Bitcoin News Today: Bitcoin at a Turning Point: Is This a Bear Market or Just a Mid-Cycle Pause?

- Bitcoin trades above $105,000 amid debate over bear market confirmation vs. mid-cycle consolidation, with key technical levels at $102,000 and $94,000 critical for near-term direction. - Whale selling (815,000 BTC in 30 days) and ETF outflows ($1.22B in two weeks) contrast with $59.97B net inflows, highlighting fragile market dynamics. - Analysts split: CryptoQuant warns bearish signals (Bull Score 20) while Bitfinex cites 72% of Bitcoin in profit, comparing current correction to prior 22% rebounds. - Ri

The latest movements in Bitcoin's price have ignited discussions about whether the market is shifting into a bearish trend or simply pausing in the middle of its cycle. As of Tuesday, the cryptocurrency is trading above $105,000, but faces significant technical and on-chain indicators that may shape its short-term direction. Ki Young Ju, CEO of CryptoQuant, cautioned that a fall below $94,000 would signal the start of a bear market, while

Both institutional and retail appetite for

Bearish sentiment has grown stronger due to significant selling by long-term investors, often referred to as "whales." In the last month, these holders have sold 815,000 BTC,

Despite these challenges, some experts believe stabilization is possible. Bitfinex pointed out that 72% of Bitcoin's supply is still profitable, which could support a mid-cycle consolidation. The company

Nevertheless, the market's vulnerability is clear from the increase in short positions and negative funding rates.

Technical signals point to potential further declines. Bitcoin needs to move back above $102,000 to avoid a steeper drop, with the next major support at $94,000.

With the U.S. government shutdown close to being resolved, uncertainty in the broader economy remains a significant factor.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

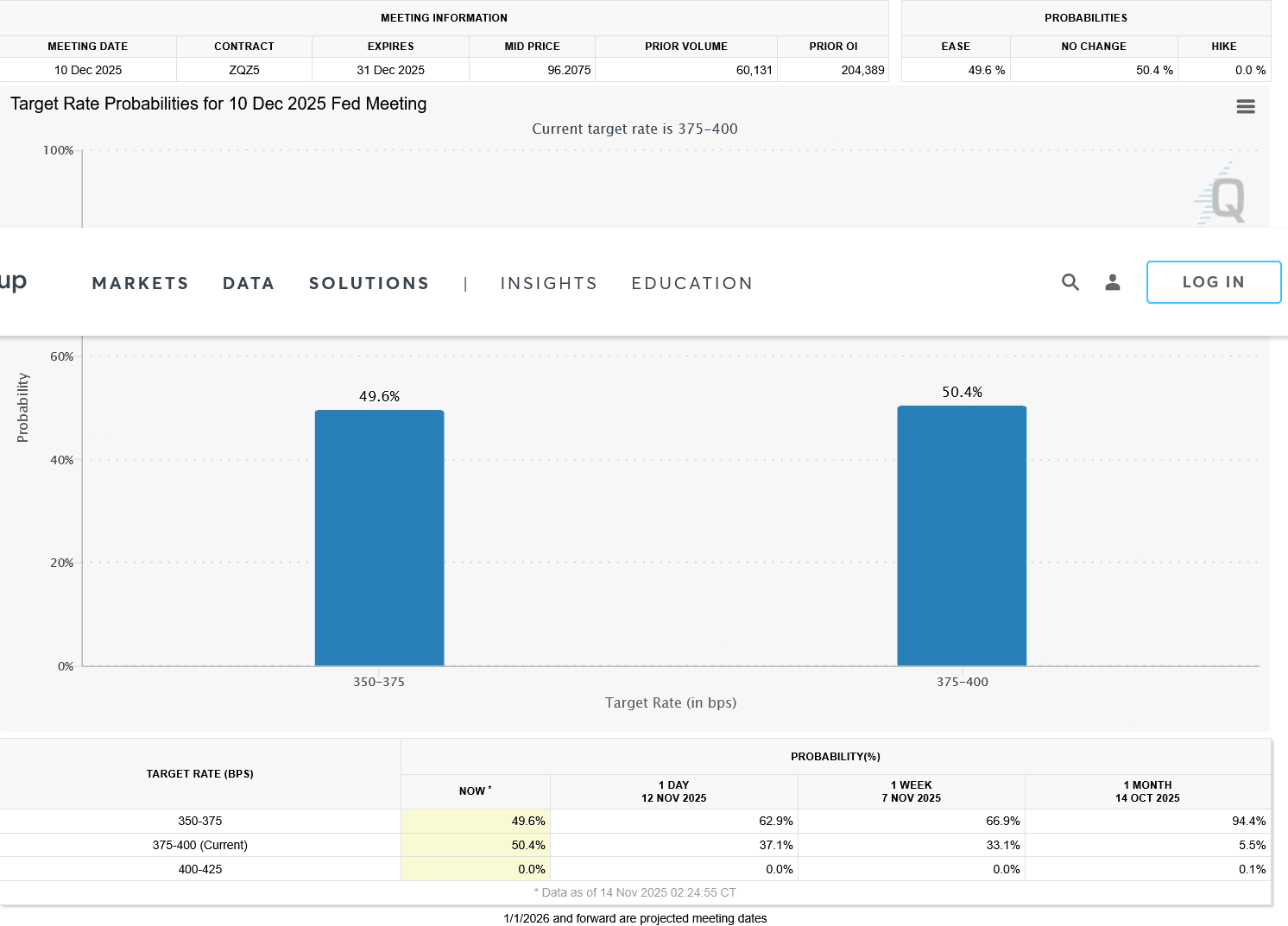

VIPBitget VIP Weekly Research Insights

Global markets are experiencing multiple transformative catalysts supporting the recovery of risk assets. For instance, Trump has revived his proposal to distribute $2000 "tariff dividend" checks to every American using tariff revenues. While the plan faces hurdles such as congressional approval and inflationary concerns, it has already boosted consumer confidence and is expected to inject trillions of dollars in liquidity, benefitting high-growth technology sectors. Meanwhile, the U.S. government shutdown has reached a record 41 days. With the Senate having reached an agreement, it's expected to end on November 11—potentially triggering a renewed fiscal injection of tens of billions of dollars and a V-shaped rebound similar to past shutdown recoveries. Market expectations for a rate cut at the Federal Reserve's December FOMC meeting are also rising, with a 62.6% probability priced in for a 25-basis-point cut. Some Trump-backed officials even advocate for a 50-basis-point reduction, which would extend the easing cycle and further stimulate investment in crypto and AI infrastructure. Together, these factors may drive a 5–10% rebound in total crypto market capitalization, creating a window of opportunity for allocation to high-quality projects.

Massive $869M Outflow Slams Bitcoin. Is a Crash Coming?

Ethereum Latest Updates: BitMine Commits $12 Billion to ETH—Chairman Predicts $12,000 Despite 13% Market Drop

- BitMine Immersion Technologies (BMNR) surged ETH purchases by 34% to 110,288 tokens weekly, now holding 3.5M ETH (2.9% supply) valued at $12.76B. - Leadership overhaul appoints Chi Tsang as CEO, aligning with chairman Tom Lee's "supercycle" vision and $12K ETH price target by 2025. - Market reacts mixed as ETH dips 13.4% in two weeks, with treasury buys currently underwater and regulatory shifts like CFTC oversight emerging. - Shareholders demand transparency amid unstaked ETH holdings and evolving crypt

Vitalik Buterin's Breakthrough in ZK Technology: Ushering in a New Age of Privacy and Blockchain Scalability

- Vitalik Buterin drives Ethereum's ZK innovations to solve scalability and privacy challenges, positioning ZK as crypto's next growth pillar. - Modexp precompile updates and GKR protocol reduce proof costs 50x-15x, enabling ZK-rollups to process 43,000 TPS with near-zero fees. - ZK integration with MPC/FHE/TEE expands use cases beyond DeFi, with ZK-FHE hybrids targeting enterprise adoption in healthcare and finance . - ZK Layer 2 market projected to grow at 60.7% CAGR to $90B by 2031, driven by institutio