Bitget Daily Digest(Nov 29)|All Major U.S. Stock Indices Closed Lower; Next Year’s FOMC Voters Emphasize Inflation Risks and Oppose Further Rate Cuts; 72 out of Top 100 Tokens Down More Than 50% from All-Time Highs

Today's Outlook

- The SEC is expected to make a decision on Grayscale’s Polkadot (DOT) ETF application by November 8, 2025.

- 72 out of the top 100 cryptocurrencies by market capitalization are down more than 50% from their all-time highs.

- Circle has submitted comments to the U.S. Treasury on the implementation of the GENIUS Act.

Macroeconomics & Hot Topics

- Deribit: Over $5 billion in Bitcoin and Ethereum options are set to expire this Friday.

- The USDC Treasury saw 10 minting and burning transactions exceeding $50 million each in the past 12 hours.

- Next year’s FOMC voting members emphasize inflation risks and oppose further rate cuts.

Market Trends

- BTC and ETH are consolidating in the short term as market sentiment remains cautious and leans towards fear. Around $563 million in liquidations occurred in the past 24 hours, mainly long positions.

- All three major U.S. stock indices closed lower: the Dow fell 0.84%, the Nasdaq plunged 1.90%, and the S&P 500 dropped over 1%.

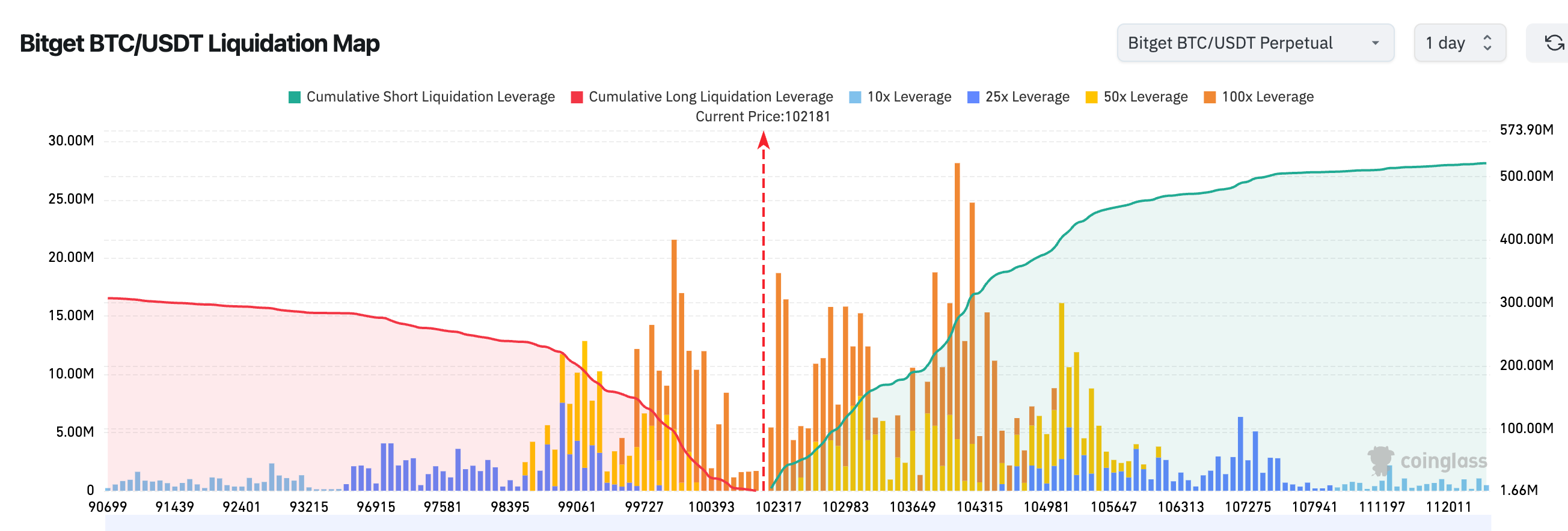

3.According to Bitget’s BTC/USDT liquidation map, BTC is currently priced at $102,181 USDT. There is a concentration of short liquidations in the 101,057 - 102,389 range. A breakdown below this range could trigger a chain reaction of liquidations and significantly increase short-term risks.

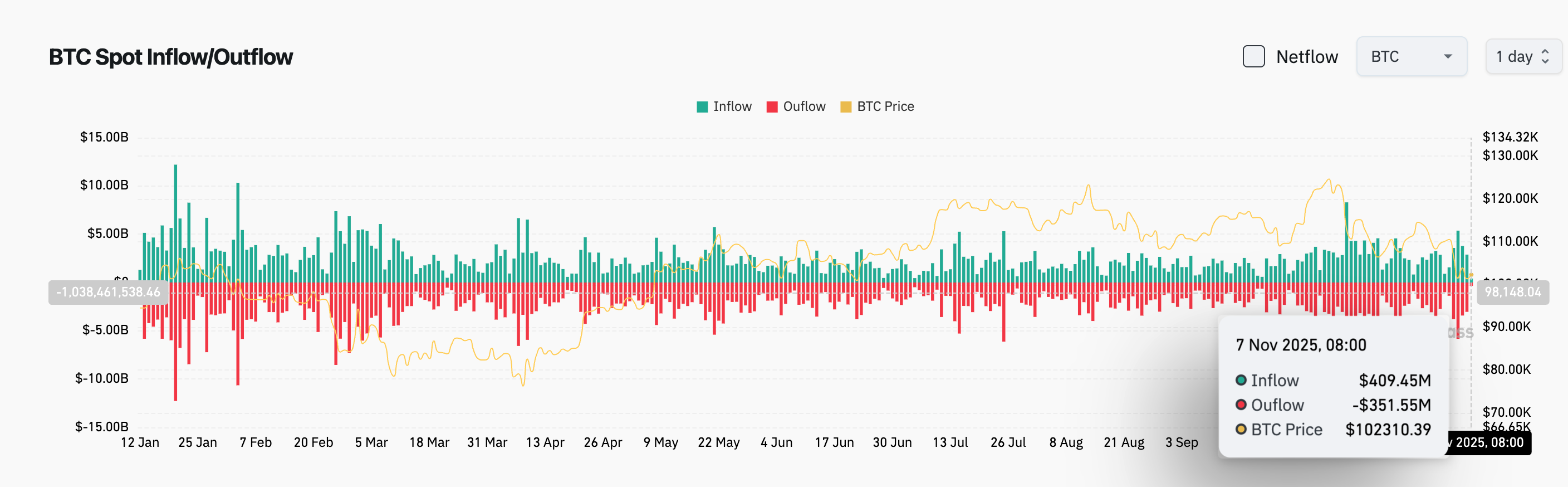

4.In the past 24 hours, BTC spot inflows reached $409 million, outflows were $351 million, for a net inflow of $58 million.

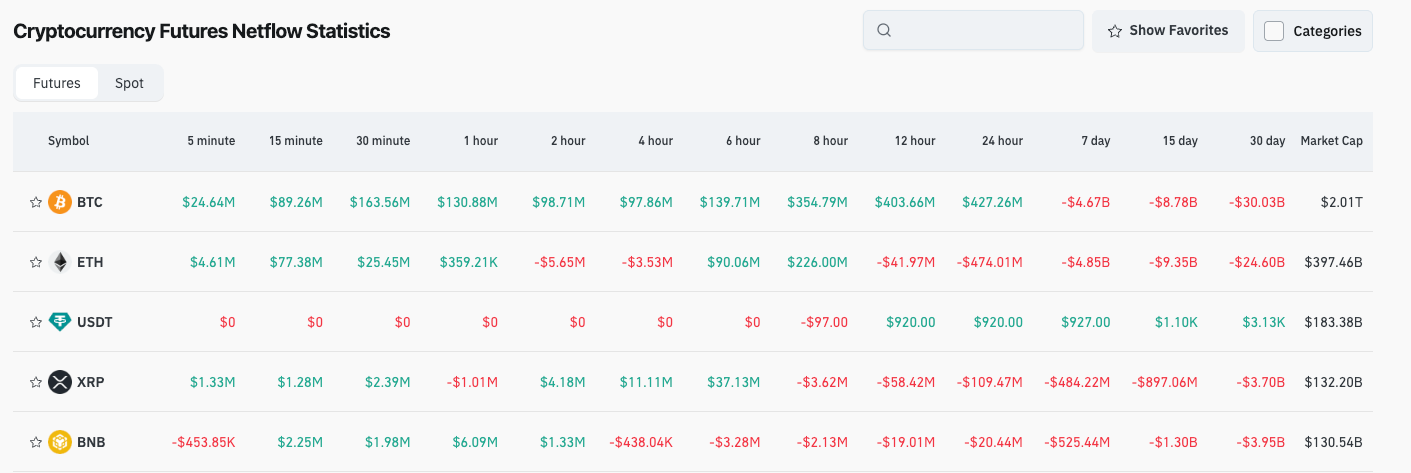

5.Over the last 24 hours, derivatives trading in BTC, ETH, USDT, XRP, and BNB saw net outflows. It's recommended to continue monitoring major cryptocurrencies for potential trading opportunities.

News Updates

- Elon Musk: SpaceX should become a publicly traded company.

- Block posted nearly $2 billion in Bitcoin revenue in Q3, accounting for almost one-third of its total revenue.

- Google will integrate prediction data from Kalshi and Polymarket into Google Finance.

- OpenAI CEO: Does not seek "government guarantees" for its data centers; annualized revenue is expected to surpass $20 billion by the end of this year.

Project Developments

- Credit Blockchain: Launched an AI-driven intelligent financial platform, combining AI with blockchain innovation.

- Ondo Finance appoints former McKinsey executive Ian De Bode as President.

- Aave founder: Gauntlet has suspended Compound withdrawals.

- Aerodrome: Major system upgrades to be released, including Slipstream V2 and Autopilot.

- Folks Finance: Native token FOLKS officially launched on November 6 with an initial circulation of 25.4%.

- Cipher issues $1.4 billion in high-yield bonds to fund Google-related data center construction.

- ORE mining program is now available on the Solana Mobile dApp Store for Seeker users.

- Berachain: Plans to launch a claims page for fund returns early next week and may execute an additional hard fork.

- ZachXBT collaborates with BNB Chain to strengthen Web3 security infrastructure.

- Hourglass: Adjusts Stable pre-deposit activity limits, clarifies KYC and settlement times.

Disclaimer: This report is AI-generated and has been manually verified for accuracy. It does not constitute any investment advice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Bitcoin Faces $103k Impasse as Bearish Signals Clash with Bullish Expectations

- Bitcoin fell near $103,000 on Nov. 8, 2025, amid Fed rate-cut uncertainty, trading in a $99,376–$103,956 range as technical indicators showed bearish consolidation. - Analysts highlighted key support at $98,900 and resistance at $104,000, with bullish sentiment driven by Cathie Wood’s $1M price target and Eric Trump’s “world-class asset” endorsement. - Strategy expanded its STRE offering to €620M to fund BTC purchases, holding 3.05% of circulating supply despite Bitcoin’s dip below $100,000. - Market cau

Ethereum Update: Validator Departures Point to a Streamlined and More Effective Network Ahead

- Ethereum's validator count fell below 1 million in November 2024, signaling structural shifts in staking dynamics and raising network security concerns. - Exit queues now take 37 days for withdrawals, driven by large-scale exits from Lido, Kiln, and leveraged staking unprofitability due to 2.9% annualized yields. - Experts predict consolidation toward professional operators, accelerated by Ethereum's Pectra upgrade allowing 2,048 ETH per validator. - Despite validator declines, Ethereum hosts $201B in to

ZEC Value Jumps 4.8% on NOV 12 2025 as Institutions Embrace and Privacy Advances Emerge

- Zcash (ZEC) surged 4.8% on Nov 12, 2025, to $464.06, with a 725.75% annual gain despite recent volatility. - Institutional adoption, including Grayscale's $137M ZCSH investment, and U.S. regulatory clarity via the Clarity and Genius Acts boosted ZEC's legitimacy. - DeFi integration via zenZEC and 30% shielded pool adoption highlight Zcash's privacy-driven appeal, supported by Electric Coin Company's ecosystem upgrades. - Whale activity and $500 support level analysis suggest potential for a $1,500 price

BCH Shares Rise 0.55% Today Following Governance and Earnings Announcements

- BCH stock rose 0.55% in 24 hours amid governance reforms approved at an Extraordinary Shareholders’ Meeting on Nov 10, 2025. - The bank reported slower growth due to reduced inflation-adjusted income and subdued loan expansion, with over 60% revenue from net interest income. - Governance amendments aim to enhance oversight, but technical analysis highlights risks from interest income reliance and macroeconomic exposure. - A backtest error occurred due to zero-price data, with three recovery options propo