3.56 million Ethereum are trapped on the books, with $3 billion in unrealized losses. Bitmine's high-stakes gamble is turning into a desperate survival test.

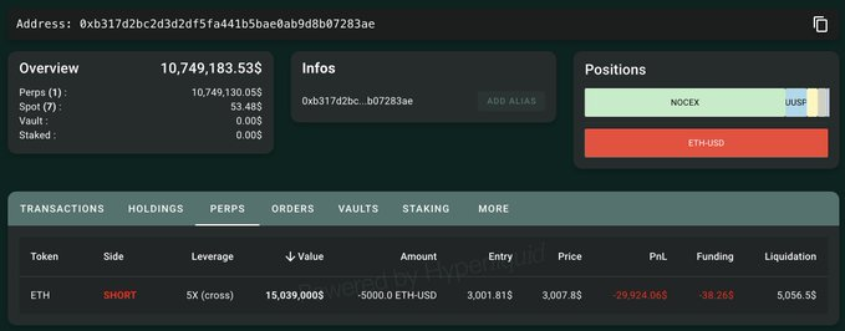

“BitcoinOG (1011short),” a name well-known in the cryptocurrency world, suddenly reversed its bullish stance on November 29 and opened a short position of 5,000 ETH, with a notional value as high as $15.04 million.

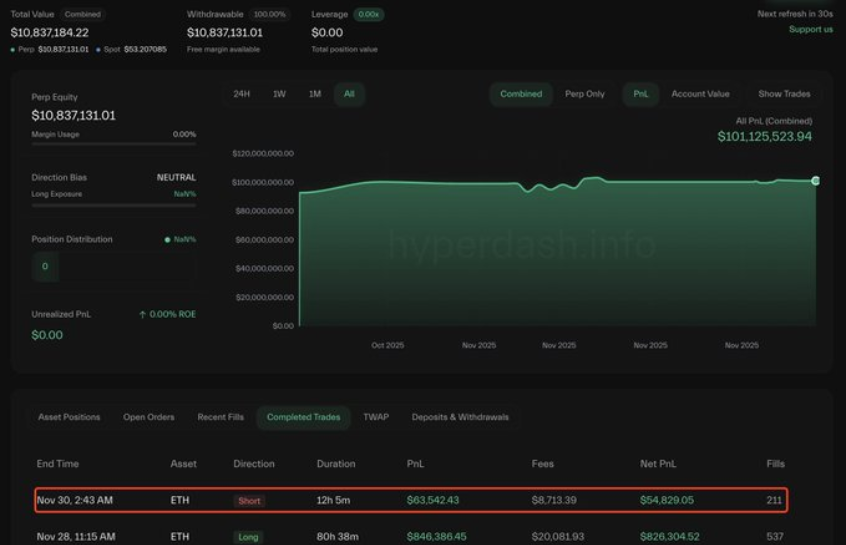

Just 24 hours later, this whale quickly closed the position, earning a profit of $54,800. This seemingly successful trade, however, reveals deeper turmoil in the Ethereum market.

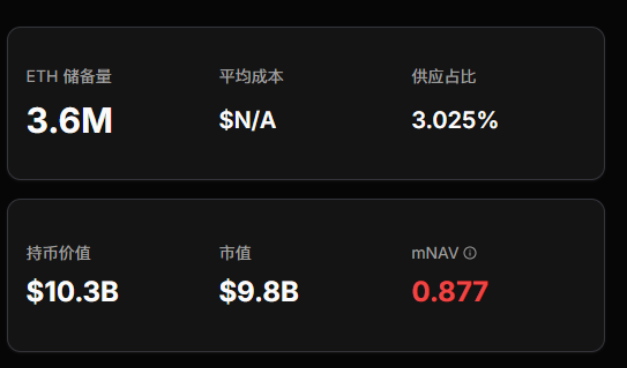

In the same market, the publicly listed company Bitmine is facing an even more severe test. As the price of Ethereum fell below $3,000, the company’s holding of 3.56 million ETH has sunk into a staggering $3 billion in unrealized losses.

I. Whale Turns

● On November 29, an Ethereum whale named “BitcoinOG (1011short)” suddenly executed a shocking strategic shift. This long-term bullish investor opened a 5x leveraged short position of 5,000 ETH, with a notional value exceeding $15 million, and set a liquidation price at $5,056.5.

● However, the market drama was just beginning. The very next day, on November 30, this whale suddenly closed the massive short position. The trade ultimately realized a profit of $54,800, which, relative to its $15.04 million notional value, is a return of only 0.36%.

● Analysts reviewing this trade pointed out: “The profit from this trade is very small relative to the notional value, indicating that the drop in Ethereum’s price was not as large as the trader expected, or the holding period for the position was very short.”

II. Bitmine’s Predicament

● As the local price of Ethereum fell from above $4,000 to the current level of around $3,000, Bitmine’s balance sheet came under immense pressure. The publicly listed company had planned to accumulate 5% of Ethereum’s total supply and now holds 3.56 million ETH, accounting for nearly 3% of the circulating supply.

● However, as market headwinds intensified, Bitmine’s aggressive strategy began to reveal serious problems. Based on an average purchase price of $4,009, Bitmine’s paper losses have approached $3 billion.

● Even more worrying, the company’s cash reserves are about $607 million, and it has “almost invested all cash” in acquiring Ethereum, losing the ability to buy more at lower prices.

● This has left Bitmine in a “toxic financing” predicament. In a financing round in September 2025, the company was forced to sell 5.22 million shares at $70 per share, with two warrants attached to each share.

There’s an old saying on Wall Street: “When the tide goes out, you find out who’s been swimming naked.” In November 2025, the tide receded faster than anyone could have imagined.

III. Market Background

The Ethereum market is experiencing a comprehensive withdrawal of buying power, with the once three major pillars—ETFs, treasury companies, and on-chain funds—now fully diverged.

● Digital asset treasury companies have also entered a phase of divergence. Currently, the total strategic Ethereum reserves in the treasury sector amount to 6.2393 million ETH, accounting for 5.15% of supply, but the pace of accumulation has clearly slowed in recent months.

● On the other side of the market, long-term holders (addresses holding for more than 155 days) are currently selling about 45,000 ETH per day, equivalent to $140 million, the highest level of selling since 2021. This large-scale selling further intensifies downward pressure on the market.

● On the macro level, uncertainty in Federal Reserve policy has also cast a shadow over the market. Expectations for a rate cut in December have plummeted from 66% to 44%, putting pressure on risk assets.

● The cryptocurrency market was hit by a storm on December 1, with Ethereum’s price dropping 6% to below $2,900 that day. Sean McNulty, Head of APAC Derivatives Trading at FalconX, said: “This is the prelude to December starting with risk aversion. The most worrying thing is the meager inflows into bitcoin ETFs and the lack of dip buyers.”

IV. In-Depth Analysis

Beneath the surface turmoil of the Ethereum market, a deeper game of supply control is unfolding.

● The Ethereum market in 2025 presents two sharply contrasting behavioral patterns: On one hand, OG sellers (long-term holders) have liquidated over 100,000 ETH holdings as prices fell. On the other hand, whale accumulators have increased their holdings by 8.01 million ETH since April 2025, with a single-day inflow of 871,000 ETH on June 12, marking the largest whale accumulation of the year.

This divergence has created a tug-of-war over supply, bringing both short-term volatility risks and the possibility that, if institutional buying can maintain Ethereum in the $3,000–$3,400 support range, a turning point may emerge.

● In this tug-of-war, Bitmine’s predicament reflects deeper issues. The company’s stock price has fallen about 80% from its July peak, with a current market cap of about $9.2 billion, even lower than the value of its ETH holdings at $10.6 billion.

● Market doubts about the company’s value are directly reflected in its mNAV (market cap to net asset value ratio), which has dropped to 0.87, highlighting concerns over the company’s paper losses and funding sustainability.

● This discount phenomenon is not unique; the entire DAT (Digital Asset Treasury) sector is undergoing structural adjustment. Leading companies can still maintain buying thanks to capital and confidence, while small and medium-sized companies are caught in liquidity constraints and debt pressure. The market baton has shifted from broad incremental buying to a few “lone warriors” who still have capital strength.

V. Outlook

Although the market is shrouded in pessimism, some potential positive factors may change the current trajectory.

● The Ethereum Fusaka upgrade scheduled for December 4 plans to increase the number of blobs from 9 to 15, which directly means Layer2 transaction fees will drop sharply again. Mainstream L2s such as Arbitrum, Optimism, and Base are expected to see gas fees fall by another 30%-50%, which could stimulate activity in the Ethereum ecosystem.

● There is also a turning point at the macroeconomic level. The latest CME FedWatch Tool data shows that the probability of a 25 basis point rate cut at the December 10 FOMC meeting has soared to 85%, up from just 35% a week ago. The direct reason for this sharp increase is that November PPI data was much lower than expected, and inflationary pressures continue to ease.

● Even more anticipated is that the candidate for Federal Reserve Chair may be announced as early as before Christmas, with National Economic Council Director Kevin Hassett currently leading by a wide margin. Hassett is a typical “rate cut advocate” + “tax cut advocate,” who has repeatedly publicly criticized Powell for raising rates too aggressively and believes interest rates should be much lower than the inflation rate.

● All these positive factors do not mean the end of the DAT companies’ predicament. Global leading index provider MSCI has launched a consultation, considering removing companies with more than 50% of their balance sheet in crypto assets from its indices. The final decision will be announced on January 15, 2026, a date seen as judgment day for the DAT sector.

The market’s attention is now focused on two key dates: the Federal Reserve’s FOMC meeting on December 10, and MSCI’s final decision on January 15, 2026, regarding whether to remove crypto-heavy companies from its indices.

These events will determine the financing ability of companies like Bitmine and will also influence the investment strategies of whales. As one market observer put it, in this game between whales and holders, the real test is not who can make more in a bull market, but who can survive longer in a bear market.