Bitget Daily Digest (Nov 11)|Uniswap Proposal Activates Protocol Fee Switch & UNI Burn; Monad Announces Tokenomics, 3% Airdropped to Community; Strive Increases BTC Holdings to 7,525

Today's Outlook

- The Uniswap ecosystem sees a major governance proposal: On November 10, Uniswap Labs and the Foundation proposed activating the protocol fee switch and implementing a UNI burn mechanism. UNI surged over 38% in the past 24 hours, now trading at $41.66 with a market cap rising to $7.192 billion.

- Monad unveiled its tokenomics: total token supply of 100 billion, with 7.5% to be sold at a fully diluted valuation (FDV) of $2.5 billion and 3% to be airdropped to the community.

- Solayer (LAYER) will unlock around 27.02 million tokens (~$6.6 million) on November 11, 2025, accounting for 9.51% of circulating supply.

Macro & Trending News

- The U.S. Senate has approved a bill to avert a government shutdown, sending it to the House of Representatives.

- No net inflows reported for the US Hedera spot ETF; Litecoin spot ETF recorded a single-day net inflow of $2.11 million.

- The U.S. Depository Trust & Clearing Corporation (DTCC) has added 5 XRP spot ETF products to its clearing list, with related products expected to launch soon.

- Nasdaq-listed Strive announced the purchase of 1,567 BTC at an average price of $103,315, bringing its total Bitcoin holdings to 7,525 BTC.

Market Overview

- BTC/ETH dipped slightly in the short term, with the market leaning bearish. The total liquidation across the market in the past 24 hours amounted to approximately $318 million, with long liquidations accounting for $178 million.

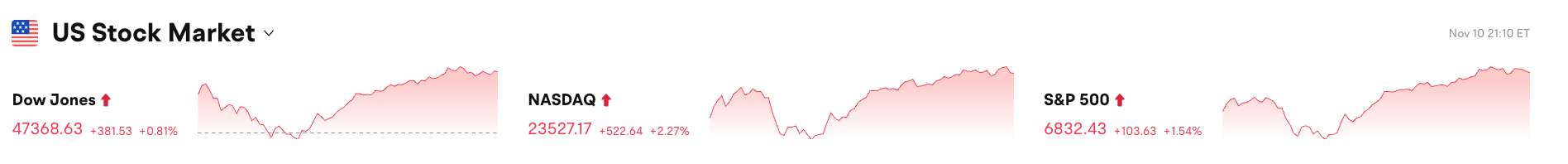

- U.S. stocks closed higher on Monday: Dow Jones rose 0.81%, Nasdaq jumped 2.27%, and the S&P 500 climbed 1.54%.

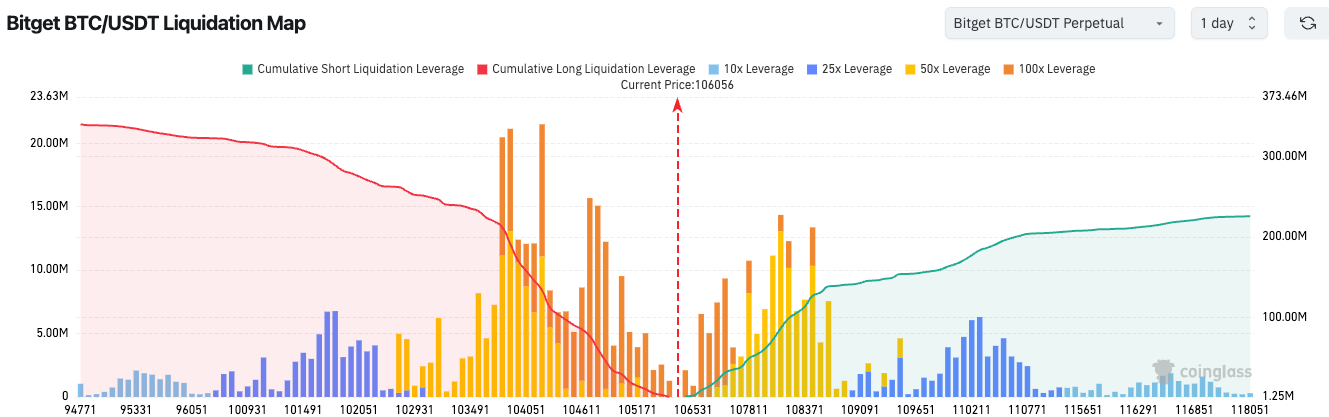

3.According to Bitget’s BTC/USDT liquidation map, BTC is currently priced at $105,992 USDT. Heavy high-leverage long liquidation is concentrated in the $104,000–$105,500 range; a break below could trigger a long-side flush.

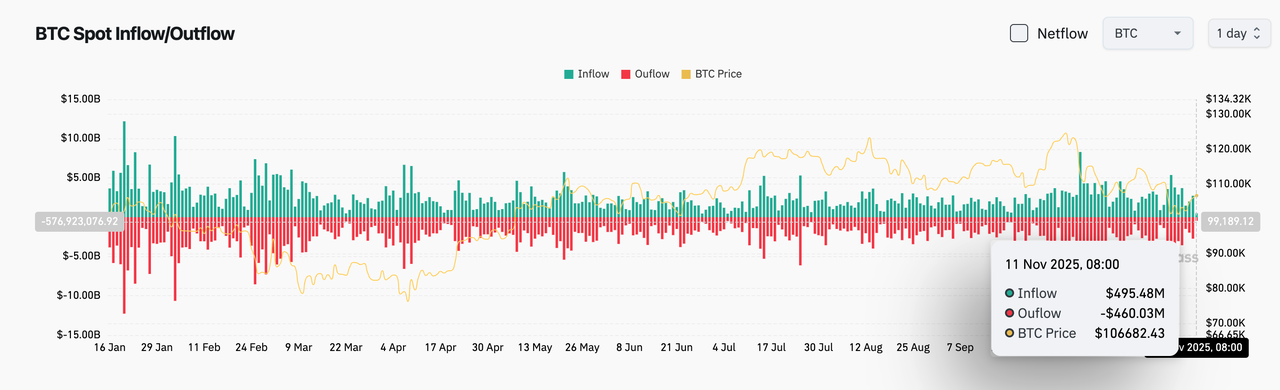

4.In the past 24 hours, BTC spot inflows totaled $495 million, with outflows at $460 million, for a net inflow of $35 million.

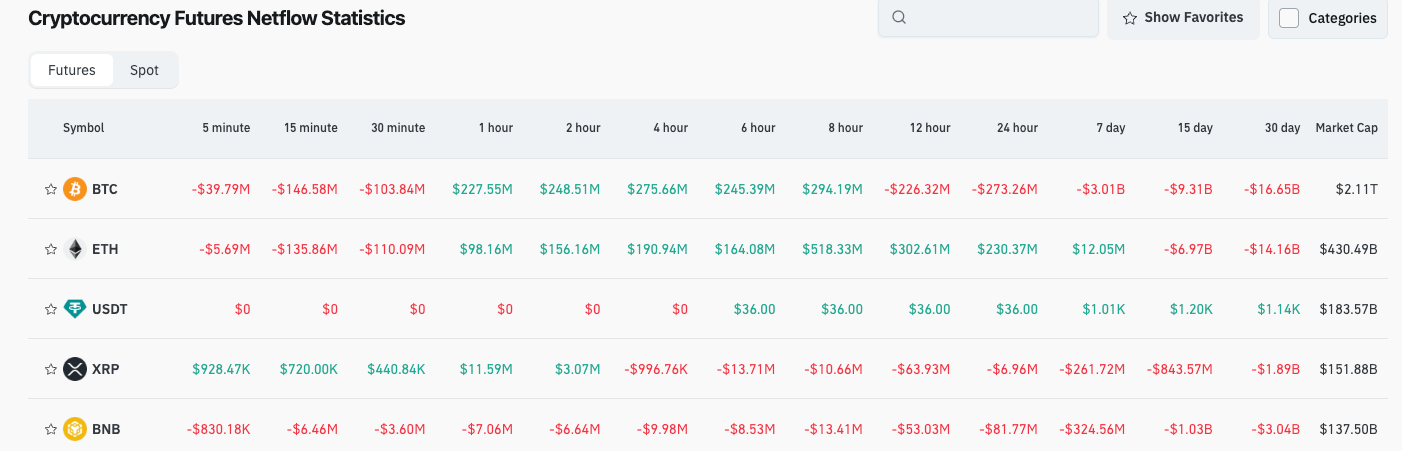

5.Over the past 24 hours, contract trading in BTC, ETH, USDT, XRP, and BNB saw notable net outflows, indicating potential trading opportunities.

Latest Developments

- The U.S. Senate's Agriculture Committee released a draft crypto regulation bill, aiming to grant new oversight powers to the CFTC for digital commodities.

- ZK Nation announced a proposal to upgrade its ZK token with a permissionless burn function; voting begins November 14.

- The U.S. Treasury and IRS released new guidance, outlining clear pathways for staking with crypto ETPs.

- Brazil’s central bank issued new regulations for virtual asset oversight, officially establishing a legal framework for "Virtual Asset Service Providers", effective February 2026.

Project Updates

- Starknet (STRK) v0.14.1 upgrade will launch on its testnet on November 11, 2025.

- peaq (PEAQ) will unlock around 84.84 million tokens (~$6 million), making up 5.57% of circulating supply, on November 12, 2025.

- SUI Group and Bluefin announced a partnership: 2 million SUI provided as loans in exchange for 5% of Bluefin’s revenue.

- Rumble inked a $100 million advertising deal with Tether, spread over two years at $50 million per year.

- Hourglass’s Stable Vault phase 2 KYC application deadline extended, with over 17,000 applications approved so far.

- Aptos (APT) will unlock around 11.31 million tokens (~$33.4 million, 0.49% of circulating supply) on November 11, 2025, 14:00.

- Chainlink (LINK) will kick off its Season 1 incentive program—covering LINK staking and token claims—on November 11, 2025.

- In Q3, 23 Solana-based projects secured over $211 million in total fundraising, up 70% quarter-over-quarter.

- Japan’s Financial Services Agency (FSA) plans to require mandatory registration for third-party crypto custodians to enhance industry security.

- Strive increased its Bitcoin holdings to 7,525 BTC, accelerating digital asset allocation.

Disclaimer: This report is AI-generated, with manual verification for accuracy. It does not constitute investment advice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DODO Rises 2.11% on November 12, 2025 Despite Ongoing Yearly Decline

- DODO rose 2.11% on Nov 12, 2025, but remains in a 12-month bearish trend with an 80.93% annual decline. - Analysts debate if the short-term rebound signals a critical support level reversal amid oversold RSI conditions (30) and downtrend indicators. - A backtest strategy evaluates historical cases of similar sharp one-day gains (-80.93% annual drop + 2.11% daily rise) to assess reversal probabilities.

Bitcoin News Update: Traditional Banks Struggle to Compete with SoFi's All-in-One Crypto Expansion

- SoFi becomes first U.S. bank to launch integrated crypto trading via its app, offering BTC, ETH, and SOL. - The service uses in-house infrastructure and regulatory compliance, replacing a 2019 Coinbase partnership (suspended in 2023). - Enabled by March 2025 OCC guidance, it aims to attract risk-conscious users with FDIC-insured accounts and a Bitcoin giveaway promotion. - Future plans include a USD-backed stablecoin by 2026 and blockchain remittances, though crypto remains speculative and uninsured.

XRP News Today: XRP Faces Technical Challenges While Ripple Grows Its Institutional Presence

- XRP's price has fallen below $2.40 amid a "death cross" technical signal and weak RSI, with key resistance at $2.50–$2.60. - On-chain data shows 240% higher profit-taking by long-term holders, with $470M in realized losses as prices drop below $2.50. - Ripple secures $500M funding at $79B valuation but XRP remains detached from institutional progress, down 20% in Q4 2025. - Whale activity declines sharply while retail sentiment wanes, with trading forum engagement down 25% month-over-month. - XRP trades

JPMorgan's Advantage with Deposit Tokens: Institutional Options Beyond Stablecoins

- JPMorgan launches JPM Coin, a 24/7 USD deposit token for institutional clients via Coinbase's Base blockchain, enabling real-time settlements beyond banking hours. - The token, piloted with Mastercard and B2C2, aims to streamline cross-border payments and will expand to non-institutional clients and euro-denominated JPME pending approvals. - JPM Coin serves as collateral on Coinbase and differentiates from stablecoins by representing tokenized bank deposits with potential yield-bearing features. - The in