- Whales moved ETH off exchanges and bought OTC, showing long-term confidence.

- Large holders increased LINK balances by 22%, stabilizing prices amid new token supply.

- Whales bought 660,000 UNI, sparking a 12% rebound after a sharp monthly drop.

While many traders panic during market crashes, crypto whales often see opportunity. These deep-pocketed investors have quietly started accumulating key altcoins again, even as prices slide. Their buying patterns often reveal where long-term confidence lies. Recent data shows that whales are scooping up Ethereum, Chainlink, and Uniswap, signaling renewed faith in these projects. This silent accumulation could shape the next major rally once market sentiment turns positive.

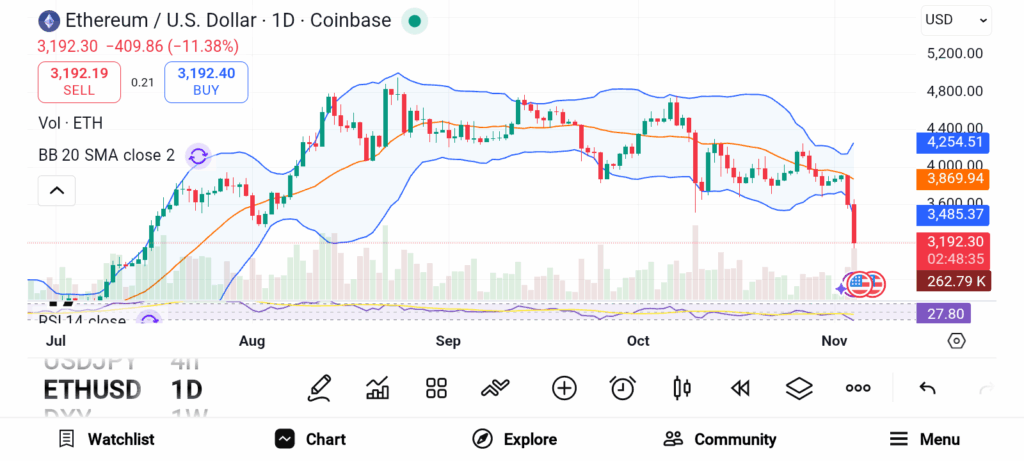

Ethereum Whales Show Long-Term Confidence

Source: Trading View

Source: Trading View

Ethereum didn’t escape the market sell-off. ETH’s price dropped from $4,350 to $3,700 within 12 hours, a steep 13.7% decline. Instead of panicking, Ethereum whales took action. They transferred large amounts of ETH from exchanges to private wallets, showing they plan to hold rather than sell. Reports also revealed hundreds of millions of dollars in over-the-counter Ethereum purchases. These off-exchange trades helped stabilize the price and drive recovery above $4,100. Despite brief selling pressure, overall whale activity around Ethereum remains strong. Their steady accumulation signals confidence in Ethereum’s long-term growth, especially with continued network upgrades and ecosystem expansion.

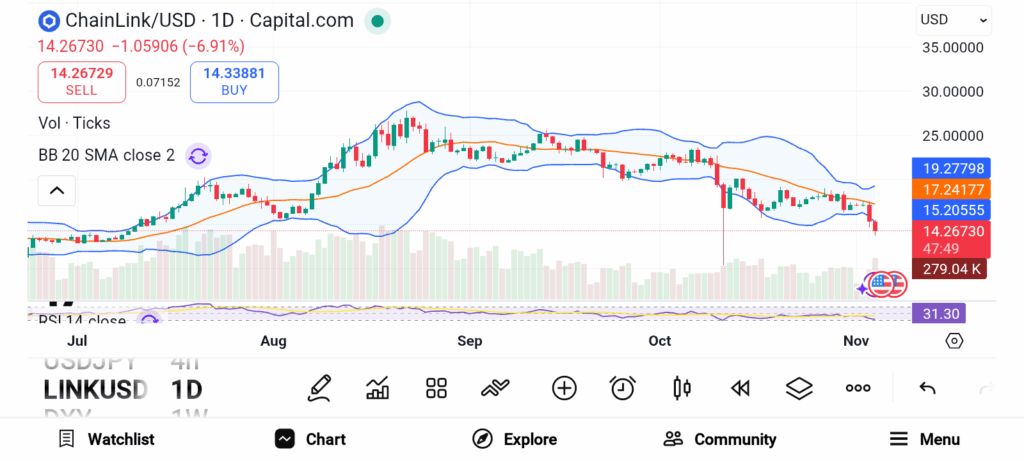

Chainlink Accumulation Strengthens Despite Market Pressure

Source: Trading View

Source: Trading View

Chainlink’s LINK became another favorite among whales during the downturn. Wallets holding over 100,000 LINK boosted their balances by about 22%. This accumulation brought total holdings to roughly 760 million LINK, worth between $13 million and $16 million. Interestingly, this buying occurred even as 18.75 million new LINK tokens entered circulation, creating temporary selling pressure.

Whales stepped in during the dip, helping absorb the excess supply and reduce volatility. By doing so, they stabilized prices and restored balance to the market. Their consistent support highlights belief in Chainlink’s decentralized oracle system, which remains vital to smart contracts and blockchain integrations across the industry.

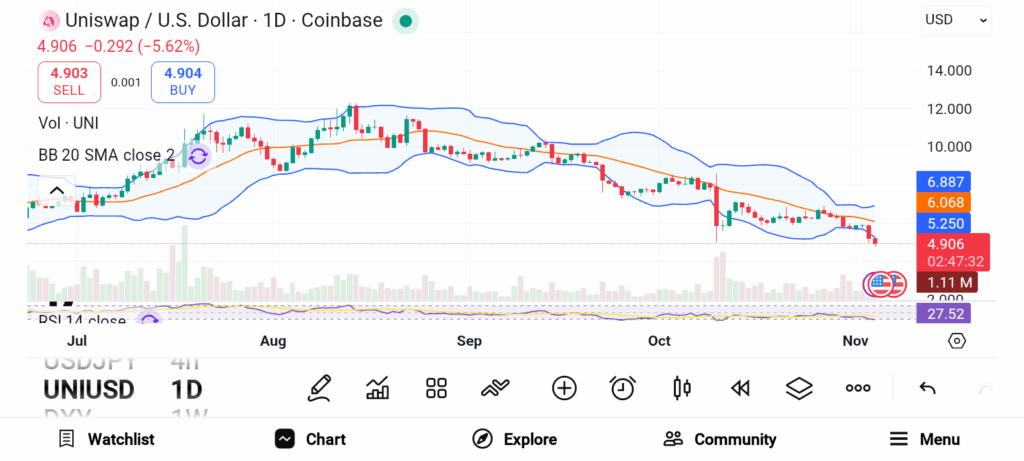

Uniswap Whales Quietly Boost Market Confidence

Source: Trading View

Source: Trading View

Uniswap also caught whale attention, though on a smaller scale. Large investors purchased about 660,000 UNI tokens, valued near $4 million. The token had fallen more than 33% in the past month and dipped below $2 before the whales stepped in. Their timely purchases quickly changed market dynamics. UNI’s price jumped 12% within 24 hours, reversing short-term sentiment. Analysts note that even moderate whale accumulation can shift momentum, especially when retail investors remain hesitant. The renewed buying interest shows belief in Uniswap’s decentralized exchange model, which continues to play a central role in DeFi trading activity.

Whales are quietly accumulating top altcoins during the latest market downturn. Ethereum transfers to private wallets and OTC buys show deep confidence. Chainlink whales are adding millions in tokens despite fresh supply pressure. Uniswap buyers are helping shift sentiment back toward optimism. Together, these moves suggest whales are preparing for the next crypto rebound while smaller investors remain cautious.