Key Market Intelligence on November 28th, how much did you miss out on?

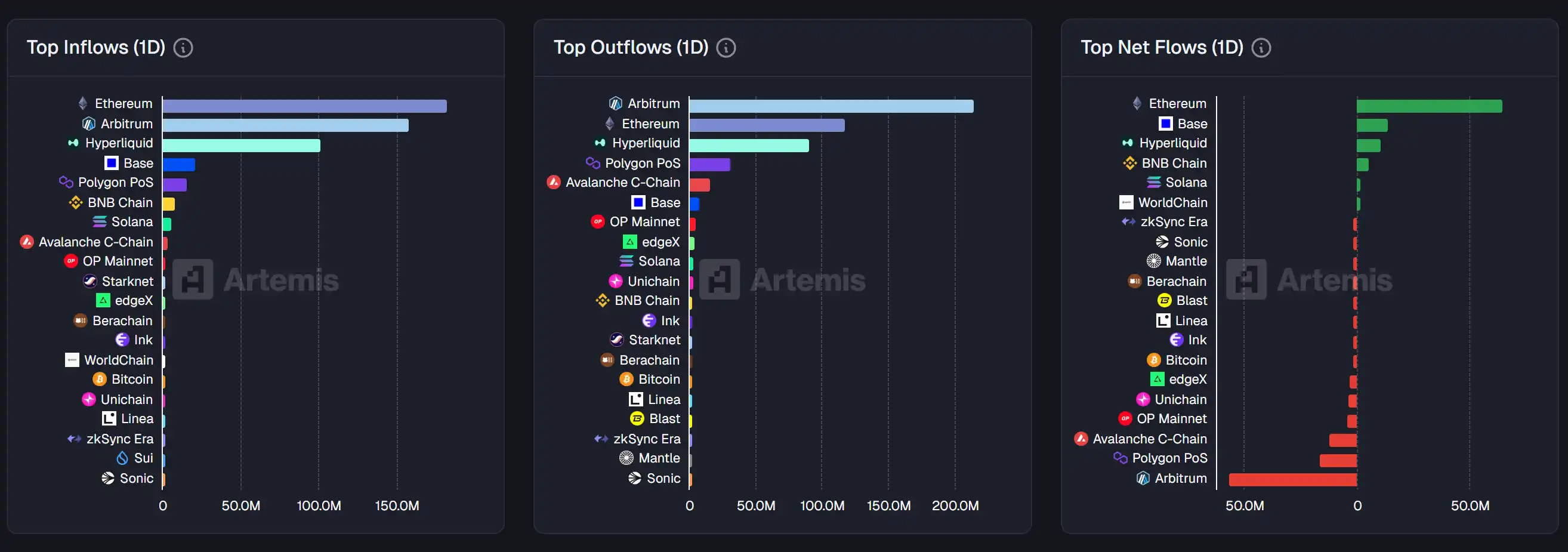

1. On-chain Funds: $64.5M USD inflow to Ethereum today; $56.3M USD outflow from Arbitrum 2. Largest Price Swings: $TRADOOR, $AT 3. Top News: Monad on-chain Meme "emo" with a 24-hour price surge of 290%, currently valued at $570,000 USD

Featured News

1. Monad On-Chain Meme "emo" Surges 290% in 24 Hours, Market Cap Currently at $570,000

2. "BNB Version MicroStrategy" BNC Price Drops Over 92% from its All-Time High, Currently at $5.97

3. ZEC Dips Below $450 Temporarily, 24-Hour Decline of 10.87%

4. Suspected Google Insider Leaks Gemini 3.0 Flash Release Schedule, Multiple Accounts Simultaneously Bet on Narrow Window

5. New Suspicion in Qian Zhimin Case, Whereabouts of Over 120,000 Bitcoins Unknown, with 20,000 Claimed to be "Lost Password"

Featured Articles

1. "Bitcoin Returns to $90,000, Will It Be Christmas or Christmas Robbery Next?"

Whether Chinese or foreigners, no one can escape the traditional psychological expectation of "having a good reunion holiday." Every year, on the fourth Thursday of November, is the traditional major holiday in the United States, Thanksgiving. And this year's Thanksgiving, what people in the crypto industry may be most grateful for is Bitcoin's return to $90,000. In addition to the "holiday market" factor, a "Brown Paper" that unexpectedly became a key decision basis due to government shutdown has also helped reshape the final monetary policy direction of the year. The probability of a Fed rate cut in December has skyrocketed from 20% a week ago to 86%.

2. "How to Speculate on US Stocks with 100x Leverage?"

Money always flows to where more money is, and liquidity is always in pursuit of deeper liquidity. Bitcoin has a market cap of $1.7 trillion, while the total market cap of the US stock market exceeds $50 trillion. Tech giants like Apple, Microsoft, and NVIDIA, each with a market cap that can dominate the entire cryptocurrency market. More and more savvy crypto enthusiasts also seem to have reached a subtle consensus that trading stocks may really be better than trading coins.

On-chain Data

On-chain fund flow last week on November 28

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Chainlink ETF Set to Debut as LINK Slips Amid Market Weakness

Striking baristas win $38.9 million in compensation, yet contract disputes continue

- Starbucks settles NYC Fair Workweek Law violations for $38.9M, including $35.5M restitution to 15,000+ workers. - Striking baristas demand collective bargaining amid ongoing labor disputes and unionization efforts at 550 stores. - Mayor-elect Mamdani and Sen. Sanders join protests, framing demands as moral issues against corporate resistance. - Settlement addresses 500,000 scheduling violations since 2021, with workers receiving $50/week compensation. - Starbucks defends labor law complexity but faces cr

Alphabet's AI-driven ecosystem accelerates flywheel momentum, driving shares up by 68% in 2025

- Alphabet's stock surged 68% in 2025, outperforming peers like Microsoft and Nvidia , driven by strong AI monetization and cloud growth. - Analysts raised price targets to $375-$335, citing Google Cloud's $15.2B Q3 revenue (34% YoY) and $155B cloud backlog growth. - The company's AI ecosystem spans Search, YouTube, and Workspace, generating premium subscriptions and ad yield through Gemini's 650M MAUs. - Projected cloud revenue could exceed estimates by $40B, but risks include regulatory scrutiny and comp

XRP News Today: Vanguard Changes Position on Crypto ETFs, Pointing to Market Maturity and Increased Demand

- Vanguard Group will enable crypto ETF trading on its platform from December 2, 2025, reversing years of opposition to digital assets. - The firm supports Bitcoin , Ethereum , XRP , and Solana ETFs but excludes memecoins, treating crypto as non-core assets like gold . - Market maturation, $25B+ ETF inflows, and regulatory compliance drive the shift, positioning Vanguard as the last major U.S. broker to adopt crypto ETFs. - The move reflects growing institutional confidence in regulated crypto structures a