Bitcoin Updates: Renewed Institutional Trust Drives Bitcoin ETFs to Achieve Initial Net Inflows

- U.S. Bitcoin ETFs saw first net inflow ($1.15M) as institutional demand and corporate purchases offset prior $1.22B outflows, signaling market stabilization. - Solana ETFs extended 9-day inflow streak to $575.93M, while Ethereum ETFs faced $46.6M outflows despite BlackRock's ETHA gaining $34.4M. - MicroStrategy bought 487 BTC ($102,557 each) and JPMorgan increased IBIT holdings to $343M, reflecting growing institutional confidence in crypto assets. - Analysts warn inflows may only temporarily counter wha

U.S.

The prior week was marked by heavy withdrawals, with all 12 U.S. Bitcoin ETFs seeing a combined $558.44 million outflow on Nov. 7 alone—the second-largest single-day withdrawal since these funds began, as

Ethereum (ETH) ETFs also saw net outflows, with $46.6245 million leaving on Nov. 7, led by Fidelity’s FETH, which recorded a $72.228 million withdrawal. On the other hand, BlackRock’s ETHA brought in $34.4326 million, marking its largest single-day inflow, as

Bitcoin’s ability to hold above $100,000 has been credited to both corporate treasury acquisitions and ETF inflows. MicroStrategy purchased an additional 487

Experts warn that while the latest inflows may indicate a period of consolidation, ongoing demand is essential for maintaining long-term price stability. “ETF inflows help cushion against large-scale selling, but a decrease could renew downward pressure,” Glassnode analysts commented, suggesting that Bitcoin’s current stability near $100,000 could represent a medium-term support level, as

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

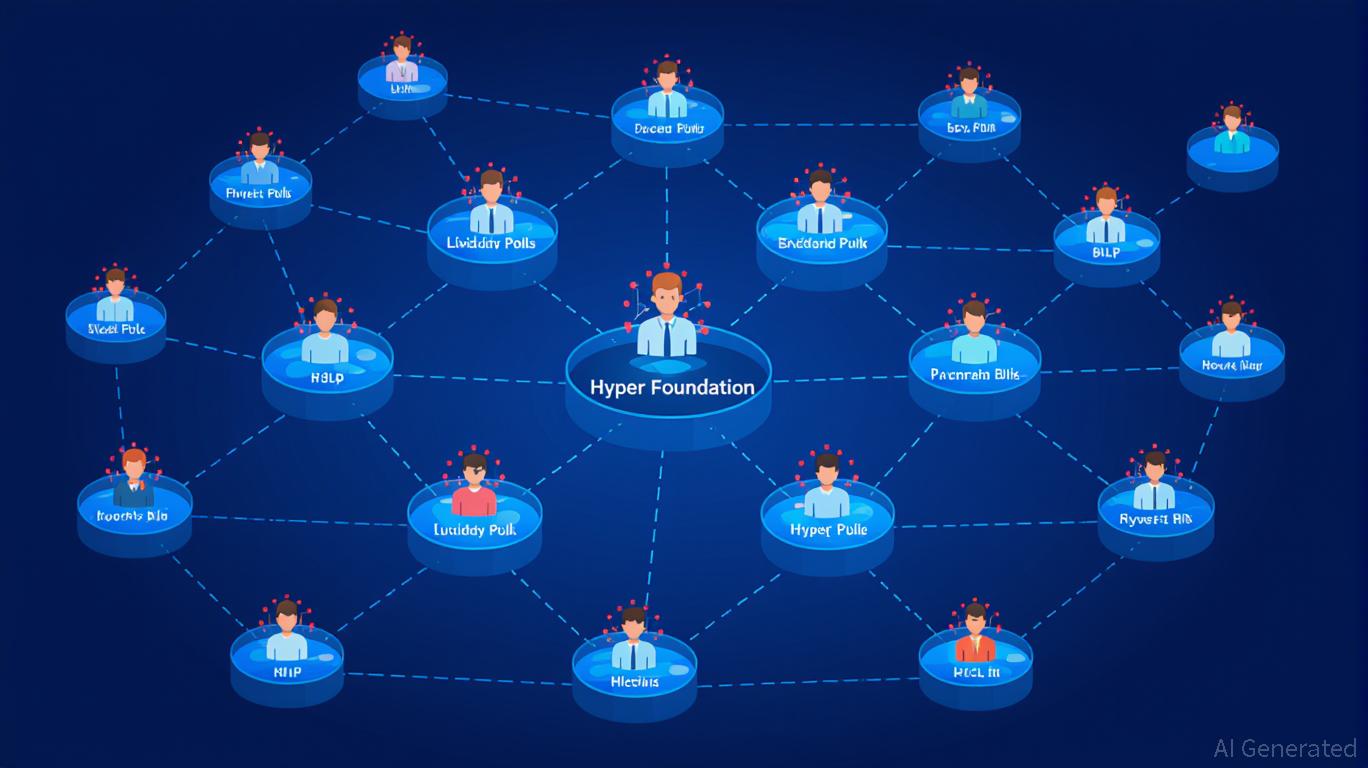

Hyperliquid's Growing Influence in Crypto Trading: Can It Maintain Long-Term Investment Appeal?

- Hyperliquid dominates 80% of 2025 perpetual contract market via on-chain governance and user-driven liquidity innovations. - Centralized governance (HIP-3 protocol, USDH stablecoin launch) balances permissionless market creation with validator dominance risks. - HLP liquidity model generates $40M during crashes but faces regulatory scrutiny and token economics challenges from 2025 HYPE unlock. - TVL growth to $5B and 518K active addresses highlight adoption, yet governance centralization and institutiona

Ethereum Latest Updates: JPMorgan and Bitmine Make $1.3B ETH Investment, Showing Institutional Trust Amid Market Fluctuations

- Institutional Ethereum investments surged $1.3B as JPMorgan and Bitmine capitalized on price dips, with Bitmine now holding 3.4M ETH (2.8% of supply). - JPMorgan's $102M Bitmine stake reflects strategic crypto exposure via traditional instruments, aligning with U.S. ETF approvals and regulatory clarity on staking ETPs. - Bitmine's 5% supply target and SharpLink's 6,575 ETH staking highlight growing institutional confidence, despite 27.7% monthly price declines creating buying opportunities. - Regulatory

Bitcoin News Today: Bitcoin Miners Bet on AI: Will Technological Advances Outpace Market Fluctuations?

- Bitcoin miners adopt AI/HPC to offset bear market pressures, leveraging energy infrastructure for GPU workloads. - TeraWulf's $1.85M/MW/year AI hosting benchmark and CleanSpark's Texas campus highlight infrastructure diversification. - Grid constraints and GPU shortages challenge transitions, while Bitcoin ETF outflows ($558M) signal shifting investor sentiment. - Analysts warn of potential $100,000 price correction if $104,000 resistance fails, despite positive on-chain demand signals. - JPMorgan identi

Brazil Sets Sights on Crypto Regulation to Build Confidence and Strengthen Regional Leadership

- Brazil's central bank introduced Latin America's strictest crypto regulations, requiring VASPs to obtain authorization and comply with banking-level oversight by November 2026. - New rules mandate $2M+ capital requirements, classify stablecoin transactions as forex operations, and cap unapproved crypto transfers at $100,000 per transaction. - The framework aims to combat fraud and illicit finance by extending AML protocols to stablecoins, which account for 90% of Brazil's crypto activity, while enhancing