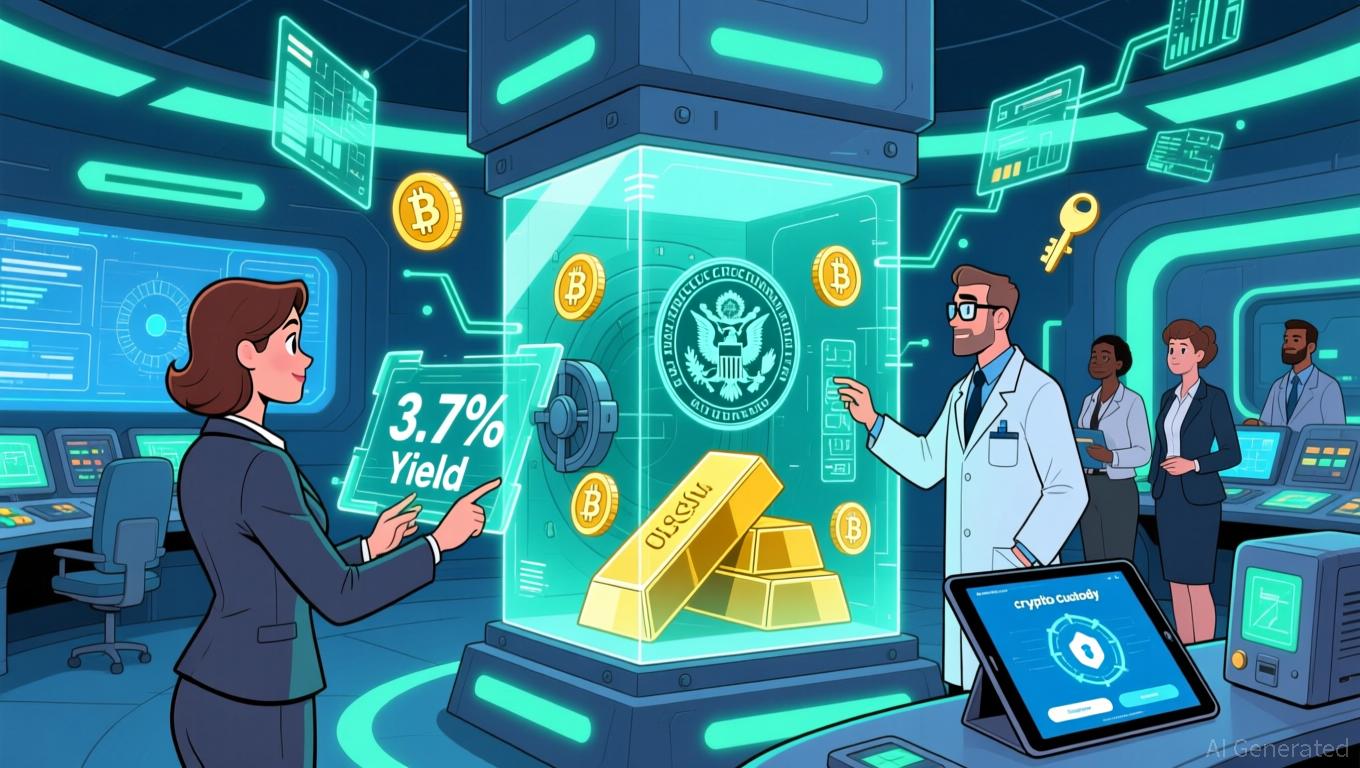

BNB News Update: BlackRock’s BUIDL Connects Conventional Finance with Blockchain Networks

- Binance partners with BlackRock to use BUIDL tokenized fund as institutional collateral via Securitize, bridging traditional finance and blockchain. - BUIDL ($2.5B AUM) offers 3.7% yield as compliant collateral, enhancing capital efficiency for institutional traders through Ceffu and triparty banking. - BUIDL expands to BNB Chain (via Wormhole) and multiple blockchains, accelerating real-world asset (RWA) adoption on public networks. - JPMorgan estimates $36B tokenized RWA market, with BUIDL redefining c

Binance, recognized as the leading cryptocurrency exchange by trading volume, has revealed that

The BUIDL fund,

This development mirrors larger trends in the RWA sector,

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates Today: Investors Manage AI and Crypto Profits Amid Market Fluctuations and Regulatory Ambiguity

- BigBear .ai surged 19% premarket after Q3 results and acquiring Ask Sage, boosting secure AI revenue potential. - Rocket Lab rose 9.6% on 48% revenue growth but faces Neutron rocket delays and valuation concerns. - GameSquare and American Bitcoin highlighted crypto resilience, while Ethereum fell below $3,100 amid ETF outflows. - Market volatility persists as AI, space, and crypto sectors balance growth opportunities with regulatory risks.

Ethereum News Update: As Solana Slows Down, Investors Turn Attention to XRP and Ethereum

- Solana (SOL) price drops near $164 as derivatives market wanes, with open interest halving to $7.72B, signaling retail investor retreat. - XRP's ETF gains $58M in volume, leveraging traditional finance ties to outperform Solana-focused funds. - Ethereum (ETH) treasuries rise via staking and DeFi, with ETHZilla and BTCS boosting holdings for yield generation. - Blockchain firms like Figure and GameSquare expand Ethereum's appeal through asset tokenization and Web3 strategies. - MoonLake's securities fraud

XRP News Today: SEC Gives Green Light to XRP ETF, Signaling a Major Regulatory Milestone for Cryptocurrency

- SEC approves first XRP ETF (XRPC) by Canary Capital, marking regulatory milestone for Ripple after years of legal scrutiny. - XRP surged 12% post-approval as institutional demand grows, with projected $5B inflows and 0.5% management fee. - ETF aligns with new SEC rules for commodity-based funds, accelerating XRP's potential normalization in traditional portfolios. - Institutional custodians and partners like Gemini and U.S. Bancorp support the fund, mirroring Bitcoin/Ethereum ETF success trajectories. -

Progressive Shakeup in Seattle Indicates Nationwide Shift Driven by Calls for Greater Affordability

- Seattle progressive Katie Wilson defeated Mayor Bruce Harrell in a historic upset, reflecting national trends demanding affordability and systemic change. - Wilson's platform focused on capital gains taxes for housing funds and renter protections, contrasting Harrell's law-and-order approach amid rising costs and homelessness. - The win signals urban Democratic realignment, with progressive policies challenging traditional centrism as Trump-era policies galvanized left-leaning voters nationwide. - Harrel