Key takeaways

- ETH is down 1.5% and is now trading above $3,500 per coin.

- The positive performance comes as whales accelerate buying pressure.

Whales stack up Ethereum

Ether, the second-largest cryptocurrency by market cap, is trading above $3,500 after defending the $3,300 low on Wednesday. The coin is still down 1.5% in the last 24 hours, but could rally higher in the near term.

The positive performance comes as a key Ethereum whale has added over $1.38 billion worth of Ether coins to their wallet over the last ten days. According to Arkham Intelligence, the whale added another million in ETH to its holdings, while also borrowing $270 million from the decentralized lending platform Aave to potentially expand its ETH position.

The whale now holds 228.39K ETH in loaned positions worth about $818.6 million and 157.32K ETH in direct spot holdings worth $563.8 million. A few other onchain platforms also reveal similar bullish sentiment among Ethereum whales.

Ether eyes $3,900 despite choppy market conditions

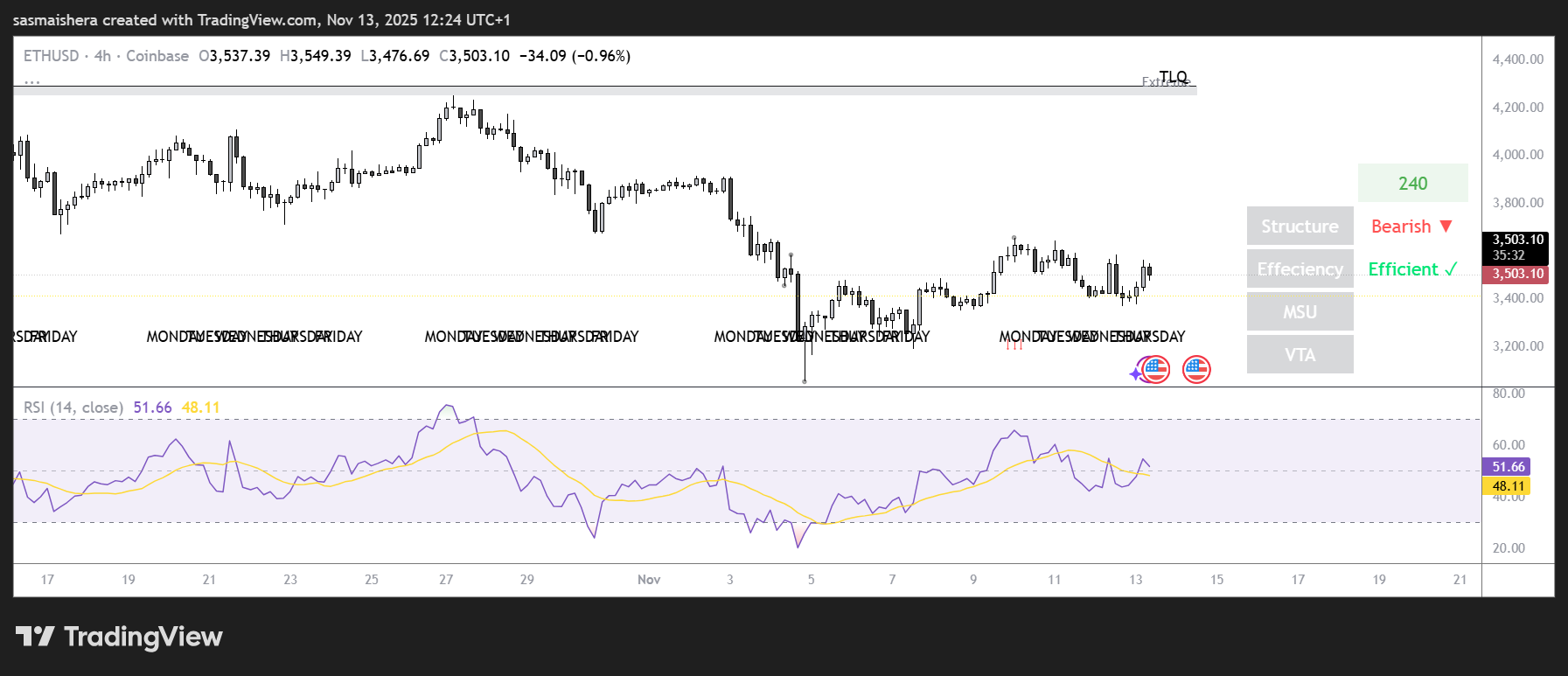

The ETH/USD 4-hour chart is bearish and efficient as Ether is down 1.5% in the last 24 hours. The cryptocurrency saw over $153 million in liquidations in the last 48 hours, led by $122.8 million in long liquidations.

The bearish performance comes after Ether faced a rejection at the 200-day Exponential Moving Average (EMA), just below the $3,660 resistance, on Wednesday. It dropped to the $3,470 support level but has now bounced back and is trading above $3,500 per coin.

If ETH sustains its recovery above $3,470, it could rally higher and hit the $3,900 mark. However, the resistance level at $3,660 will provide a challenge in the near term. On the flip side, failure to surpass the $3,660 resistance level could see ETH retest $3,470, with another support level just around $3,100.

The Relative Strength Index (RSI) stands at 51, showing a fading bearish trend. The MACD line is also below the neutral zone, but could crossover into the bullish region if the recovery continues.