3 Altcoins Facing Major Liquidation Risk in the Second Week of November

XRP, Zcash, and Starknet are showing strong momentum but carry high liquidation risks for leveraged traders this week. Analysts warn that overleveraged longs could face steep losses if market sentiment turns.

While the altcoin season has yet to return, a few altcoins are showing stronger performance than the rest of the market in the second week of November. However, these same tokens also face the risk of triggering massive liquidations for short-term traders.

Which altcoins are they, and what risks are involved in trading their derivatives?

1. XRP

Short-term trader sentiment for XRP remains highly optimistic as Canary Capital prepares to launch its Spot XRP ETF on November 13.

Additionally, five XRP spot ETFs from Franklin Templeton, Bitwise, Canary Capital, 21Shares, and CoinShares have appeared on the DTCC list. This development strengthens investor confidence that multiple XRP ETFs could soon receive approval.

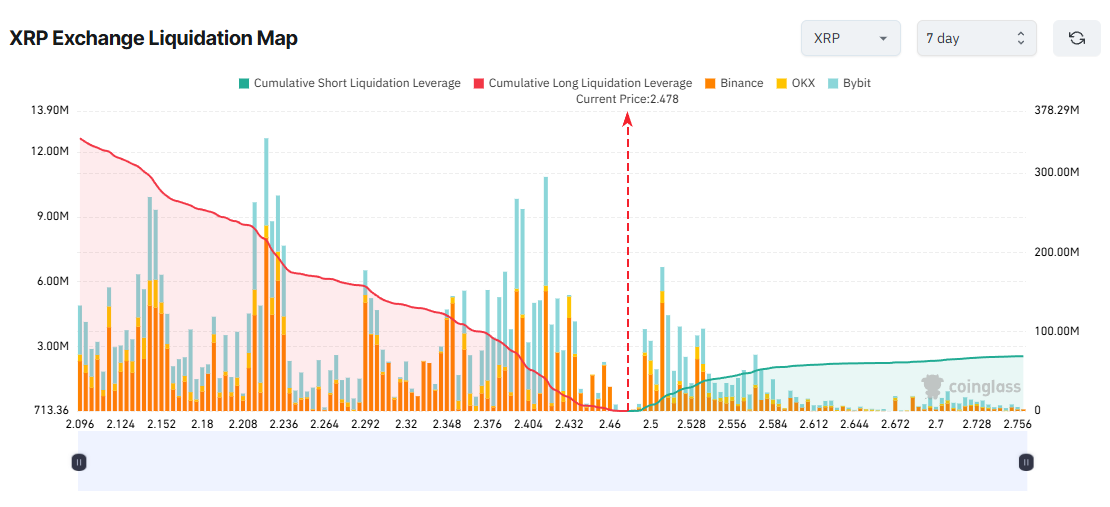

XRP Exchange Liquidation Map. Source:

Coinglass

XRP Exchange Liquidation Map. Source:

Coinglass

The 7-day liquidation map indicates a significant concentration of potential long liquidations, suggesting that many traders are anticipating an XRP price rally this week.

However, BeInCrypto’s latest analysis reveals a sharp decline in new XRP addresses over the past week, indicating a weakening of interest from new investors. Moreover, the MVRV Long/Short Difference has dropped, increasing the likelihood of a price correction.

If XRP falls toward $2.10 this week, long positions could face more than $340 million in liquidations. Conversely, if XRP rises to $2.75, short positions may be liquidated for around $69 million.

2. Zcash (ZEC)

The rally in Zcash (ZEC) shows no sign of slowing down in the second week of November. Although ZEC reached $750 before correcting to around $658, many traders still expect the price to climb toward $1,000.

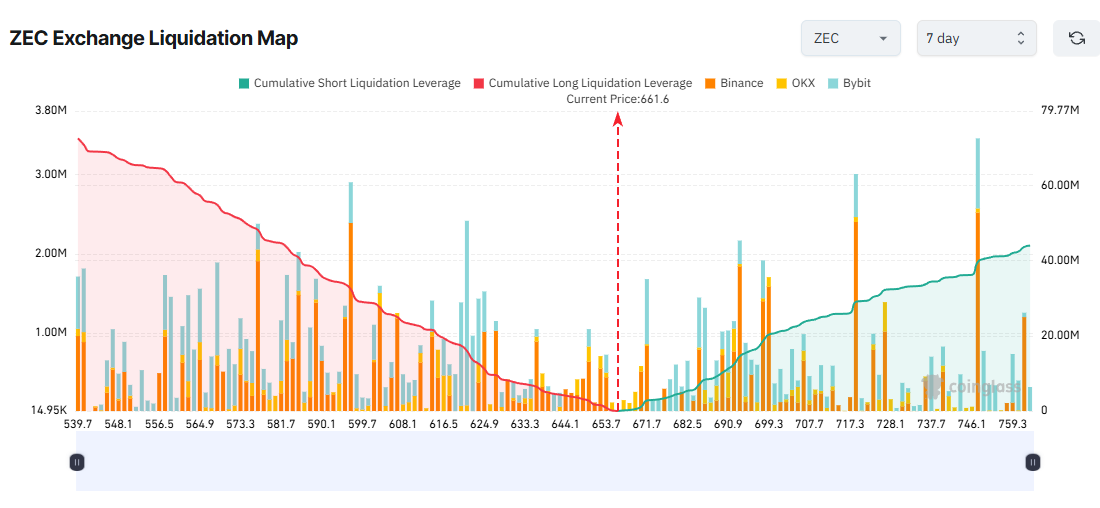

The 7-day liquidation map reveals that short-term derivatives traders are allocating more capital and leverage toward long positions. This means they could face larger losses if ZEC experiences a correction this week.

ZEC Exchange Liquidation Map. Source:

Coinglass

ZEC Exchange Liquidation Map. Source:

Coinglass

If ZEC drops to $540, over $72 million in long positions could be liquidated. Conversely, if ZEC surges to $760, roughly $44 million in shorts could be wiped out.

Analysts warn that ZEC may be forming a classic parabolic uptrend after a 10x rally, possibly nearing the final stage of the pattern.

“Just sold 90% of my ZEC. I’m bullish on the privacy thesis, but parabolic charts rarely sustain in the short run without a meaningful retrace. Too much short-term FOMO imo,” investor Gunn said.

3. Starknet (STRK)

Starknet (STRK) surprised the market in the second week of November with a 30% daily surge, recovering losses from last month’s sharp decline.

Several analysts suggest STRK may be breaking out of a long-term resistance line, potentially kicking off a strong new bull run.

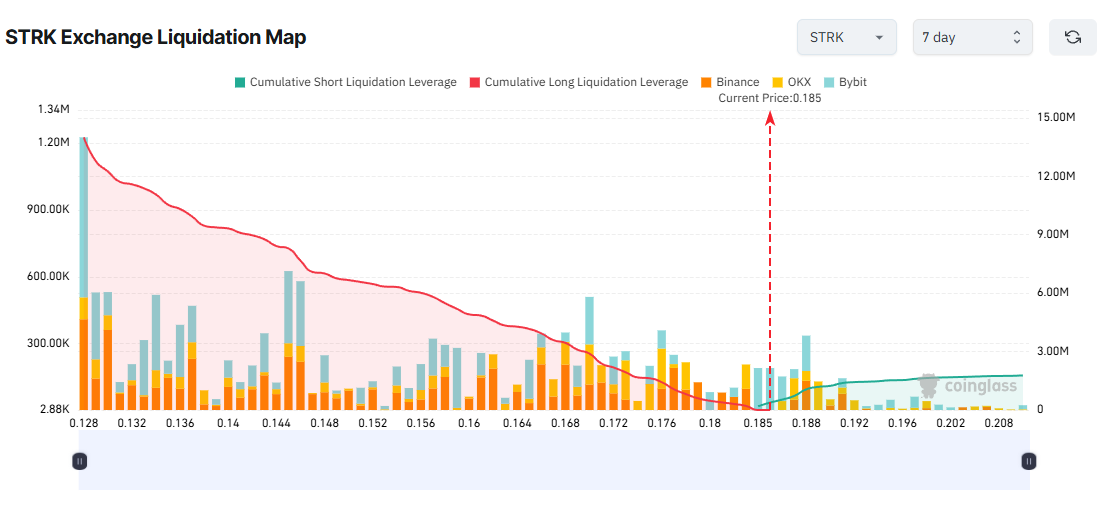

Liquidation map data reflects this short-term bullish sentiment, showing a dominance of potential long liquidations over shorts.

STRK Exchange Liquidation Map. Source:

Coinglass

STRK Exchange Liquidation Map. Source:

Coinglass

However, CryptoRank reports that STRK is among the top 7 altcoins with major token unlocks this week. More than 127 million STRK tokens will be unlocked, potentially adding significant selling pressure and disrupting the plans of leveraged long traders.

If STRK falls to $0.128, approximately $14 million in long positions could be liquidated. Conversely, if it breaks above $0.20, about $1.78 million in shorts could be wiped out.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DODO Rises 2.11% on November 12, 2025 Despite Ongoing Yearly Decline

- DODO rose 2.11% on Nov 12, 2025, but remains in a 12-month bearish trend with an 80.93% annual decline. - Analysts debate if the short-term rebound signals a critical support level reversal amid oversold RSI conditions (30) and downtrend indicators. - A backtest strategy evaluates historical cases of similar sharp one-day gains (-80.93% annual drop + 2.11% daily rise) to assess reversal probabilities.

Bitcoin News Update: Traditional Banks Struggle to Compete with SoFi's All-in-One Crypto Expansion

- SoFi becomes first U.S. bank to launch integrated crypto trading via its app, offering BTC, ETH, and SOL. - The service uses in-house infrastructure and regulatory compliance, replacing a 2019 Coinbase partnership (suspended in 2023). - Enabled by March 2025 OCC guidance, it aims to attract risk-conscious users with FDIC-insured accounts and a Bitcoin giveaway promotion. - Future plans include a USD-backed stablecoin by 2026 and blockchain remittances, though crypto remains speculative and uninsured.

XRP News Today: XRP Faces Technical Challenges While Ripple Grows Its Institutional Presence

- XRP's price has fallen below $2.40 amid a "death cross" technical signal and weak RSI, with key resistance at $2.50–$2.60. - On-chain data shows 240% higher profit-taking by long-term holders, with $470M in realized losses as prices drop below $2.50. - Ripple secures $500M funding at $79B valuation but XRP remains detached from institutional progress, down 20% in Q4 2025. - Whale activity declines sharply while retail sentiment wanes, with trading forum engagement down 25% month-over-month. - XRP trades

JPMorgan's Advantage with Deposit Tokens: Institutional Options Beyond Stablecoins

- JPMorgan launches JPM Coin, a 24/7 USD deposit token for institutional clients via Coinbase's Base blockchain, enabling real-time settlements beyond banking hours. - The token, piloted with Mastercard and B2C2, aims to streamline cross-border payments and will expand to non-institutional clients and euro-denominated JPME pending approvals. - JPM Coin serves as collateral on Coinbase and differentiates from stablecoins by representing tokenized bank deposits with potential yield-bearing features. - The in