BREAKING News: Bitcoin Crashes Below $100,000 as Panic Selling Intensifies

Bitcoin Price Breaks 100K: A Critical Psychological Level Lost

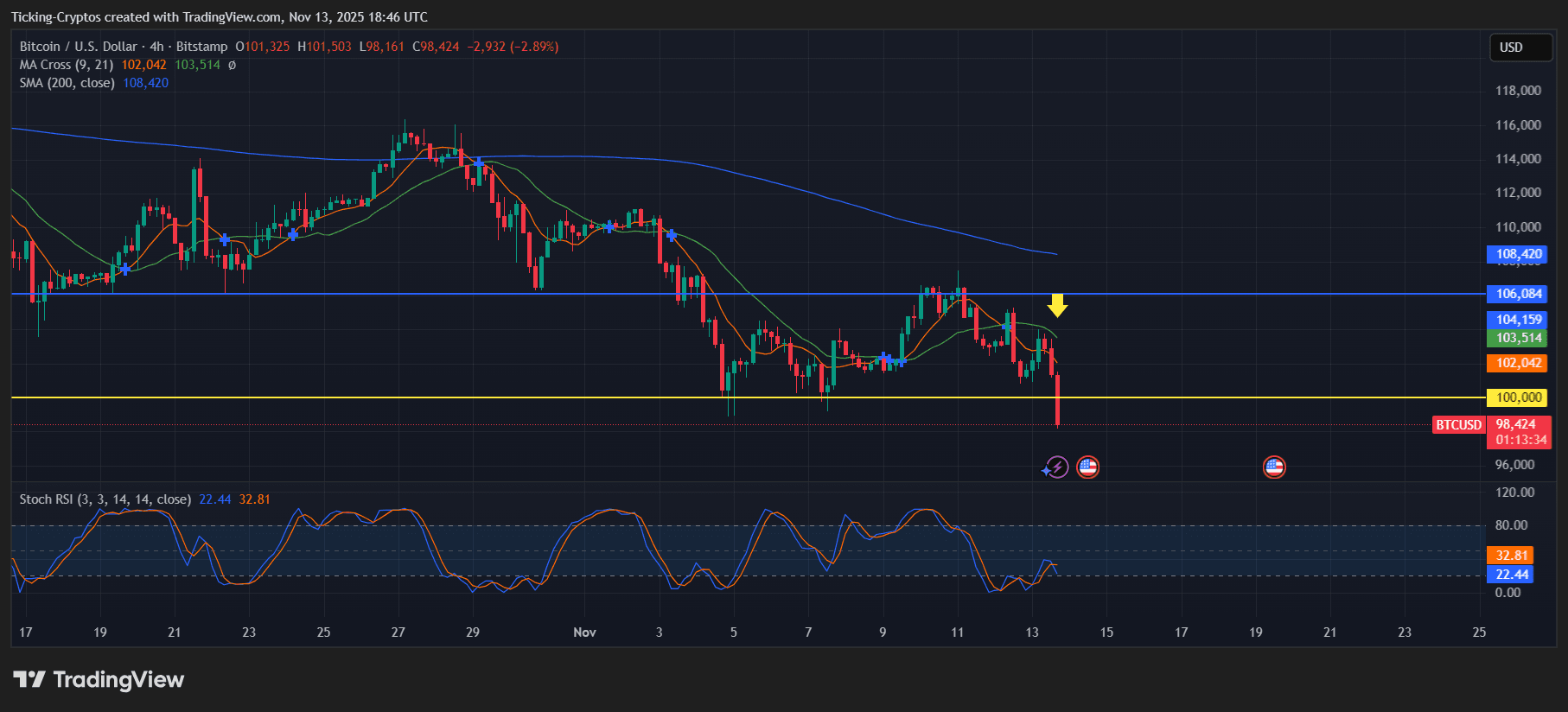

$Bitcoin has officially broken below the $100,000 psychological support, sending shockwaves across the crypto market . The 4H chart shows a sharp rejection from the $104K–106K resistance zone, followed by a steep selloff that accelerated once BTC slipped under the yellow support area.

BTC/USD 4-hours chart - TradingView

The break below $100K wasn’t just technical—it triggered panic selling, liquidations, and a massive imbalance in the order book, all visible in the depth chart.

$BTC is now trading around $98,500, with fear rising rapidly as traders reassess downside risks.

Bitcoin Crash: BTC Loses Structure and Re-Tests Local Lows

1. Major resistance rejection

On the 4H chart:

- BTC attempted to reclaim the $104K–106K zone, but the rejection (highlighted by your yellow arrow) confirmed strong seller dominance.

- Moving averages (9/21 EMA cross) remain bearish.

- Price quickly accelerated toward the next major support: $100K.

2. Support finally breaks

The long-tested horizontal zone at $100,000 has acted as:

- A psychological barrier

- A liquidity magnet

- A momentum pivot

Once price slipped under it, the market reacted violently.

3. Momentum indicators signal oversold

Stoch RSI is diving into oversold territory, suggesting short-term exhaustion—

…but not enough yet to prevent further downside if liquidity gets swept.

Depth Chart Analysis: Heavy Sell-Side Pressure

The depth chart clearly shows:

- Massive buy liquidity from 99K → 95K wiped out

- Increasing sell walls from $102K–105K

The order book shows a strong imbalance:

Buy-side liquidity (green):

- Deep stack down at $98K–96K

- Thinner liquidity as you approach $100K → meaning less support to stop crashes

Sell-side liquidity (red):

- Thick sell walls starting at $102K

- Strong bearish pressure preventing a quick recovery

- This confirms stronger sellers than buyers, signaling that BTC may not reclaim $100K immediately.

Bitcoin Price Prediction: What Comes After the Crash?

Immediate Support Levels

🔻 $98,300 – first bounce zone: (This area appears in both the trading chart and depth chart as a large liquidity pocket.)

🔻 $96,000 – $95,500: Stronger buy liquidity zone. If BTC continues falling, this is the next major support.

🔻 $92,000 – $90,000: A complete liquidity sweep may target this region if panic selling accelerates.

Upside Recovery Targets

If BTC manages to reclaim $100K:

🔼 $102,000 – $103,500: First resistance cluster (21 EMA + sell wall)

🔼 $104,000 – $106,000: The key area where BTC was previously rejected. Must be broken to regain bullish structure.

🔼 $108,400: 200 SMA resistance on the 4H—major trend confirmation point.

Market Sentiment: Fear Is Rising, But Opportunity Brewing?

The break below $100K triggered:

- Liquidations

- Panic exits

- Social sentiment collapse

- Derivatives funding flipping negative

However, structurally:

- BTC is still in a macro uptrend

- $96K–$98K has strong spot demand

- Whales historically accumulate during shakeouts

- Short-term pain is possible, but long-term buyers may see this as a rare dip.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

VIPBitget VIP Weekly Research Insights

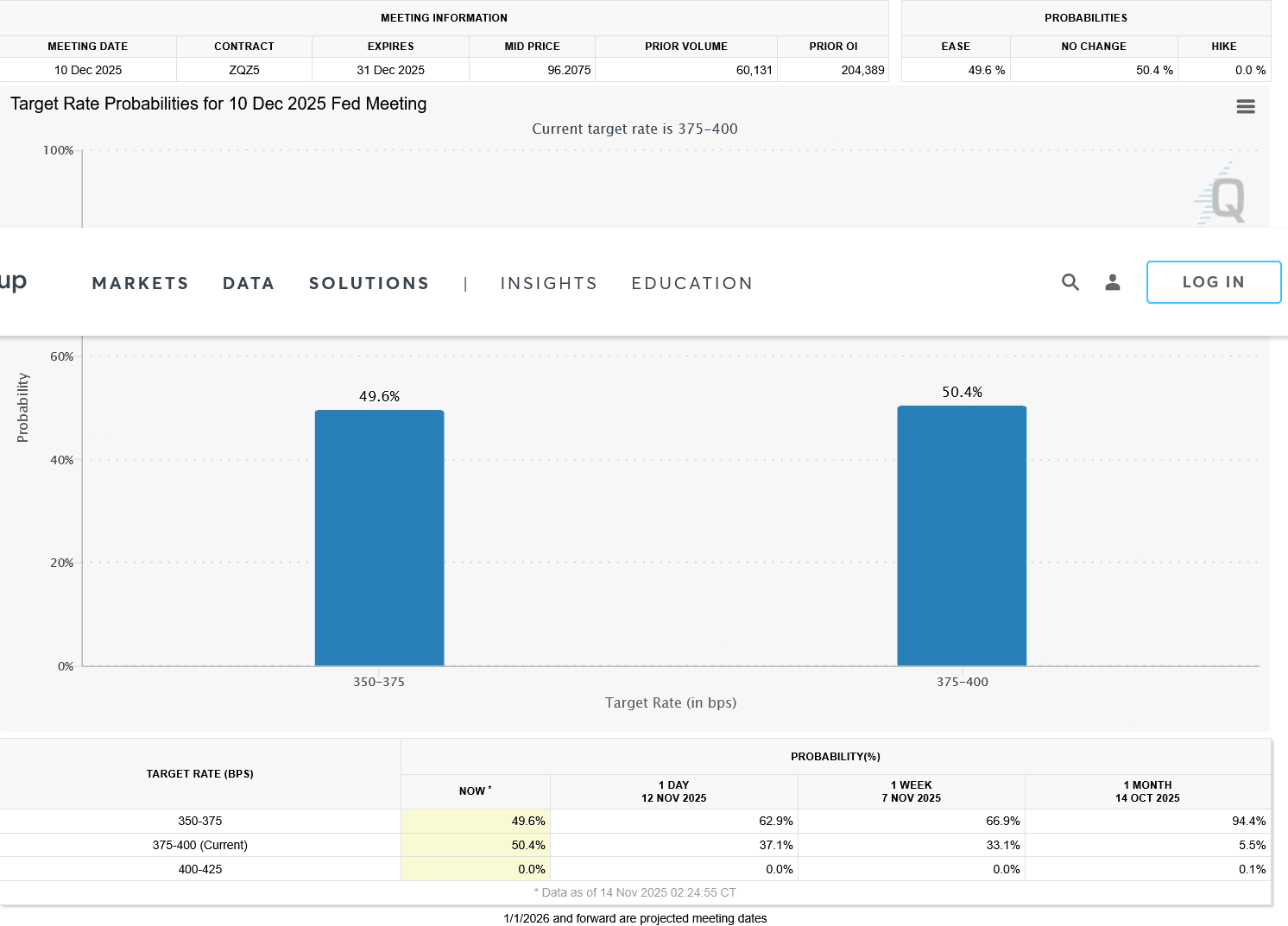

Global markets are experiencing multiple transformative catalysts supporting the recovery of risk assets. For instance, Trump has revived his proposal to distribute $2000 "tariff dividend" checks to every American using tariff revenues. While the plan faces hurdles such as congressional approval and inflationary concerns, it has already boosted consumer confidence and is expected to inject trillions of dollars in liquidity, benefitting high-growth technology sectors. Meanwhile, the U.S. government shutdown has reached a record 41 days. With the Senate having reached an agreement, it's expected to end on November 11—potentially triggering a renewed fiscal injection of tens of billions of dollars and a V-shaped rebound similar to past shutdown recoveries. Market expectations for a rate cut at the Federal Reserve's December FOMC meeting are also rising, with a 62.6% probability priced in for a 25-basis-point cut. Some Trump-backed officials even advocate for a 50-basis-point reduction, which would extend the easing cycle and further stimulate investment in crypto and AI infrastructure. Together, these factors may drive a 5–10% rebound in total crypto market capitalization, creating a window of opportunity for allocation to high-quality projects.

Massive $869M Outflow Slams Bitcoin. Is a Crash Coming?

Ethereum Latest Updates: BitMine Commits $12 Billion to ETH—Chairman Predicts $12,000 Despite 13% Market Drop

- BitMine Immersion Technologies (BMNR) surged ETH purchases by 34% to 110,288 tokens weekly, now holding 3.5M ETH (2.9% supply) valued at $12.76B. - Leadership overhaul appoints Chi Tsang as CEO, aligning with chairman Tom Lee's "supercycle" vision and $12K ETH price target by 2025. - Market reacts mixed as ETH dips 13.4% in two weeks, with treasury buys currently underwater and regulatory shifts like CFTC oversight emerging. - Shareholders demand transparency amid unstaked ETH holdings and evolving crypt

Vitalik Buterin's Breakthrough in ZK Technology: Ushering in a New Age of Privacy and Blockchain Scalability

- Vitalik Buterin drives Ethereum's ZK innovations to solve scalability and privacy challenges, positioning ZK as crypto's next growth pillar. - Modexp precompile updates and GKR protocol reduce proof costs 50x-15x, enabling ZK-rollups to process 43,000 TPS with near-zero fees. - ZK integration with MPC/FHE/TEE expands use cases beyond DeFi, with ZK-FHE hybrids targeting enterprise adoption in healthcare and finance . - ZK Layer 2 market projected to grow at 60.7% CAGR to $90B by 2031, driven by institutio