ZCash has become a trader’s battleground with wild price swings and a surge of attention this month. After an explosive 1,103% 90-day rally, ZEC hit overbought territory and major players rushed to secure profits.

This shark-like sell-off was compounded by Arthur Hayes urging users to move funds off exchanges, cranking up outflow pressure and thinning liquidity. Now, ZEC’s price action and market data show a tug-of-war playing out, as traders restructure their holdings after a feverish run-up and an equally swift pullback.

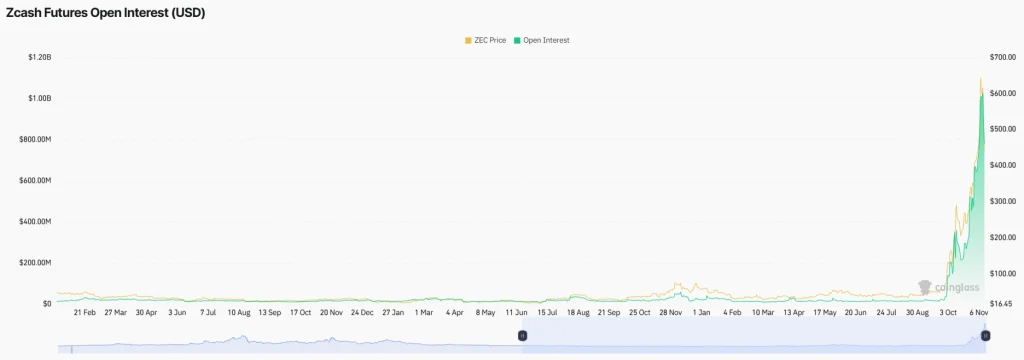

The story of on-chain is all about leverage. As per CoinGlass , ZCash futures open interest recently spiked to $708 million, nearly tracking the parabolic rise in price. This metric shows a record level of derivatives activity, suggesting traders are piling in with outsized bets.

When open interest and price rise together, volatility tends to heat up, and whipsaws become frequent. If liquidations hit, the cascade can amplify moves in both directions. These high OI levels reflect aggressive positioning and hint that the next major move, whichever way, may be violent.

The 4-hour chart, I’ve shared below, shows ZEC price consolidating just below $480. This has come after cooling off from a $505.62 high and bouncing from a daily low of $426.83. Digging into technical indicators, the Bollinger Bands are still wide, reflecting volatility, while the middle band around $556 acts as a short-term ceiling.

ZEC faces resistance zones at $537 and $662. If buyers reclaim momentum and ZEC breaks above $505 decisively, a test of $537 could come within the next 2 to 3 sessions. Momentum beyond that might open a quicker path to $662 if overall market sentiment holds up.

However, failure to defend the $476–$480 zone brings $433 and possibly $402 into play as bearish targets. These could arrive within days amid high leverage and thin liquidity. The RSI at 42.7 suggests ZEC is not oversold, so there’s potential for further downside if the bears dig in.