Bitcoin Updates: Texas Community's Attempt to Control BTC Mining Falls Short, Underscoring Ongoing Regulatory Hurdles for the Industry

- Hood County voters rejected Mitchell Bend's incorporation bid by 25%, blocking noise regulations on MARA's Bitcoin mining facility. - MARA sued over petition flaws, claiming the proposed city aimed to "regulate it out of business," but the case was dismissed before the vote. - Residents cited environmental concerns while MARA implemented noise mitigation measures, highlighting tensions between crypto mining and local communities. - The outcome underscores regulatory challenges for Texas-based miners as l

An effort by a rural Texas neighborhood to establish its own city government in order to enforce noise restrictions on a

MARA strongly resisted the incorporation plan, submitting a 47-page lawsuit in federal court in October 2025, as outlined in a

Locals, organized as Citizens Concerned About Wolf Hollow, have long objected to the noise and environmental effects of MARA’s air-cooled mining facility. In response, the company implemented noise reduction steps, including building a 24-foot sound barrier and transitioning to quieter immersion cooling systems. Two independent noise assessments in 2024 determined the site operated below Texas’s 85-decibel threshold, though one study noted that state regulations are “quite lenient” compared to typical local standards, as reported by Data Center Dynamics.

The defeat of the incorporation measure does not resolve the dispute. MARA’s attorneys continue to argue that the county’s handling of the petition involved constitutional breaches, as described in the Bitcoin.com post. At the same time, residents remain concerned about the data center’s future growth. “Our main objective was to safeguard our way of life,” stated a representative for Citizens Concerned About Wolf Hollow, who asked not to be named due to ongoing legal proceedings.

This conflict is part of a larger pattern of friction between crypto mining companies and local populations. Texas, known for its affordable electricity, has experienced similar disputes over noise, land use, and environmental issues, according to

For now, the failure to incorporate Mitchell Bend means there will be no immediate new local regulations affecting MARA’s Granbury facility. Still, the company’s legal actions highlight how vulnerable its operations can be to local opposition and regulatory uncertainty. “This situation demonstrates how unpredictable municipal rules can disrupt even large-scale mining businesses,” commented a blockchain industry analyst.

---

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

VIPBitget VIP Weekly Research Insights

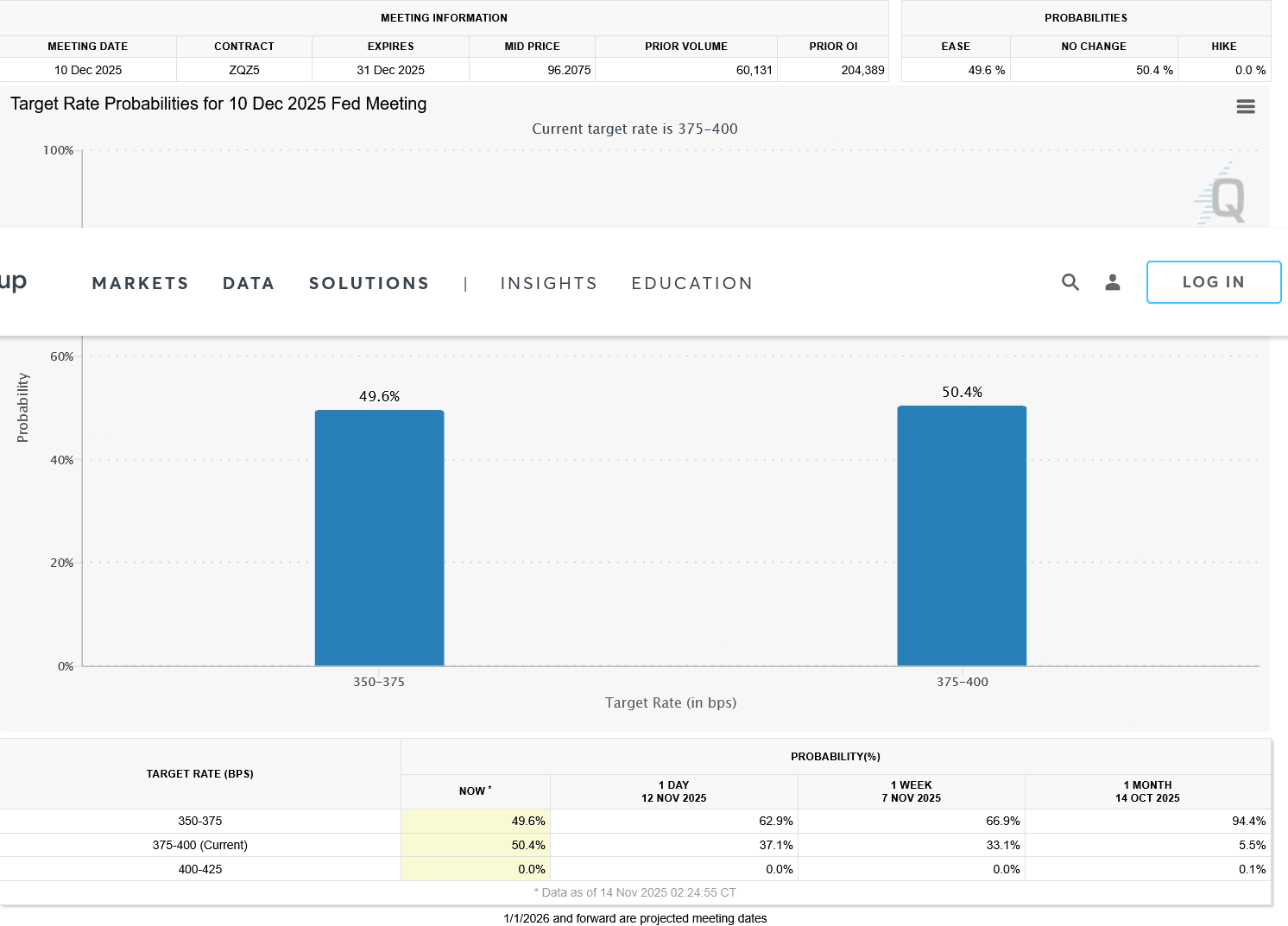

Global markets are experiencing multiple transformative catalysts supporting the recovery of risk assets. For instance, Trump has revived his proposal to distribute $2000 "tariff dividend" checks to every American using tariff revenues. While the plan faces hurdles such as congressional approval and inflationary concerns, it has already boosted consumer confidence and is expected to inject trillions of dollars in liquidity, benefitting high-growth technology sectors. Meanwhile, the U.S. government shutdown has reached a record 41 days. With the Senate having reached an agreement, it's expected to end on November 11—potentially triggering a renewed fiscal injection of tens of billions of dollars and a V-shaped rebound similar to past shutdown recoveries. Market expectations for a rate cut at the Federal Reserve's December FOMC meeting are also rising, with a 62.6% probability priced in for a 25-basis-point cut. Some Trump-backed officials even advocate for a 50-basis-point reduction, which would extend the easing cycle and further stimulate investment in crypto and AI infrastructure. Together, these factors may drive a 5–10% rebound in total crypto market capitalization, creating a window of opportunity for allocation to high-quality projects.

Massive $869M Outflow Slams Bitcoin. Is a Crash Coming?

Ethereum Latest Updates: BitMine Commits $12 Billion to ETH—Chairman Predicts $12,000 Despite 13% Market Drop

- BitMine Immersion Technologies (BMNR) surged ETH purchases by 34% to 110,288 tokens weekly, now holding 3.5M ETH (2.9% supply) valued at $12.76B. - Leadership overhaul appoints Chi Tsang as CEO, aligning with chairman Tom Lee's "supercycle" vision and $12K ETH price target by 2025. - Market reacts mixed as ETH dips 13.4% in two weeks, with treasury buys currently underwater and regulatory shifts like CFTC oversight emerging. - Shareholders demand transparency amid unstaked ETH holdings and evolving crypt

Vitalik Buterin's Breakthrough in ZK Technology: Ushering in a New Age of Privacy and Blockchain Scalability

- Vitalik Buterin drives Ethereum's ZK innovations to solve scalability and privacy challenges, positioning ZK as crypto's next growth pillar. - Modexp precompile updates and GKR protocol reduce proof costs 50x-15x, enabling ZK-rollups to process 43,000 TPS with near-zero fees. - ZK integration with MPC/FHE/TEE expands use cases beyond DeFi, with ZK-FHE hybrids targeting enterprise adoption in healthcare and finance . - ZK Layer 2 market projected to grow at 60.7% CAGR to $90B by 2031, driven by institutio