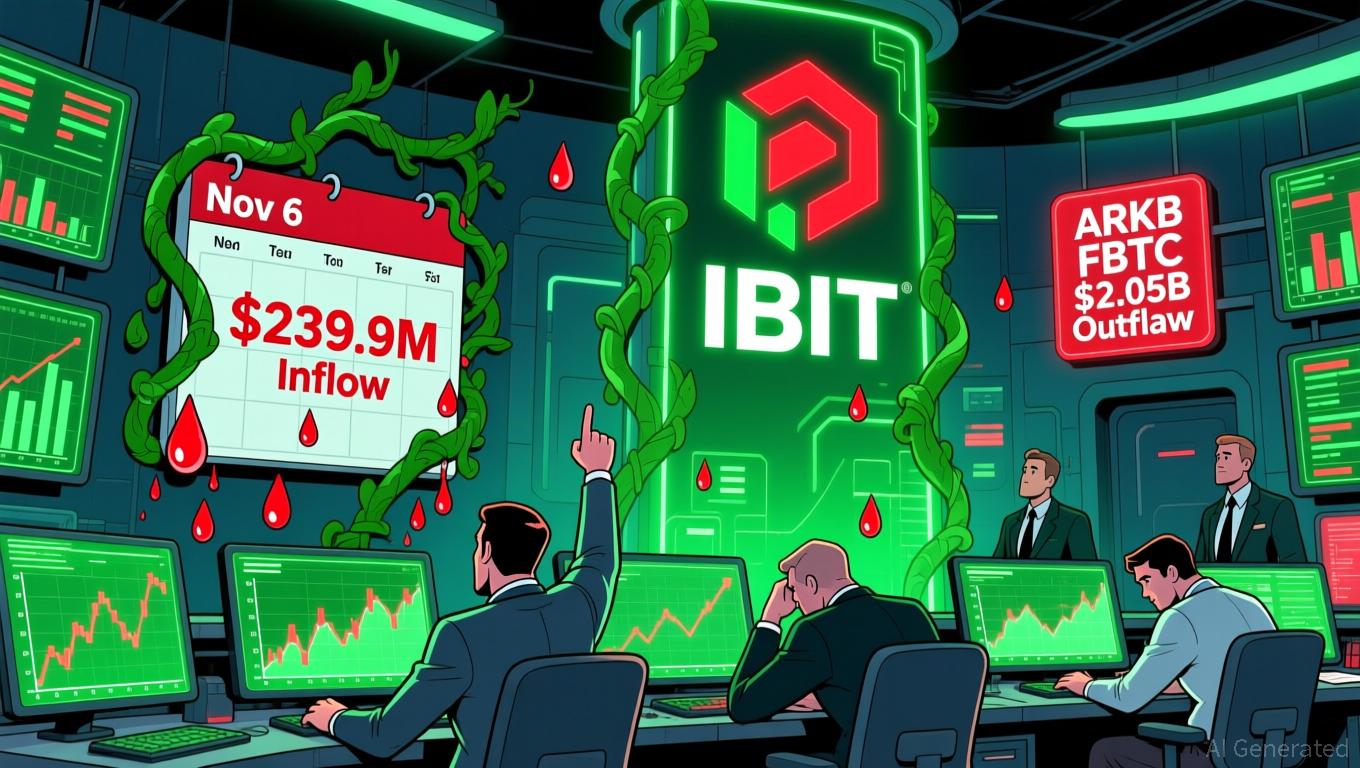

Bitcoin Updates: Investor Optimism Grows as Bitcoin ETFs End Outflow Trend

- U.S. spot Bitcoin ETFs ended a six-day outflow streak with $239.9M net inflows on Nov 6, led by BlackRock's IBIT ($112.4M) and Fidelity's FBTC ($61.6M). - Bitcoin's price rebounded to $103,000 from below $99,000 as improved liquidity and reduced macro volatility drove inflows, though risks persist without sustained buying pressure. - Ethereum ETFs saw smaller $12.5M inflows while Grayscale's ETHE continued outflows, highlighting diverging investor preferences between BTC and ETH. - Solana ETFs emerged as

Bitcoin ETFs See Net Inflows After Six Consecutive Days of Outflows

U.S. spot

The uptick in Bitcoin ETF inflows comes alongside a modest recovery in

The difference in flows between Bitcoin and Ethereum ETFs highlights changing investor sentiment. While Bitcoin ETFs ended their streak of outflows, Ethereum ETFs had registered $219 million in net outflows on November 4, led by ETHA and ETHE,

Market participants remain wary, as Bitcoin’s price hovers near significant resistance points. Technical analysis suggests more sideways movement is likely, with BTC facing resistance at $106,000 and the possibility of retesting $100,000 support if buyers remain cautious, according to Crypto.news. Ethereum’s outlook is also bearish, with its RSI nearing oversold levels and declining open interest indicating reduced demand from both retail and institutional investors,

The return to net inflows also points to broader institutional portfolio adjustments. Some asset managers see these inflows as part of regular quarter-end rebalancing, while others emphasize Bitcoin’s increasing role in long-term investment strategies, FinanceFeeds reported. For now, the crypto market remains volatile, with ETF flows serving as a key indicator of institutional sentiment. If this trend persists, it may signal a wider return to digital assets, but ongoing volatility and macroeconomic challenges are likely to keep the outlook uncertain, Crypto.news warned.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Public's $65 Million CryptoIRA Initiative Reflects Surging Interest in Tax-Beneficial Crypto Retirement Options

- Public acquires Alto's CryptoIRA business for $65M to enable IRA crypto trading by early 2026. - Acquisition expands retirement crypto options amid rising retail demand and evolving regulations. - Existing Alto customers retain platform access until integration, with seamless transition planned. - Alto shifts to custodial role under CaaS model, while Public handles trading functionality. - Move reflects crypto fintech consolidation and growing investor interest in tax-advantaged digital assets.

ZEC Jumps 6.68% Following Winklevoss-Supported Treasury Approach

- Zcash (ZEC) surged 6.68% in 24 hours to $548.91 on Nov. 14, 2025, despite a 9.98% weekly decline. - Winklevoss-backed Cypherpunk Technologies rebranded from a biotech firm to a ZEC-focused treasury strategy, acquiring 1.25% of total ZEC supply. - The firm aims to hold 5% of ZEC supply (800,000 tokens) as a privacy hedge, supported by $58.9M in funding and a $200M equity facility. - ZEC's 37.03% monthly gain and 885.34% annual rise reflect growing demand for privacy-centric assets, with Network Upgrade 6.

Investors Embrace AI and Tokenization Amid Decline in Conventional Markets

- Crypto market declines reflect investor shift to AI-driven platforms and tokenized assets amid traditional market volatility. - Recent token listings show diminishing returns (e.g., SEI/2Z 8-5% drops), signaling skepticism toward conventional mechanisms. - AI optimizes private market operations (e.g., SaaS growth, HELOC underwriting) while democratizing capital access beyond institutional bias. - Tokenization unlocks liquidity in art and healthcare via AI-driven insights, challenging traditional VC model

Cardano News Update: Institutions Embrace Cardano While DeFi Advances—Cardano and Mutuum Finance Set the Stage for 2025 Crypto Evolution

- Cardano (ADA) and Mutuum Finance (MUTM) lead 2025 crypto divergence through institutional adoption and DeFi innovation. - Cardano partners with EMURGO/Wirex to launch ADA-spending "Cardano Card," targeting 6M users and ISO 20022 alignment for institutional credibility. - Mutuum Finance raises $18.8M in presale, plans Q4 2025 testnet with liquidity pools and mtTokens, offering 250% returns for early buyers. - ADA faces bearish technical patterns and whale selling, while MUTM's low entry price and structur