Altcoin season signals hide in 'many weeks' of bearish BTC dominance: Analyst

The recent volatility in Bitcoin’s dominance could be a signal that altcoin season is approaching sooner than many traders expect, according to a crypto analyst.

“The reason why you should have confidence in the altcoin price action is because the BTC Dominance chart looks bearish and has looked bearish for many weeks,” crypto analyst Matthew Hyland said in an X post on Friday.

“The downtrend is favorable to continue; therefore, this relief rally has been a dead cat bounce in a downtrend,” Hyland said. In a separate video on Saturday, Hyland said that the recent volatility in Bitcoin’s (BTC) price may have been orchestrated by traditional finance giants.

“Over the past month, I’ve kind of just maintained the view that a lot of this was really just manipulation, essentially for Wall Street to set themselves up,” he claimed.

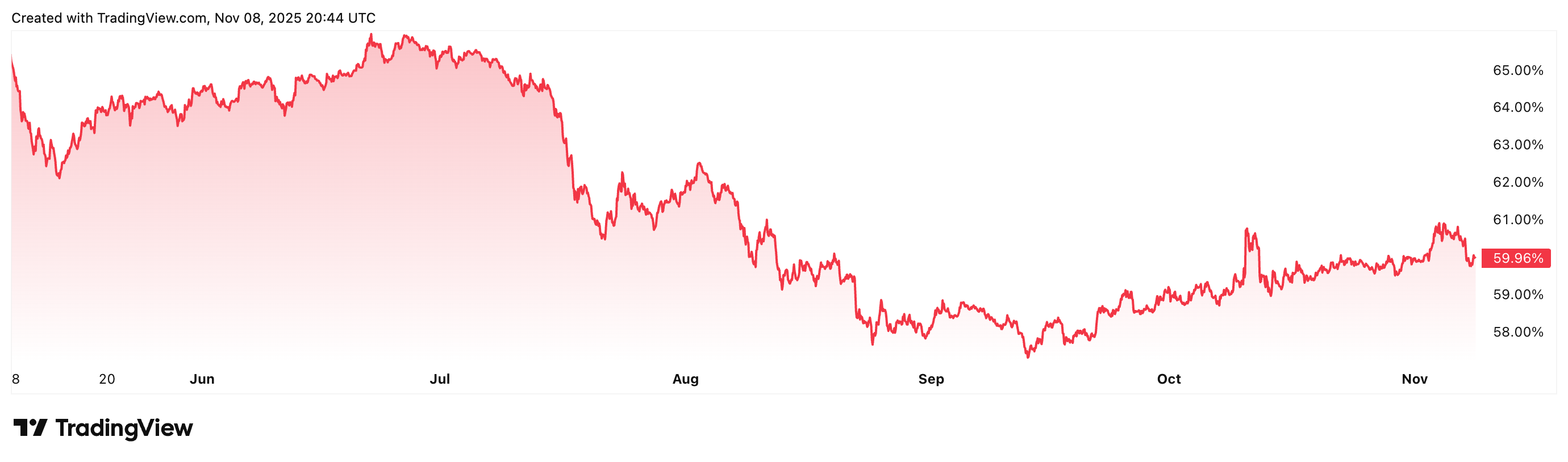

Bitcoin dominance has dropped 5% since May

Bitcoin’s dominance, which measures Bitcoin’s overall market share, is down 5.13% over the past 6 months, and holding 59.90% at the time of publication, according to TradingView.

It was only on Nov. 4 that Bitcoin slipped below the $100,000 price level for the first time in four months, leading to broader market concerns about where the asset’s price will go next.

Bitcoin is trading at $102,090 at the time of publication, according to CoinMarketCap.

While Hyland speculated that the altcoin market may gain momentum soon, other indicators, however, continue to point to a market centered around Bitcoin.

CoinMarketCap’s Altcoin Season Index currently sits at 28 out of 100, well within “Bitcoin Season” territory.

Altcoin season may be different from previous cycles

The last time the indicator signaled “Altcoin Season” was on Oct. 8, just days after Bitcoin hit a new all-time high of $125,100, when traders appeared to anticipate a rotation of capital further up the risk curve.

However, the indicator quickly plunged to risk-off mode after the Oct. 10 market crash which saw around $19 billion in leveraged positions wiped out of the crypto market.

Some crypto executives expect the next altcoin season to be more selective and concentrated than in previous market cycles.

Maen Ftouni, CEO of CoinQuant, a company that produces algorithmic trading tools, recently said that older cryptocurrencies with an exchange-traded fund (ETF) or expected to receive an ETF will soak up much of the capital deployed during the next altcoin season.

“Not every single coin is going to have massive returns; the liquidity is going to be concentrated into certain places, dinosaurs being one of them, of course,” Ftouni said.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

YFI Gains 0.38% Over 24 Hours Despite Year-Long Downtrend

- YFI rose 0.38% in 24 hours to $4768, contrasting a 40.84% annual decline and 5.56% weekly drop. - Analysts highlight need for improved utility/adoption to reverse long-term bearish trends despite short-term resilience. - Technical indicators show no strong reversal patterns, with bearish pressure dominating despite 1-month 0.45% recovery. - Mixed performance reflects complex market dynamics between temporary buying interest and structural bear market challenges.

Bitcoin News Update: Hyperliquid's BTC Short Balances on Edge: $17 Million Profit Nears as $111,000 Liquidation Threatens

- Hyperliquid's largest BTC short holds $17M unrealized gains, risking liquidation above $111,770 amid volatile $106K price. - 20x leveraged position shows 4.86% profit from $111K entry, with 55% of platform's $5.3B total positions in shorts. - $30M POPCAT manipulation incident exposed liquidity risks, causing $63M liquidations and $4.9M HLP losses. - BTC faces bearish pressure below $101K despite 15/1 technical buy signals, as ETF inflows revive institutional demand.

Bitcoin News Today: Bitcoin’s Recent Decline Ignites Discussion: Is This a Temporary Correction or the Start of a Larger Downtrend?

- Bitcoin long-term holders offloaded 815,000 BTC in 30 days, pushing price below $100,000 and triggering $683M liquidations. - Analysts link the selling to profit-taking after prolonged rallies, with open interest dropping 27% to $68.37B as demand remains subdued. - Market debates whether this marks a mid-cycle correction (22% average drawdowns historically) or a broader bearish shift. - Despite volatility, 72% of BTC supply remains in profit, and DeFi TVL exceeding $1T signals potential long-term resilie

Bitcoin Updates: Metaplanet Increases Its Bitcoin Assets While Competitors Shift Focus from Mining

- Metaplanet boosted Bitcoin holdings via $100M credit and 75B yen buybacks, now holding 30,823 BTC ($3.5B) to drive capital strategy. - Q3 revenue surged 115.7% to ¥2.438B as peers like TeraWulf shift from mining to HPC amid declining crypto profitability. - Japan's JPX considers stricter crypto treasury rules after Metaplanet lost 82% of peak value since May amid market volatility. - BitMine Immersion accelerated Ethereum accumulation to 110,288 ETH ($12.5B) while Hyperscale Data targets 100% Bitcoin/mar