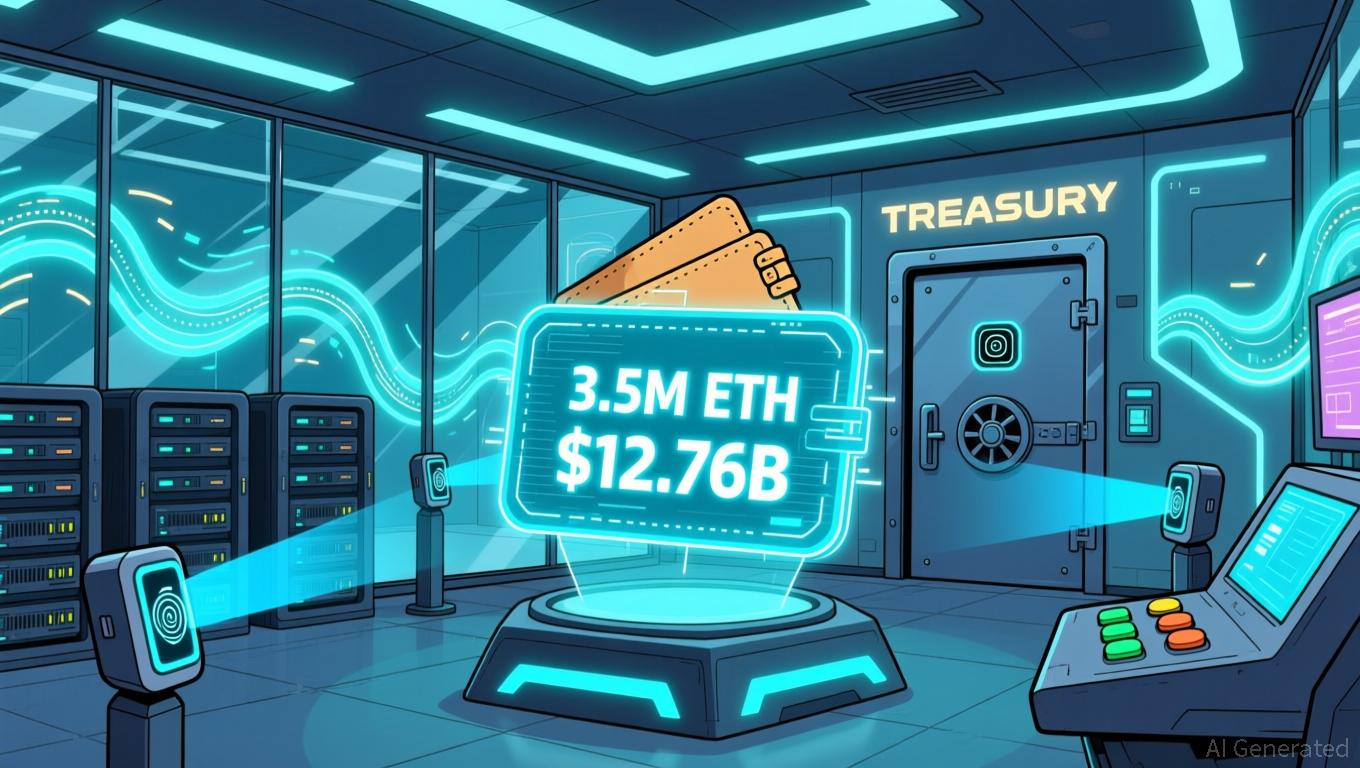

Ethereum Latest Updates: BitMine Commits $12 Billion to ETH—Chairman Predicts $12,000 Despite 13% Market Drop

- BitMine Immersion Technologies (BMNR) surged ETH purchases by 34% to 110,288 tokens weekly, now holding 3.5M ETH (2.9% supply) valued at $12.76B. - Leadership overhaul appoints Chi Tsang as CEO, aligning with chairman Tom Lee's "supercycle" vision and $12K ETH price target by 2025. - Market reacts mixed as ETH dips 13.4% in two weeks, with treasury buys currently underwater and regulatory shifts like CFTC oversight emerging. - Shareholders demand transparency amid unstaked ETH holdings and evolving crypt

Vitalik Buterin's Breakthrough in ZK Technology: Ushering in a New Age of Privacy and Blockchain Scalability

- Vitalik Buterin drives Ethereum's ZK innovations to solve scalability and privacy challenges, positioning ZK as crypto's next growth pillar. - Modexp precompile updates and GKR protocol reduce proof costs 50x-15x, enabling ZK-rollups to process 43,000 TPS with near-zero fees. - ZK integration with MPC/FHE/TEE expands use cases beyond DeFi, with ZK-FHE hybrids targeting enterprise adoption in healthcare and finance . - ZK Layer 2 market projected to grow at 60.7% CAGR to $90B by 2031, driven by institutio