BTC Volatility Weekly Review (November 3rd - 10th)

Core Data (Hong Kong Time, 16:00 on November 3 → 16:00 on November 10) BTC/USD: -1.0% ($1...)

Core Data (Hong Kong Time November 3, 16:00 → November 10, 16:00)

- BTC/USD: -1.0% ($107,200 → $106,200)

- ETH/USD: -1.9% ($3,690 → $3,620)

- After finally breaking through the $100,000 psychological barrier last week, positive news from Washington over the weekend drove a relief rally at the start of this week, pushing the market to test the previous support (now turned resistance) range of $104,000 - $107,000. If it breaks through $107,000 - $108,000, given that $108,000 - $114,000 is a key/consolidation range, we expect the market to see some acceleration to the upside.

- If the price effectively breaks through the resistance level, it indicates that this round of long-term correction may be complete, and the market may be ready to quickly and turbulently test historical highs. We believe this will trigger a larger and more sustained correction (possibly a months-long sideways adjustment).

- If it fails to break through $107k, it suggests the market may retest the $100,000 support level, with a more "complete" downside breakout point near $95,000. However, considering the low has already touched the $98,000 range, we are only one step away from that level. We believe that probing down to $100,000 or below will be an opportunity to increase positions, but operations should be cautious and calm, leaving enough room in case downward pressure intensifies due to stop-losses/liquidations before a major reversal arrives.

Market Themes

- Risk assets experienced a turbulent week as the U.S. government shutdown was extended, raising concerns about its broad impact on the U.S. economy. In addition, although U.S. corporate earnings were generally solid, the market began to worry about overvaluation in artificial intelligence, especially considering the massive spending and investment by some companies to continue developing and integrating AI (for example, Meta... what if all this spending ultimately fails to deliver the revenue expected in the pricing?). Ultimately, these investments have been paying dividends so far, so this part of the price movement feels more like chasing a narrative. Given the significant rise in some of these stocks this year, this may just be a healthy correction.

- Cryptocurrencies have underperformed risk assets (and gold) all year, and as risk assets as a whole turn, their situation has become fragile. BTC eventually fell below $100,000, but selling in the $98,000 - $100,000 range was well absorbed, while ETH tested the $3,000 mark and then also found some support. The end of the government shutdown and the possibility of another Fed rate cut in December (especially considering the recent impact of the shutdown on the U.S. economy) should support risk assets through the end of the year and may bring a relief rally. However, after a challenging year and the high opportunity cost of cryptocurrencies, in the absence of any crypto-specific catalyst, bitcoin still feels like a "high risk, low return" asset. Therefore, if risk assets unexpectedly turn again before the end of the year, the situation for cryptocurrencies could become fragile once more.

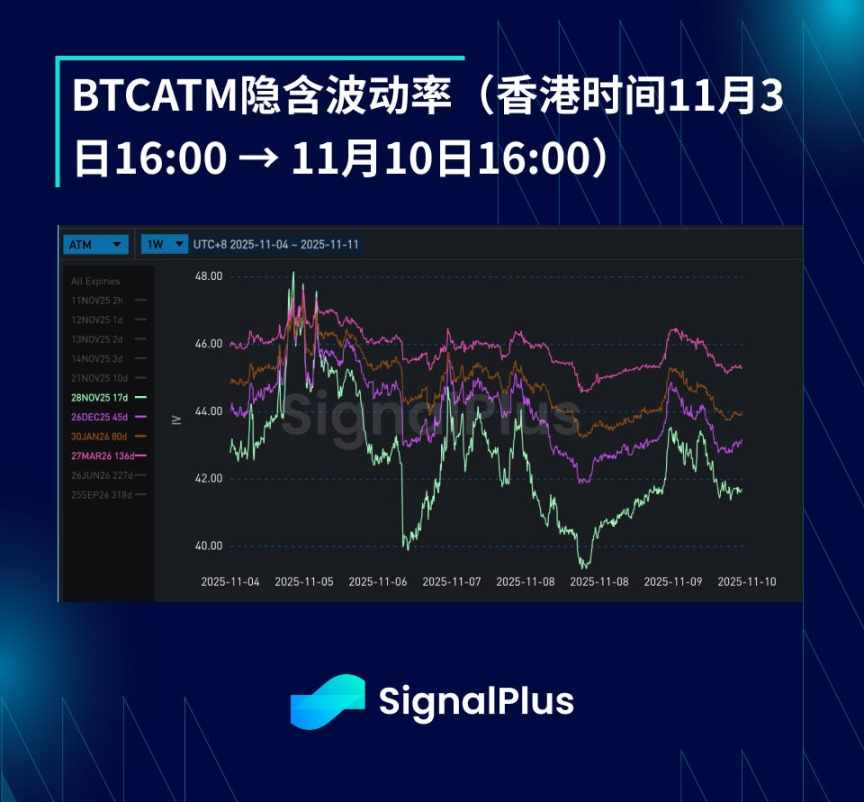

BTC Implied Volatility

- Implied volatility was largely range-bound this week, as (high-frequency) realized volatility remained in the low-to-mid 40% range, confirming that we have reset to a new baseline level. At the start of the week, implied volatility briefly declined but found support after the spot price broke below $100,000. However, as there was no follow-through below this key level, implied volatility gradually declined before the weekend, only to find support again as spot prices rebounded sharply from the lows at the start of the new week.

- The term structure of implied volatility is starting to steepen. In the short term, realized volatility is beginning to decrease as spot prices consolidate within a range and lack immediate catalysts for change. Directional trades (bullish side) have shifted positions to December and beyond to give the market more time to digest recent price action.

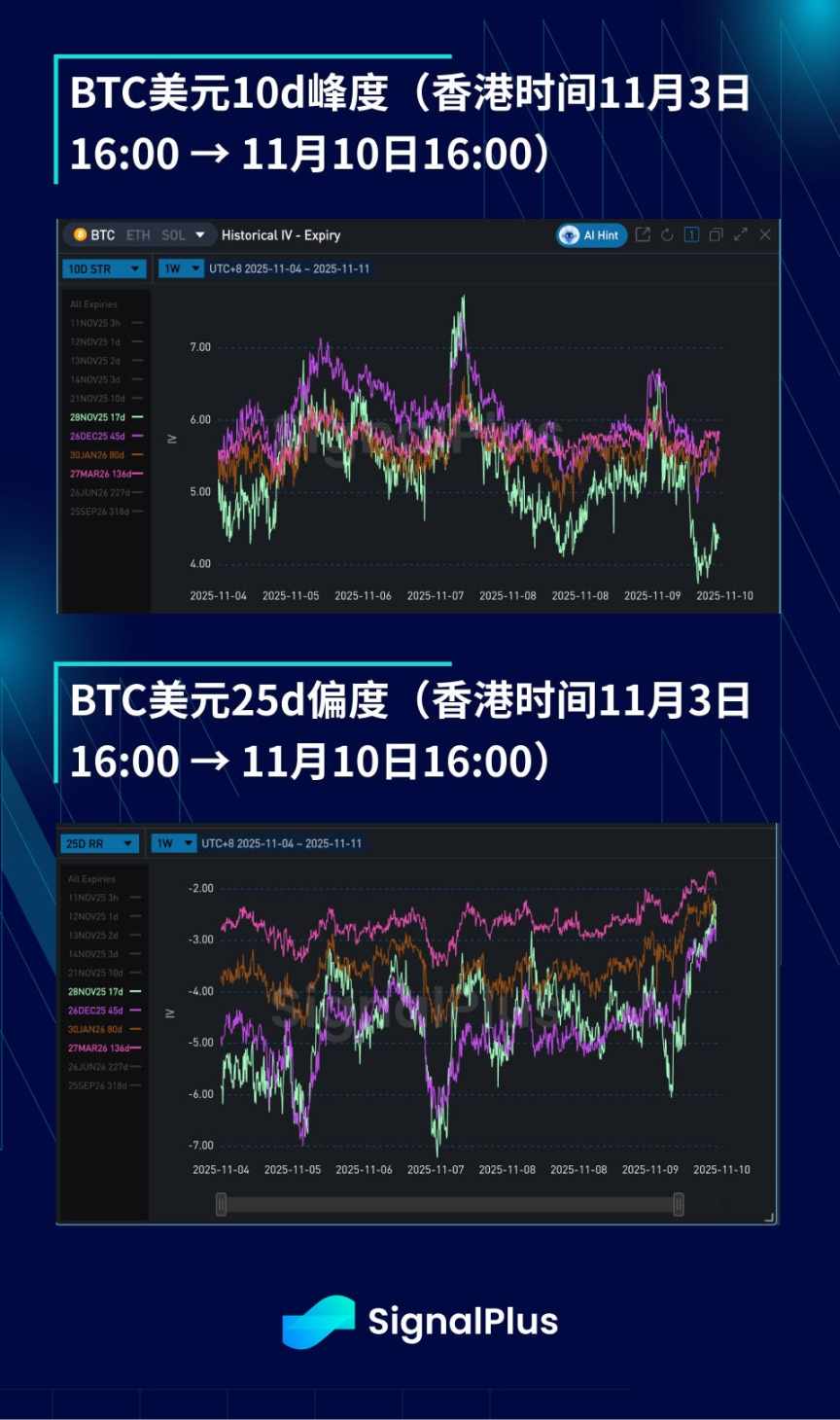

BTC USD Skew/Kurtosis

- When the price broke below $100,000, skew deepened to the downside, but then found solid support and saw a rapid relief rebound after news of the U.S. government shutdown ending over the weekend, with technical bullish options buying causing skew to retrace from the bearish side. Structurally, the price-volatility correlation remains evident (implied/realized volatility rises when price falls), and BTC is becoming more correlated with traditional stocks/risk assets in this respect.

- Kurtosis declined as the price briefly fell below $100,000 and then rebounded to the wide range of $104,000 - $112,000. Volatility of volatility remains high, but the market seems to be seeking equilibrium within this new price range, as the price has already probed and found strong support at $98,000 - $100,000. Any substantial breakout of the wide $98,000 - $117,000 range will structurally trigger a repricing of skew and bring kurtosis back into focus.

Wishing you a successful trading week!

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How Bedrock Strengthens BTCFi Security With Chainlink Proof of Reserve and Secure Mint

By winning the championship with Faker, he earned nearly $3 million.

Faker's sixth championship also marks fengdubiying's legendary journey on Polymarket.

Warren Buffett's "Last Letter" in Full: "I Was Just Lucky," But "Father Time" Has Caught Up

Buffett concluded his legendary 60-year investment career with the British expression "I'm 'going quiet'" in his letter.

Trending news

MoreMarket sentiment in the crypto space remains fragile; even the positive news of the "U.S. government shutdown" ending failed to trigger a meaningful rebound in bitcoin.

Bitget Daily Digest (Nov 12)|Solana financial firm Upexi posts record quarterly results; Nick Timiraos: “Fed increasingly divided over December rate cut”; Injective launches native EVM mainnet, advancing MultiVM roadmap