3 Signs Pointing to Mounting Selling Pressure on Pi Network in November

Pi Network’s price may hit new lows in November as massive token unlocks, rising exchange reserves, and weak liquidity weigh on sentiment. Yet, loyal supporters remain hopeful that long-term fundamentals will eventually spark a rebound.

Trading data for Pi Network (PI) signals a bearish outlook for its price in November. Although Pi has already dropped more than 90% from its peak, market forces may continue to push the price lower.

What are the warning signs, and how do Pi’s loyal supporters explain them?

A Massive Amount of Pi Tokens Being Unlocked

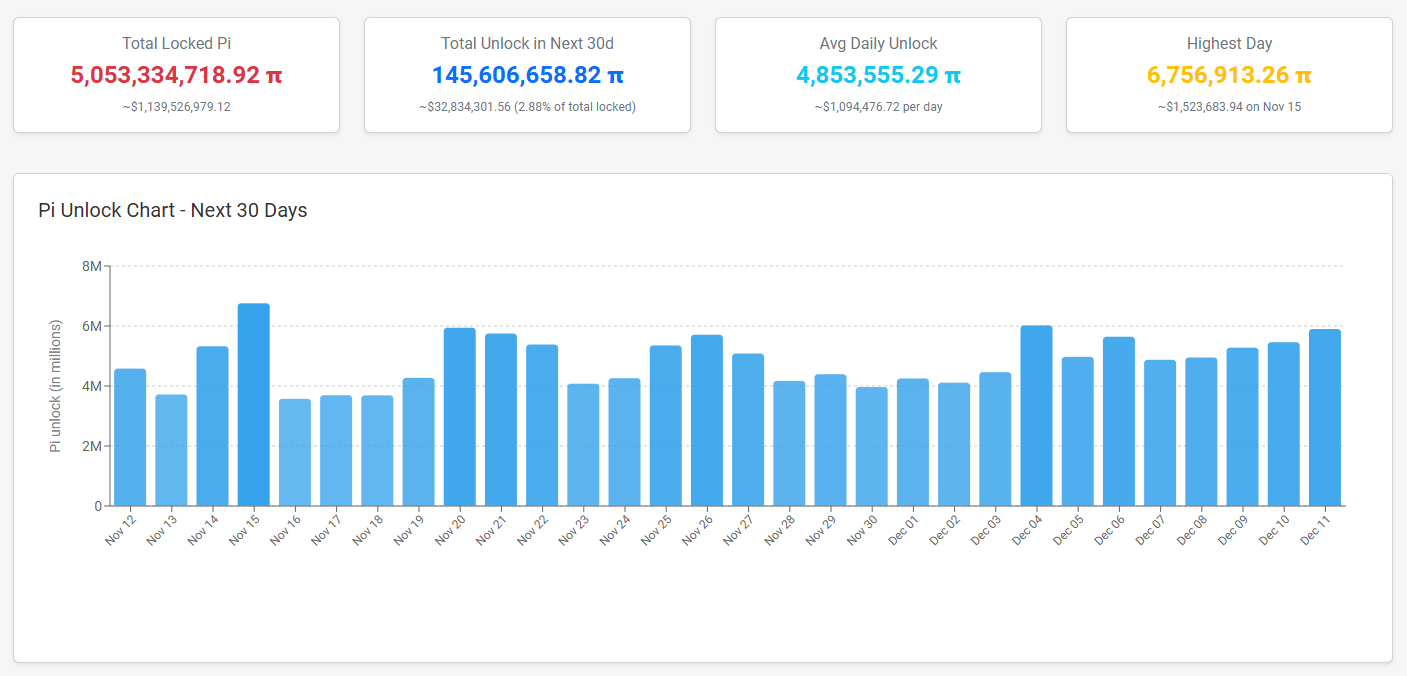

First, Piscan data shows that the number of Pi unlocked per day is up to 4.85 million PI, and the number of Pi unlocked in the next 30 days is up to 145 million Pi.

Number of Pi Tokens Unlocked Per Day. Source:

Piscan

Number of Pi Tokens Unlocked Per Day. Source:

Piscan

Piscan data also reveals that in December, more than 173 million Pi will be unlocked — the highest monthly unlock volume until September 2027.

This steady and increasing unlock pressure is likely to persist through the end of the year, creating a significant obstacle to any price recovery on exchanges.

Rising Exchange Balances Indicate Continuous Selling Pressure

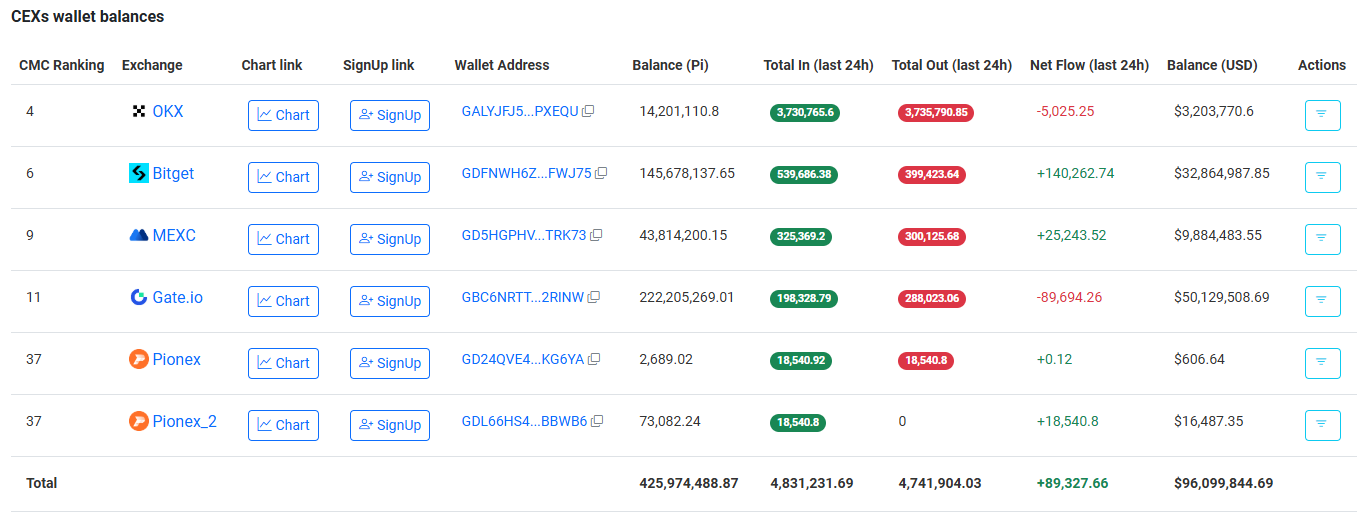

The amount of Pi held on exchanges continues to increase in November.

Pi Supply on Exchanges. Source:

Piscan

Pi Supply on Exchanges. Source:

Piscan

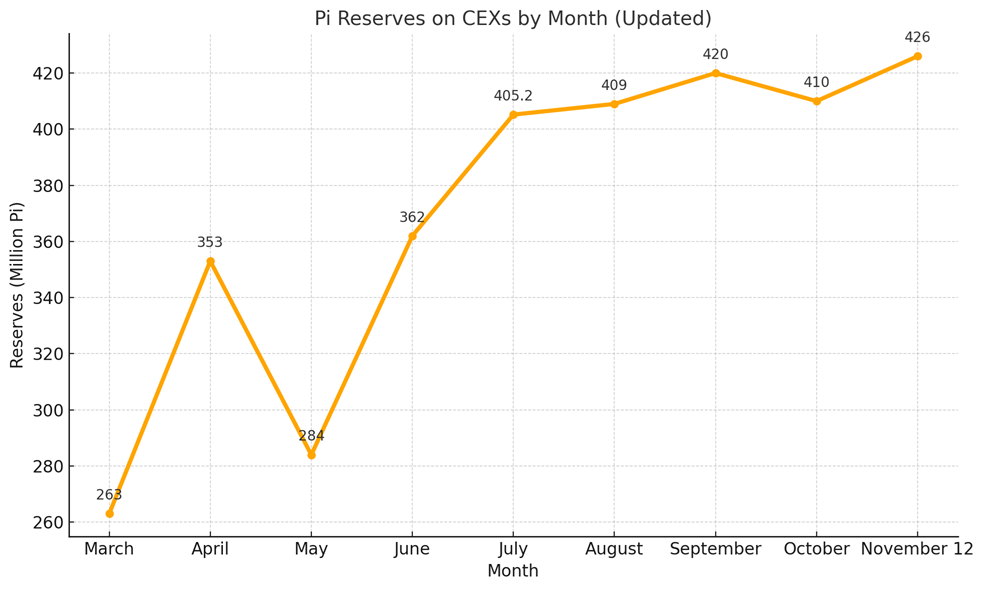

According to Pi Network’s early-month report, there were about 423 million Pi on exchanges. By mid-November, that figure had climbed to nearly 426 million Pi, marking an all-time high.

Pi Reserves on CEXs by Month. Source: Data Curated by BeInCrypto

Pi Reserves on CEXs by Month. Source: Data Curated by BeInCrypto

Such growth in exchange reserves indicates that exchanges now hold more Pi tokens, ready for trading or sale, which could put downward pressure on prices.

Weak Trading Volume Reflects Low Market Activity

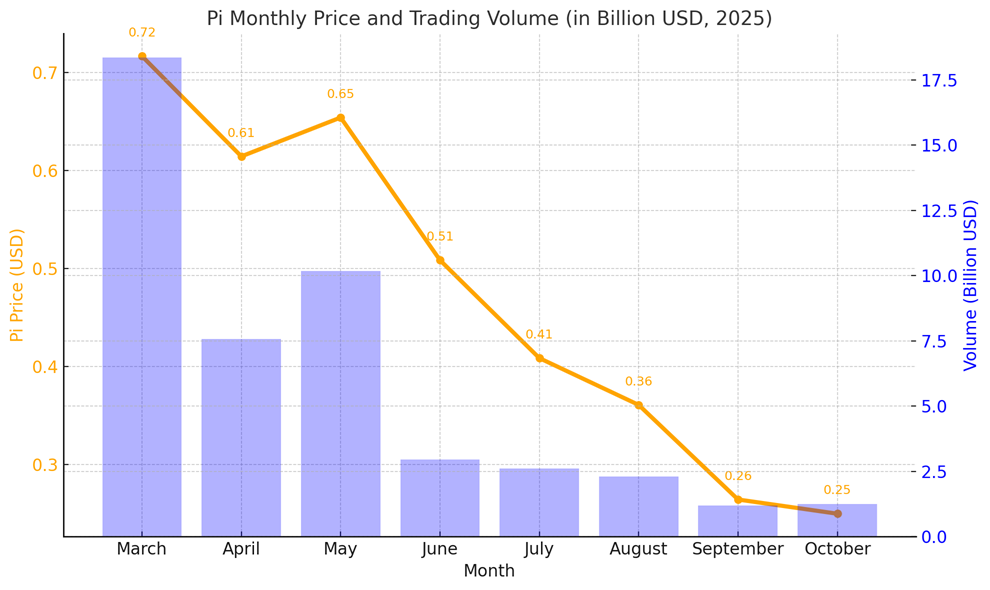

Spot trading volume for Pi on centralized exchanges has shown little improvement in November. The 24-hour trading volume currently hovers around $30 million.

CoinMarketCap data indicates that Pi’s monthly trading volume fell to just $1.2 billion last month. Both price and trading volume have declined in parallel.

Pi Monthly Price & Trading Volume. Source:

CoinmarketCap

Pi Monthly Price & Trading Volume. Source:

CoinmarketCap

Weak liquidity, along with the constant unlocking and inflow of Pi to exchanges, could intensify the downward price movement.

Pi Supporters Remain Confident Despite the Pressure

Despite the bearish signals, Pi supporters remain optimistic.

An X account named Dao World, identifying as a Pioneer, argued that while Pi has a large maximum supply, the actual circulating amount is only around 3 billion. The Pi Core Team, he noted, has not been aggressively selling.

He also suggested that a few market makers (MM) on certain exchanges mainly control Pi’s current price. Once selling pressure is fully absorbed, he believes the price could rebound.

Even though $Pi has a large max supply, considering that the CT has not been aggressively selling tokens and the actual circulating supply is only a little over 3B, and price action is largely managed by MM on a few exchanges — am I the only one who thinks that when it’s time for… pic.twitter.com/0GUIXfx2EF

— Dao world November 11, 2025

Several other Pioneers share this view, claiming that the current $0.20 range presents a buying opportunity — one they expect will be remembered fondly in the future.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

What Factors Are Fueling the Rapid Popularity of Hyperliquid, the Emerging Trading Platform?

- Hyperliquid captured 73% of decentralized perpetual trading volume in Q3 2025, driven by $303B in trading volume and $5B TVL growth. - Retail demand fueled by 20x leverage on BTC/XRP and HIP-3 protocol optimization boosted $47B weekly volumes and $15B open interest. - Strategic partnerships like Felix HAUS agreement and 21Shares ETF filing expanded HYPE token utility while rejecting VC funding reinforced decentralization. - $10.8B HYPE token unlock poses 45% supply dilution risk, while competitors like A

PENGU Token's Latest Price Rally and Chart Patterns: A Brief Momentum Opportunity Among New Memecoins

- PENGU token surged 12.8% in 24 hours amid crypto rebound, driven by Bitcoin's 4.3% rise to $106,100. - Short-term bullish momentum emerged with 33% volume spike to $202M, but long-term bearish indicators persist via declining OBV and converging MACD. - Whale inflows ($157K) and a 13.69% token burn boosted optimism , though $7.68M in leveraged short positions highlight market volatility. - PENGU's price action reflects memecoin dynamics, balancing Bitcoin-linked risks with speculative potential from real-

UAE’s Digital Dirham: Shaping a Diverse Future for International Finance

- UAE completes first government transaction using Digital Dirham CBDC via mBridge platform, settling in under two minutes. - Pilot by UAE Ministry of Finance and Dubai Department of Finance validates cross-border and domestic payment capabilities without intermediaries. - Officials highlight CBDC's role in enhancing financial transparency, reducing settlement times, and advancing UAE's fintech leadership goals. - Global CBDC adoption grows with 137 countries exploring digital currencies, as UAE plans phas

Yen-backed Stablecoin Initiative May Challenge the Dollar’s Leading Role in Digital Finance

- JPYC, Japan's yen-pegged stablecoin issuer, plans to allocate 80% of 10-trillion-yen token proceeds to JGBs, aiming to fill gaps left by BOJ's stimulus tapering. - The strategy could reshape Japan's bond market as BOJ reduces its 50% JGB ownership stake, with JPYC CEO predicting global adoption of stablecoin-driven government bond demand. - Japan's FSA supports innovation through sandbox programs, including a pilot with major banks , while regulators warn stablecoins might divert funds from traditional b