DASH Drops 13.71% Following Q3 Earnings Shortfall and Announcement of 2026 Investment Strategy

- DoorDash's Q3 2025 earnings showed revenue above estimates but EPS below, leading to a 13.71% post-earnings stock drop. - Despite strong 25% YoY GOV growth and 13.8% net margin, 2026 investment plans raised short-term margin concerns. - Deliveroo acquisition's adjusted EBITDA contribution dropped by $32–$40M in 2026 due to accounting adjustments, adding investor uncertainty. - Backtesting suggests EPS misses correlate with downward price pressure when paired with significant capital allocation announceme

As of November 6, 2025,

DoorDash Inc. (NASDAQ: DASH) released its Q3 2025 results, presenting a mixed picture: revenue exceeded forecasts, but earnings per share did not meet analyst expectations. The company posted $3.45 billion in revenue, outperforming the anticipated $3.36 billion, yet its EPS came in at $0.55, falling short of the $0.68–$0.69 consensus. This gap between strong revenue growth and weaker profitability became a focal point for investors, as robust top-line performance was offset by disappointing earnings.

The Marketplace Gross Order Value (GOV) for DoorDash reached $25.0 billion, marking a 25% year-over-year increase, while total orders rose 21% to 776 million. The net revenue margin improved to 13.8%, and adjusted EBITDA climbed to $754 million, both reflecting enhanced operational performance and growth.

Despite these favorable figures, DoorDash’s shares fell by about 13.71% in after-hours trading. The decline was largely due to the EPS shortfall and the company’s outlook. Management indicated plans for a substantial boost in investments for 2026, with "several hundred million dollars" earmarked for new projects and platform expansion. This anticipated spending is expected to weigh on near-term profits, prompting investor concerns over short-term margin compression.

The recent acquisition of Deliveroo added further complexity to the earnings story. While Deliveroo is projected to add $45 million to Q4 Adjusted EBITDA, DoorDash noted that its 2026 contribution would be lower due to accounting adjustments.

Backtest Hypothesis

To assess how earnings disappointments affect stock prices, a backtesting approach can be utilized. This method examines stock reactions to earnings announcements, especially when EPS falls significantly below expectations. The process involves pinpointing earnings dates with EPS misses and tracking subsequent price changes.

For DoorDash, this strategy could be used to analyze market responses to such events. Typically, one would select a timeframe—such as from January 1, 2022, to November 6, 2025—and monitor daily closing prices around earnings releases. By focusing on these specific dates and comparing price trends to the broader market, it’s possible to determine if earnings misses reliably lead to downward stock movements.

The backtest would also factor in other elements that might influence share prices after an earnings miss, such as the size of the miss, management’s guidance, and overall market sentiment. In DoorDash’s case, the EPS miss coincided with a major investment announcement, which likely played a significant role in the observed share price decline.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

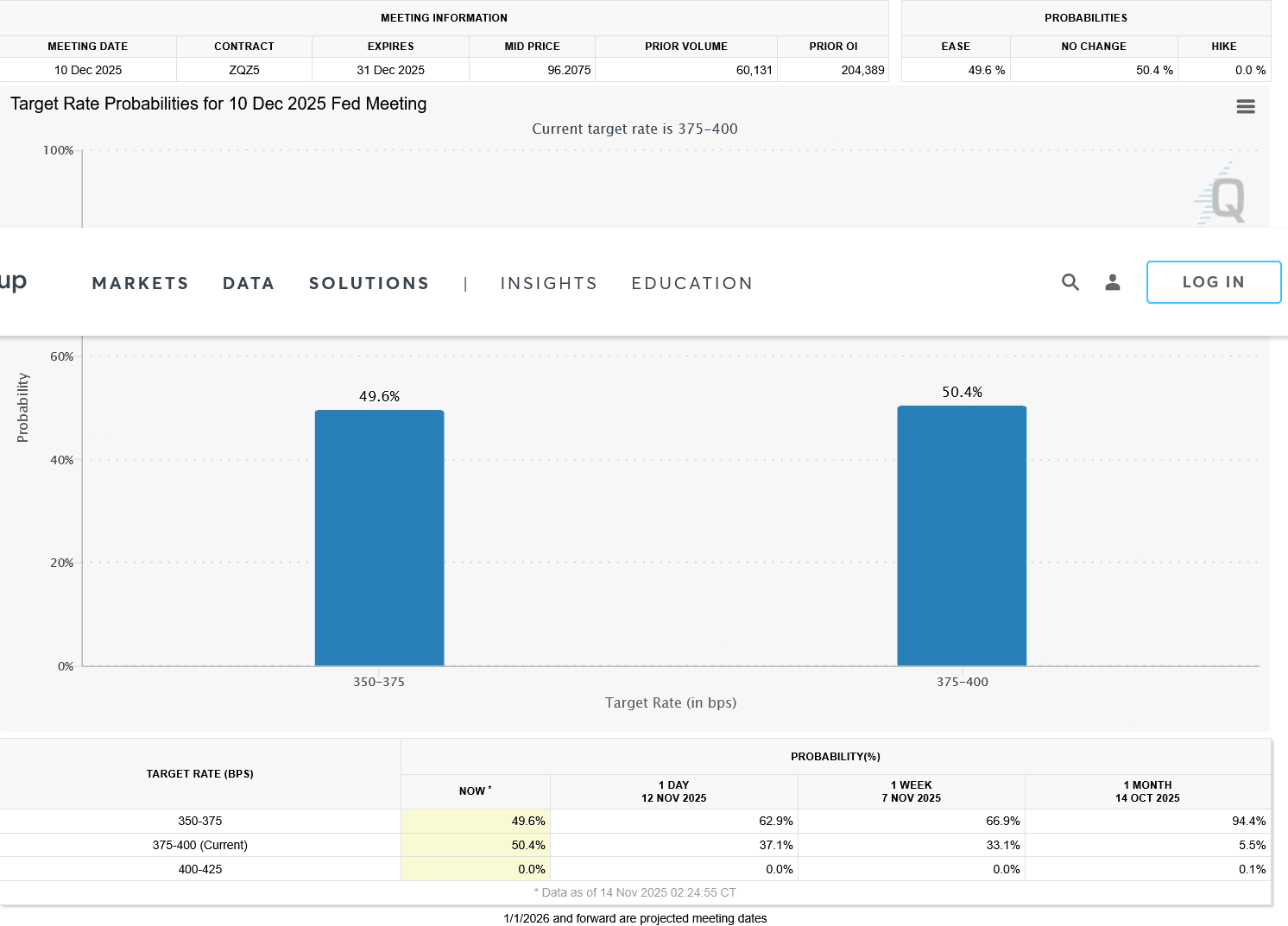

VIPBitget VIP Weekly Research Insights

Global markets are experiencing multiple transformative catalysts supporting the recovery of risk assets. For instance, Trump has revived his proposal to distribute $2000 "tariff dividend" checks to every American using tariff revenues. While the plan faces hurdles such as congressional approval and inflationary concerns, it has already boosted consumer confidence and is expected to inject trillions of dollars in liquidity, benefitting high-growth technology sectors. Meanwhile, the U.S. government shutdown has reached a record 41 days. With the Senate having reached an agreement, it's expected to end on November 11—potentially triggering a renewed fiscal injection of tens of billions of dollars and a V-shaped rebound similar to past shutdown recoveries. Market expectations for a rate cut at the Federal Reserve's December FOMC meeting are also rising, with a 62.6% probability priced in for a 25-basis-point cut. Some Trump-backed officials even advocate for a 50-basis-point reduction, which would extend the easing cycle and further stimulate investment in crypto and AI infrastructure. Together, these factors may drive a 5–10% rebound in total crypto market capitalization, creating a window of opportunity for allocation to high-quality projects.

Massive $869M Outflow Slams Bitcoin. Is a Crash Coming?

Ethereum Latest Updates: BitMine Commits $12 Billion to ETH—Chairman Predicts $12,000 Despite 13% Market Drop

- BitMine Immersion Technologies (BMNR) surged ETH purchases by 34% to 110,288 tokens weekly, now holding 3.5M ETH (2.9% supply) valued at $12.76B. - Leadership overhaul appoints Chi Tsang as CEO, aligning with chairman Tom Lee's "supercycle" vision and $12K ETH price target by 2025. - Market reacts mixed as ETH dips 13.4% in two weeks, with treasury buys currently underwater and regulatory shifts like CFTC oversight emerging. - Shareholders demand transparency amid unstaked ETH holdings and evolving crypt

Vitalik Buterin's Breakthrough in ZK Technology: Ushering in a New Age of Privacy and Blockchain Scalability

- Vitalik Buterin drives Ethereum's ZK innovations to solve scalability and privacy challenges, positioning ZK as crypto's next growth pillar. - Modexp precompile updates and GKR protocol reduce proof costs 50x-15x, enabling ZK-rollups to process 43,000 TPS with near-zero fees. - ZK integration with MPC/FHE/TEE expands use cases beyond DeFi, with ZK-FHE hybrids targeting enterprise adoption in healthcare and finance . - ZK Layer 2 market projected to grow at 60.7% CAGR to $90B by 2031, driven by institutio