Aztec launches public fundraising—are there still buyers after a 7-year wait?

A quick overview of the auction details and tokenomics.

A quick overview of the auction details and tokenomics.

Written by: 1912212.eth, Foresight News

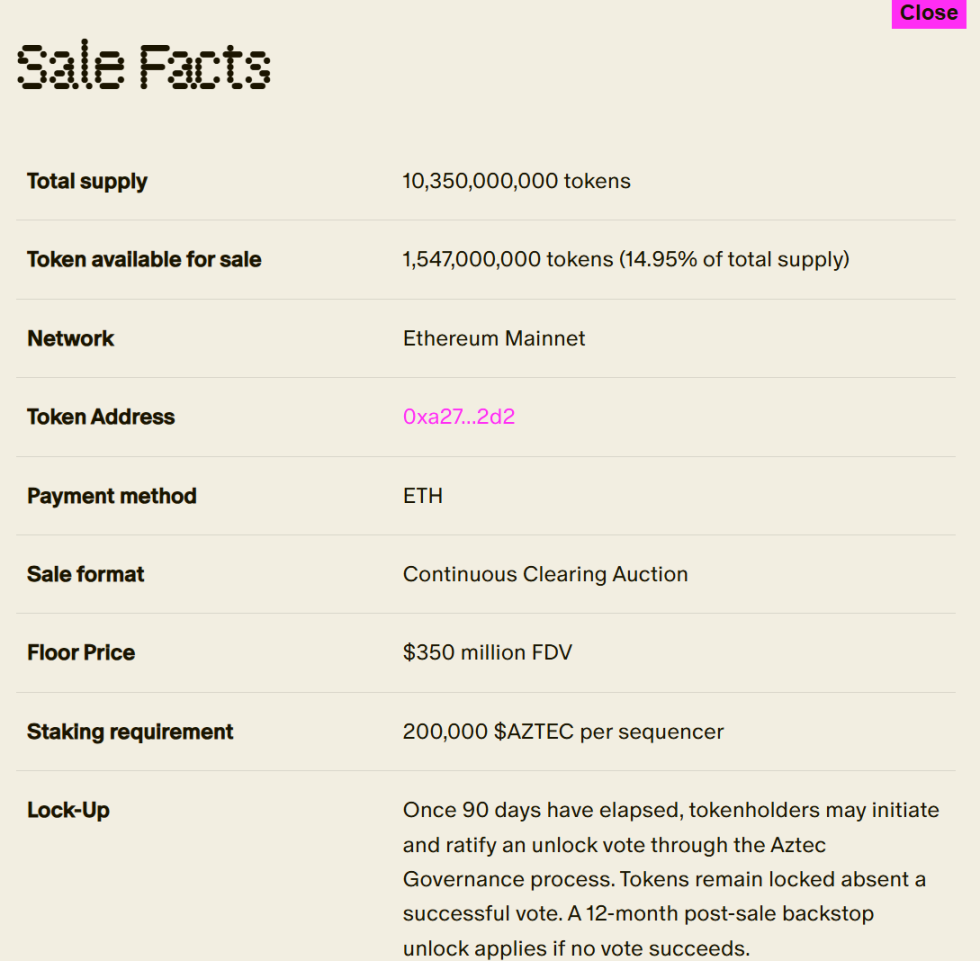

On November 13, the zero-knowledge privacy technology project Aztec announced the launch of its AZTEC token sale, with a total of 1.547 billion tokens available, accounting for 14.95% of the total supply, and payment to be made in ETH. Regarding the sale mechanism, the project stated that it will prioritize real-time price discovery and fair participation opportunities. The starting price is set at a $350 million FDV, which is about 75% lower than the implied network valuation based on the latest equity financing. Participants can mint soulbound NFTs to confirm their participation status.

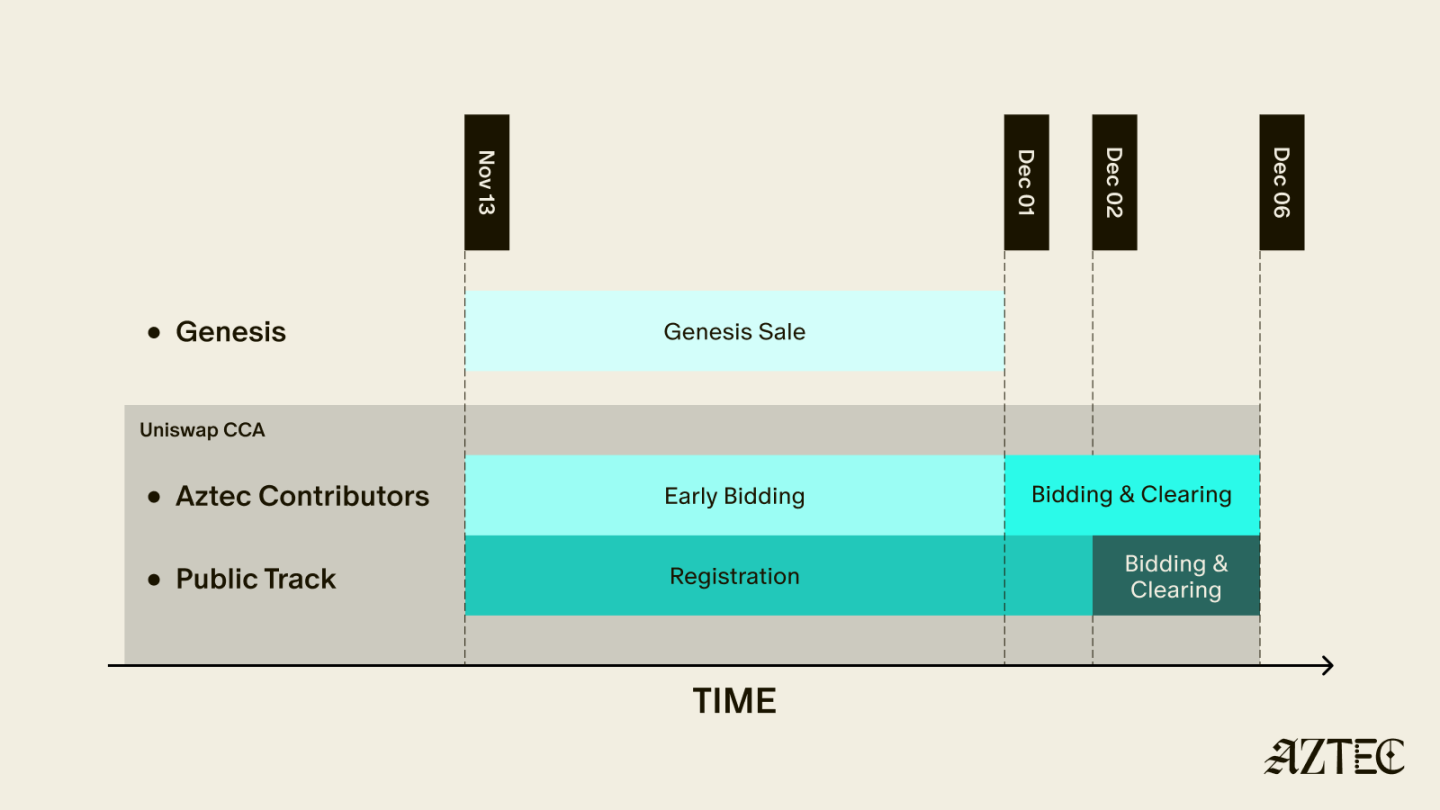

Registration and bidding for early participants will begin today (November 13) at 3:00 PM (CET). Early participants will enjoy a one-day exclusive early access period before bidding opens to the public. On December 1, AZTEC will be distributed to contributors and genesis bidders. On December 2, all NFT holders can participate in the auction bidding.

More than 300,000 addresses have been whitelisted, and these addresses will be eligible to bid on the first day. The sale is open to users worldwide, including U.S. citizens.

Contributor Eligibility Rules

Participation in one or more of the following:

- Sequencers and provers on the Aztec testnet

- ETH solo stakers, including selected StakeCat ETH operators, Obol Silver, Rocketpool, LidoCSM, and Stakers Union.

- zk.money users

- Active community members

- Uniswap traders (3,000 randomly selected from active traders in the past 30 days).

- Nansen’s Ice, North, and Star tiers.

Additionally, genesis sequencer nodes and the top 200 high-quality node operators who performed outstandingly on the Aztec testnet are also eligible to participate.

Auction Method: Continuous Clearing Auction Protocol

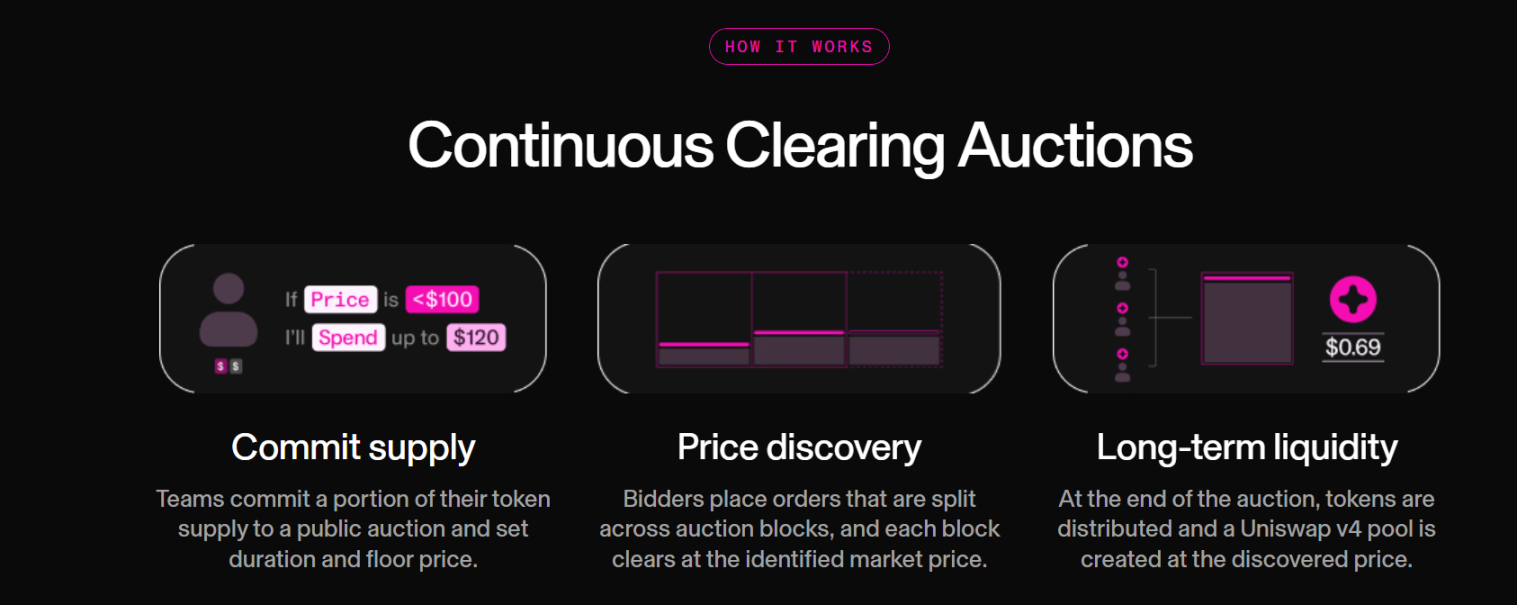

Uniswap has announced the launch of the "Continuous Clearing Auction Protocol" (CCA), a customizable protocol for launching liquidity and issuing tokens on Uniswap v4. The protocol was co-designed with Aztec, who provided a ZK Passport module to enable private and verifiable participation.

The team will commit part of the token supply to the public auction, setting a duration and a reserve price. Price discovery bidders place orders, which are split within auction blocks, and each split order is cleared at the determined market price.

At the end of the long-term liquidity auction, tokens will be distributed and a Uniswap V4 liquidity pool will be created at the discovered price.

Tokenomics

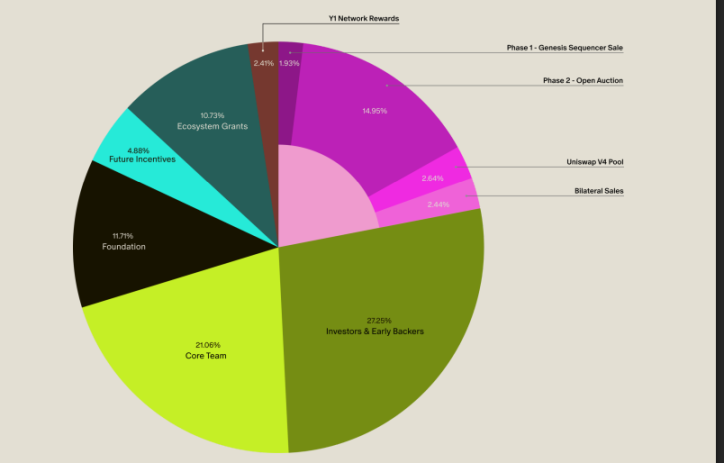

According to the Aztec whitepaper, the genesis total supply of AZTEC is 10,350,000,000 tokens, distributed as follows: 27.26% to investors and early supporters, 21.06% to the core team, 11.71% to the foundation, 10.73% to ecosystem grants, 14.95% to Phase 2 public auction, 1.93% to Phase 1 genesis sequencer sale, 2.44% to bilateral sales, 2.64% to Uniswap V4 liquidity pool, 4.89% to future incentives, and 2.41% to Y1 Network Rewards.

The total token sale accounts for 21.96%, corresponding to 2,272,500,000 tokens. These tokens will be held by token holders and the foundation at launch.

Token functions include

- Sequencer staking: Tokens will be used to secure the network through staking by Aztec validators (i.e., "sequencers"), who are responsible for generating blocks on the Aztec network. Token holders who do not operate sequencers can choose to delegate their tokens to sequencers.

- Governance: Token holders can participate in the governance of the Aztec network ("Aztec Governance").

- Execution environment: If the network is upgraded via Aztec Governance in the future to support a smart contract execution environment, tokens will be used to pay transaction fees on the Aztec network.

Starting 12 months after the token sale date (November 13, 2025)

- Aztec Governance may adjust the total token supply, including annual increases capped at a certain percentage;

- If the execution environment is enabled, transaction fees may be adjusted through an autonomous mechanism similar to Ethereum’s EIP-1559.

After the token sale is completed, the Uniswap v4 liquidity pool may provide secondary market liquidity, and the foundation plans to inject 273 million tokens into the pool. The token sale contract will automatically inject corresponding tokens into the liquidity pool based on the proportion of ETH paid by buyers. The liquidity pool will be controlled by Aztec Governance and will be locked in an immutable smart contract for at least 90 days after launch, after which restrictions can be lifted by governance vote. In addition, the token may be listed and traded on other decentralized trading protocols or centralized exchanges.

7 Years of Waiting

Aztec completed a $2.1 million seed round at the end of 2018, followed by another round of financing in September 2019. In January 2020, the Aztec Network mainnet went live. Amid the ZK zero-knowledge and L2 boom, Aztec completed a $17 million Series A round in December 2021, led by Paradigm, with participation from Vitalik and other prominent institutions, and then a $100 million Series B round in December 2022, led by a16z.

However, the star-studded venture capital lineup did not bring protocol growth.

In March 2023, Aztec Network announced the gradual shutdown of the DeFi privacy bridge project Aztec Connect, disabling deposits from zk.money and other frontends (such as zkpay.finance) into the Aztec Connect contract, and completely abandoning the Aztec Connect contract one year later, with all Rollup functions ceasing. The project lead responded that this decision was mainly for business reasons.

In May 2025, it launched a public testnet, which once attracted many airdrop hunters. The newly announced tokenomics show that Aztec has no airdrop allocation.

BTC has already fallen below $100,000, and the market is showing signs of turning bearish. How many players will actually buy in remains unknown, and the real test for Aztec may have just begun.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

As economic cracks deepen, bitcoin may become the next liquidity "release valve"

The US economy is showing a divided state, with financial markets booming while the real economy is declining. The manufacturing PMI continues to contract, yet the stock market is rising due to concentrated profits in technology and financial companies, resulting in balance sheet inflation. Monetary policy struggles to benefit the real economy, and fiscal policy faces difficulties. The market structure leads to low capital efficiency, widening the gap between rich and poor and increasing social discontent. Cryptocurrency is seen as a relief valve, offering open financial opportunities. The economic cycle oscillates between policy adjustments and market reactions, lacking substantial recovery. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

The wave of cryptocurrency liquidations continues! US Bitcoin ETF sees second highest single-day outflow in history

Due to the reassessment of Federal Reserve rate cut expectations and the fading rebound of the U.S. stock market, the crypto market continues to experience liquidations, with significant ETF capital outflows and options traders increasing bets on volatility. Institutions warn that technical support for bitcoin above $90,000 is weak.

When traditional financial markets fail, will the crypto industry become a "pressure relief valve" for liquidity?

As long as the system continues to recycle debt into asset bubbles, we will not see a true recovery—only a slow stagnation masked by rising nominal figures.