Date: Sat, Nov 29, 2025 | 09:58 AM GMT

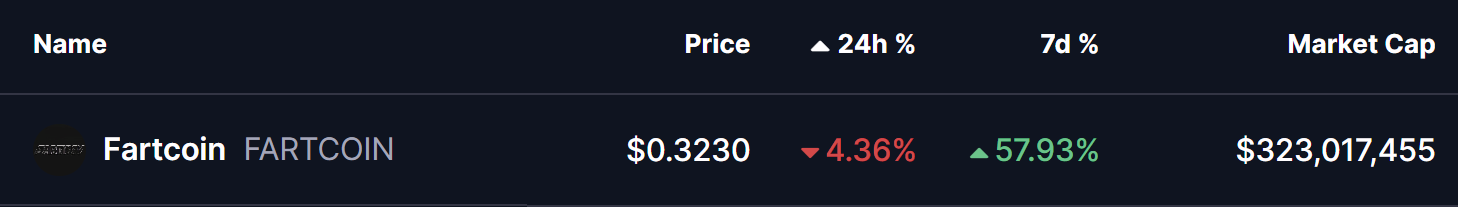

In today’s crypto market, Fartcoin (FARTCOIN) — one of the strongest-performing memecoins this week with a surge of over 57% — is now trading in red. But the bigger focus is on its technical structure, which is beginning to flash warning signals as a potential fractal setup takes shape.

Source: Coinmarketcap

Source: Coinmarketcap

Symmetrical Broadening Wedge in Play

On the 4H chart, FARTCOIN continues to consolidate inside a symmetrical broadening wedge, a neutral-to-bearish structure that often leads to volatile swings in both directions.

The recent rejection from the wedge’s upper trendline near $0.3623 pushed price sharply downward toward its immediate support at $0.3224. What makes this level important is that it aligns with the previous breakdown zone, where FARTCOIN lost both the support and the 50 MA — triggering a steep 14% decline.

FARTCOIN 4H Chart/Coinsprobe (Source: Tradingview)

FARTCOIN 4H Chart/Coinsprobe (Source: Tradingview)

Now, once again, the token is sitting at the same fractal support, and this time, FARTCOIN is hovering just above the 50 MA at $0.3146, increasing the stakes for a potential breakdown or rebound.

What’s Next for FARTCOIN?

If FARTCOIN fails to defend the current support zone around $0.32 and closes decisively below the 50 MA, the fractal setup would be confirmed. Such a move could open the doors for further downside, likely dragging the price toward the next key support around $0.2790, which sits roughly 14% lower from current levels.

On the flip side, if buyers step in and protect the support, a rebound from this zone followed by an upside breakout from the wedge could shift momentum back in favor of bulls, setting the stage for a fresh leg higher.