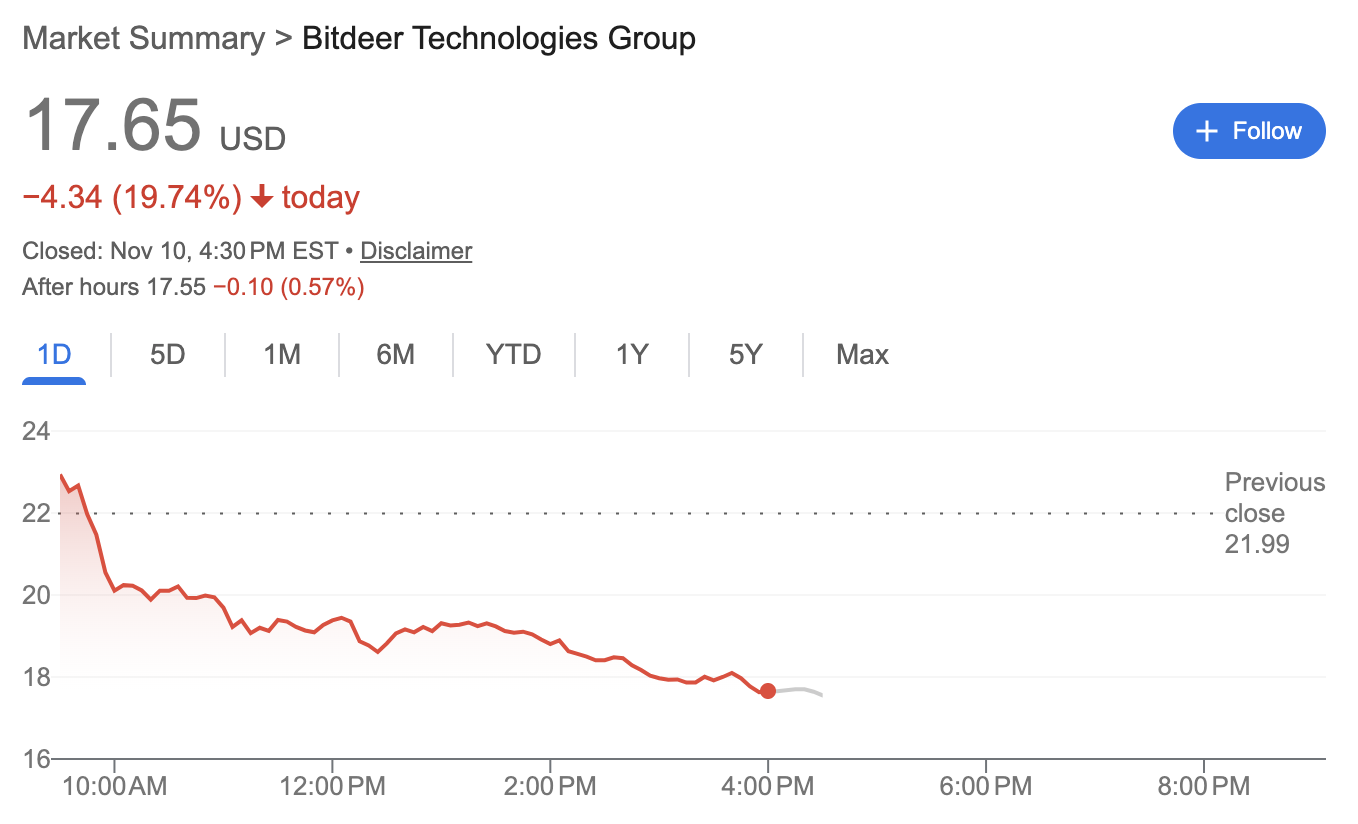

Bitdeer shares drop 20% after posting $266M quarterly loss

Shares of Singapore-based Bitcoin miner Bitdeer Technologies fell nearly 20% on Monday after the company reported a jump in quarterly losses.

Bitdeer recorded a net loss of $266.7 million for the third quarter of 2025, compared with a net loss of $50.1 million for the same period a year ago, largely due to non-cash losses resulting from the revaluation of its convertible debt.

Revenue climbed to $169.7 million, up 174% from the previous year, driven by the expansion of its self-mining operations, according to the company.

Bitdeer also reported gains in its operating performance, with adjusted EBITDA rising to $43 million from a $7.9 million loss in the same period in 2024. The company also doubled its Bitcoin production, mining 1,109 BTC during the quarter.

Bitdeer reported its first revenue from high-performance and AI cloud services, bringing in $1.8 million in Q3 as it began shifting part of its computing power toward artificial intelligence.

Matt Kong, chief business officer at Bitdeer, said the company was “uniquely positioned to capitalize” on AI and the surge in demand for computing power. He added that allocating “200 MW of power capacity to AI cloud services could generate an annualized revenue run-rate exceeding $2 billion by the end of 2026.”

Bitdeer ended the quarter holding 2,029 BTC, up from 258 BTC a year earlier, and managed 241,000 mining rigs, compared with 165,000 at the same time last year.

Related: EToro stock jumps on Q3 results, $150M buyback plan

Bitcoin miners turn to AI

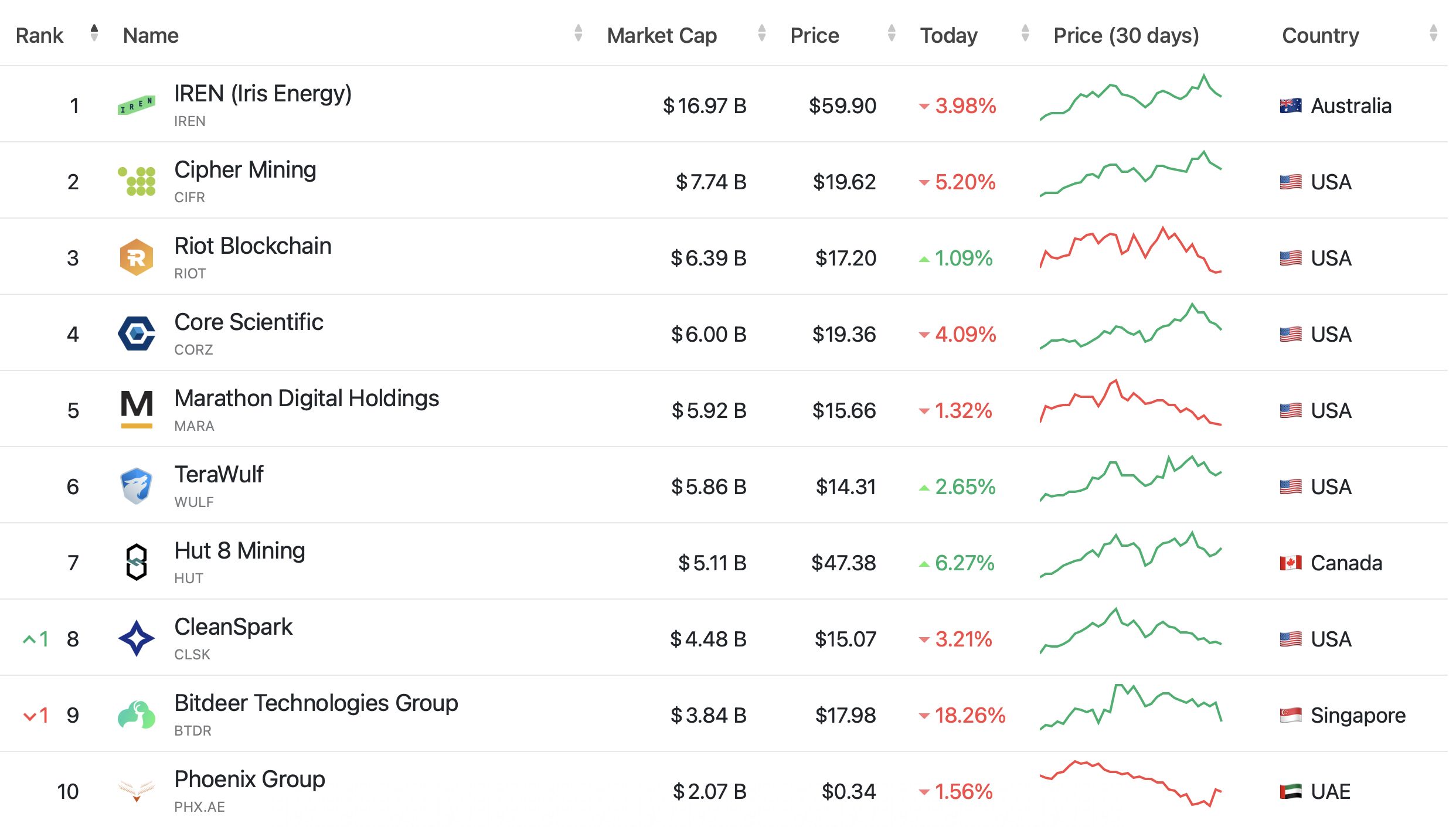

An increasing number of Bitcoin mining companies are pivoting to AI and high-performance computing (HPC), repurposing a portion of their power capacity to meet the fast-growing demand for computing power.

In August, MARA Holdings announced a $168 million deal to acquire a 64% stake in Exaion, a subsidiary of France’s EDF, to expand into low-carbon AI infrastructure, while TeraWulf signed 10-year colocation agreements with AI company Fluidstack worth $3.7 billion in contract revenue.

On Nov. 3, Bitcoin miner IREN announced a five-year, $9.7 billion GPU cloud services deal with Microsoft, giving the tech giant access to Nvidia GB300 chips hosted in IREN’s data centers.

While the pivot by Bitcoin miners into AI and HPC has been picking up momentum this year, it isn’t entirely new.

In July 2023, HIVE Blockchain Technologies rebranded as HIVE Digital Technologies, reflecting its shift to an HPC strategy, alongside its traditional cryptocurrency mining operations.

In March 2024, Core Scientific signed a multi-year, $100 million deal with GPU cloud firm CoreWeave to host HPC workloads at its Texas data center.

Magazine: How Chinese traders and miners get around China’s crypto ban

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Traditional Banks Struggle to Compete with SoFi's All-in-One Crypto Expansion

- SoFi becomes first U.S. bank to launch integrated crypto trading via its app, offering BTC, ETH, and SOL. - The service uses in-house infrastructure and regulatory compliance, replacing a 2019 Coinbase partnership (suspended in 2023). - Enabled by March 2025 OCC guidance, it aims to attract risk-conscious users with FDIC-insured accounts and a Bitcoin giveaway promotion. - Future plans include a USD-backed stablecoin by 2026 and blockchain remittances, though crypto remains speculative and uninsured.

XRP News Today: XRP Faces Technical Challenges While Ripple Grows Its Institutional Presence

- XRP's price has fallen below $2.40 amid a "death cross" technical signal and weak RSI, with key resistance at $2.50–$2.60. - On-chain data shows 240% higher profit-taking by long-term holders, with $470M in realized losses as prices drop below $2.50. - Ripple secures $500M funding at $79B valuation but XRP remains detached from institutional progress, down 20% in Q4 2025. - Whale activity declines sharply while retail sentiment wanes, with trading forum engagement down 25% month-over-month. - XRP trades

JPMorgan's Advantage with Deposit Tokens: Institutional Options Beyond Stablecoins

- JPMorgan launches JPM Coin, a 24/7 USD deposit token for institutional clients via Coinbase's Base blockchain, enabling real-time settlements beyond banking hours. - The token, piloted with Mastercard and B2C2, aims to streamline cross-border payments and will expand to non-institutional clients and euro-denominated JPME pending approvals. - JPM Coin serves as collateral on Coinbase and differentiates from stablecoins by representing tokenized bank deposits with potential yield-bearing features. - The in

Bitcoin Updates: Major Whale Moves $10 Million—Is This a Market Dump or a Tactical Shift in Holdings?

- A Bitcoin whale withdrew 100 BTC ($10.32M) from Binance, signaling renewed activity from long-term holders amid broader "OG" whale selling trends. - Over 1,000 BTC/hour has been dumped by seven-year+ holders since November 2024, with $100M+ sell-offs highlighted by Capriole's Edwards as "persistent distribution." - Technical analysis forecasts a $89,600 price drop via bear pennant patterns, compounding risks as Bitcoin trades 18.7% below its $126K all-time high. - Whale activity remains ambiguous: withdr