Tech startups across Europe are increasingly exploring stablecoins to streamline payments and boost operational efficiency, but adoption remains constrained by concerns about fraud and regulatory uncertainty, new research from Finnish payment processor Enfuce reveals.

Stablecoins Seen as Strategic Advantage

According to the study, 87% of surveyed tech startups executives view stablecoins as a competitive edge, with 76% considering them the “future of money.”

Sponsored

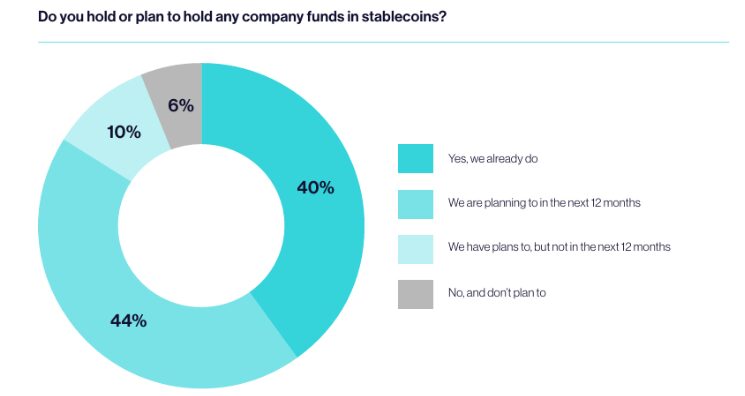

About 40% of startups already hold stablecoins. Reportedly, they keep nearly 39% of their reserves, or around €60,000, in stable digital assets. Most remain confident in the technology’s potential, with only 6% saying they have no plans to use stablecoins at all.

Source: Enfuce

Source: Enfuce

The primary motivations include faster, cheaper cross-border payments, improved operational efficiency, and access to emerging financial infrastructure.

Despite the benefits, awareness of the related risks remains low. Only 18% of startups know whether their stablecoin holdings are insured or protected, and just 20% say they fully understand current or upcoming regulations.

Fraud and Regulatory Concerns Loom Large

Still, 97% of startups see external risks that could slow stablecoin adoption. Half of them, or 50% cite potential fraud and links to illicit trade as the biggest concerns. The Financial Action Task Force has also warned that stablecoins are now among the most common assets used in illicit transactions.

Other key worries include regulatory complexity (37%), the risk of depegging or loss of value (34%), and environmental impact (27%).

Source: Enfuce

Source: Enfuce

Monika Liikamaa, Co-CEO of Enfuce, emphasized that “trust needs to catch up with innovation” to unlock stablecoins’ full potential.

“To unlock their full potential, we need to lay the groundwork: clear rules, strong safeguards and industry-wide transparency. That’s how we build confidence, and real momentum.”

Her co-CEO, Denise Johannson, added that sustainable adoption depends on clearer guidance, risk transparency, and industry collaboration.

The research, conducted in October 2025, surveyed 250 technology startups across the EU and UK.

Why This Matters

European tech startups are embracing stablecoins for efficiency, but widespread concerns over fraud and regulatory complexity are slowing broader adoption and trust in the technology.

Discover DailyCoin’s trending crypto news today:

STRK Dips After 56% Rally. What Comes Next for Starknet?

Scottie Pippen Nailed $88K, Now Predicts BTC At $180K

People Also Ask:

Startups use stablecoins for faster, cheaper cross-border payments, operational efficiency, and access to emerging financial infrastructure.

Key risks include fraud, illicit trade, regulatory uncertainty, depegging (loss of value), and environmental impact.

Concerns about fraud, links to illicit activity, and unclear regulations are slowing broader adoption.

Clear rules, robust safeguards, regulatory guidance, and industry collaboration can help manage risks and build trust.