HashKey prospectus in detail: 1.5 billion HKD loss over three years, 43% equity controlled by Wanxiang Chairman Lu Weiding

Despite HashKey's significant total revenue growth over the past two years, with rapid expansion in trading volume and client base, the underlying financial pressure remains evident: ongoing losses, long-term negative operating cash flow, and consistently high net debt all contribute to continued uncertainty regarding its financial resilience ahead of its IPO.

Author: zhou, ChainCatcher

On December 1, Hong Kong licensed digital asset trading platform HashKey passed the listing hearing of the Hong Kong Stock Exchange, just one step away from going public. The joint sponsors of this IPO are JPMorgan and Guotai Junan Financing.

1. Revenue Explosion: Trading Facilitation Services Account for Nearly 70%

The prospectus shows that HashKey is a comprehensive digital asset platform, with core businesses including trading facilitation services, on-chain services, and asset management services. The platform is capable of issuing and circulating tokenized real-world assets (RWA) and has launched the HashKey Chain—a scalable, interoperable Layer 2 infrastructure to support on-chain migration.

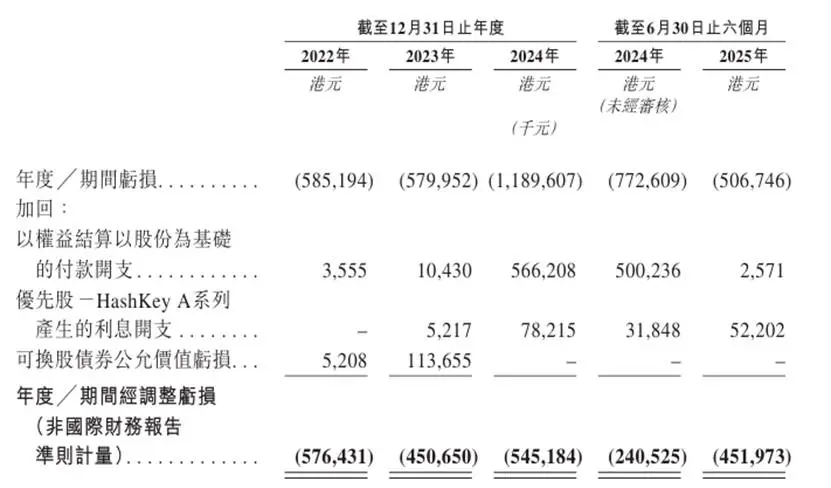

During the reporting period, the company’s total revenue achieved explosive growth, rising from HKD 129 million in 2022 to HKD 721 million in 2024, an increase of nearly 6 times in two years. However, despite the rapid revenue growth, the company remains in a state of continuous adjusted net loss (a cumulative loss of HKD 1.57 billion from 2022-2024).

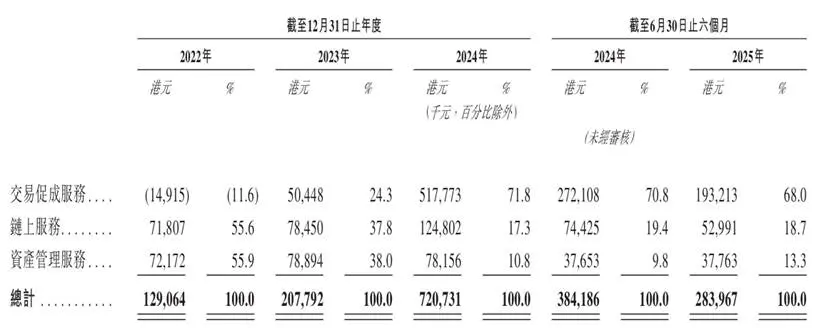

The company’s revenue mainly comes from three segments: trading facilitation services, on-chain services, and asset management services. Among them, the core driver of revenue growth is trading facilitation services.

This business has successfully turned losses into profits, jumping from a loss of HKD 14.915 million in 2022 to a positive income of HKD 518 million in 2024, accounting for 68% of total revenue in the first half of 2025. This growth is mainly due to HashKey’s compliance first-mover advantage in Asia (especially the Hong Kong market) through licensed operations.

According to Sullivan data, HashKey holds a market share of over 75% among onshore digital asset platforms in Hong Kong, occupying an absolute leading position. As of September 30, 2025, platform assets have exceeded HKD 19.9 billion, supporting trading of 80 types of digital asset tokens.

Another part of HashKey’s revenue comes from on-chain services, with a compound annual growth rate of 32%. The company provides a comprehensive suite of on-chain services, integrating blockchain staking infrastructure, tokenization capabilities, and native blockchain development.

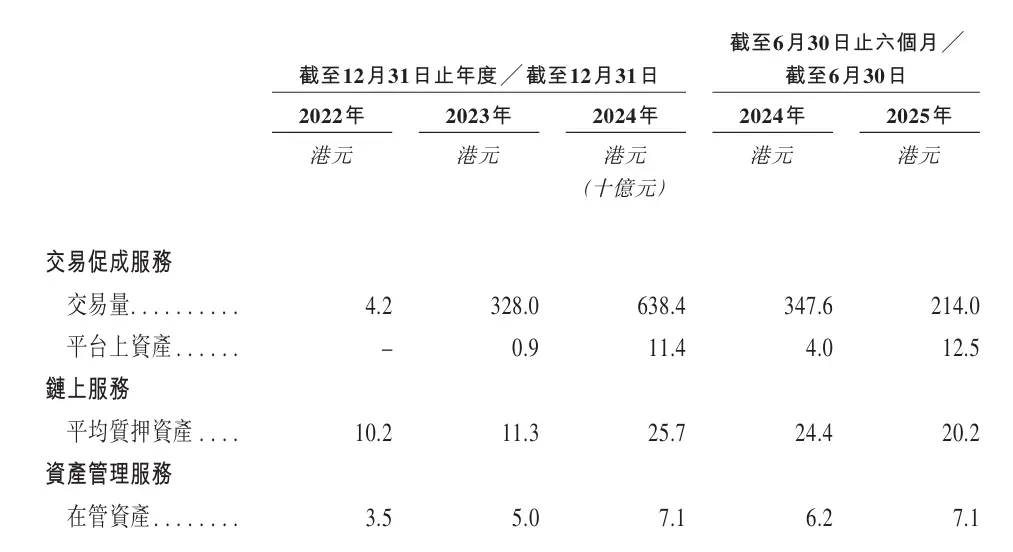

As of September 30, 2025, it had HKD 29 billion in staked assets, and the total value of real-world assets on the HashKey Chain reached HKD 1.7 billion. The company has become the largest staking service provider in Asia and the eighth largest globally.

In terms of asset management services, HashKey provides institutional clients with digital asset investment opportunities, covering venture capital and secondary fund investments. As of September 30, 2025, the company’s cumulative assets under management since its establishment reached HKD 7.8 billion. As of December 31, 2024, the company was the largest asset management service provider in Asia by assets under management.

HashKey claims its fund investment return rate exceeds 10 times, more than twice the industry average. However, as the scale of trading business expands, the proportion of asset management income in the overall business has dropped from 55.9% to 10.8%, indicating that the company’s profit focus has shifted from earning management fees and investment returns to relying on trading volume.

2. Trading Scale, User Expansion, and Equity Control

As of August 31, 2025, HashKey held HKD 1.657 billion in cash and cash equivalents, and digital assets worth HKD 592 million. Of these HKD 592 million digital assets, mainstream tokens accounted for 84%, including ETH, BTC, USDC, USDT, and SOL.

HashKey’s trading volume surged from HKD 4.2 billion in 2022 to HKD 328 billion in 2023, and further increased to HKD 638.4 billion in 2024. The rapid growth was driven by the launch of its Hong Kong digital asset trading platform in the second half of 2023 and the Bermuda digital asset trading platform in 2024.

However, on a half-year basis, the company’s trading volume dropped from HKD 347.6 billion in the six months ended June 30, 2024 to HKD 214 billion in the six months ended June 30, 2025. The company explained that this was mainly due to strategic adjustments during a market downturn, leading to reduced trading activity among retail clients, as reflected in the decline in monthly trading volume of retail clients during the same period.

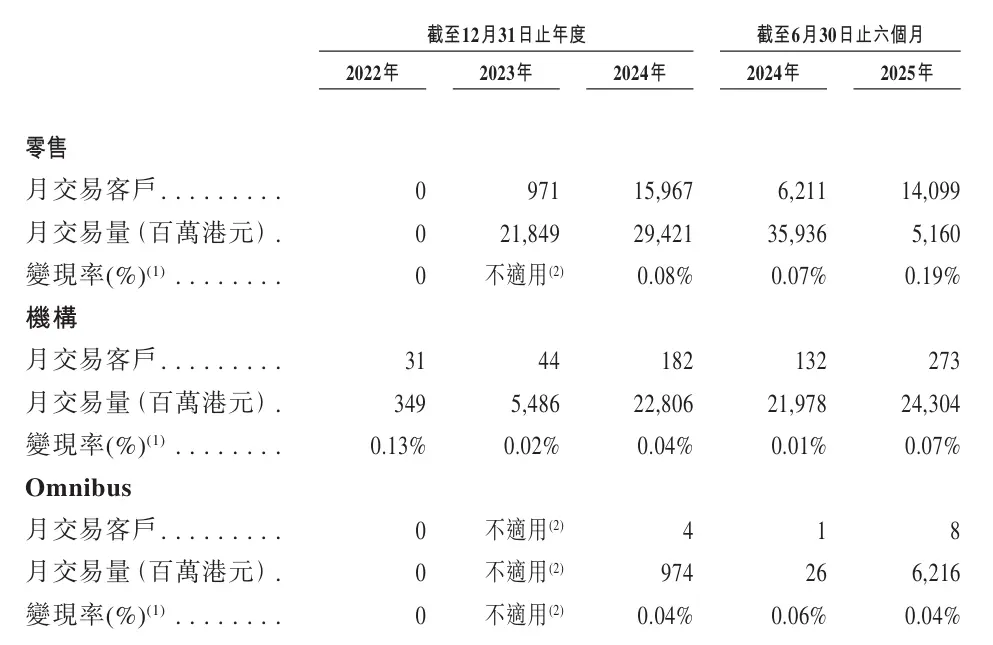

Looking at monthly trading clients, there were 15,967 retail monthly trading clients in 2024, with both monthly trading volume and number of trading clients contracting in the first half of 2025; institutional monthly trading clients increased from 31 in 2022 to 273 in the first half of 2025, and Omnibus monthly trading clients expanded from 1 in the first half of 2024 to 8 in the first half of 2025, indicating rising stickiness and participation of institutional and Omnibus clients on the platform.

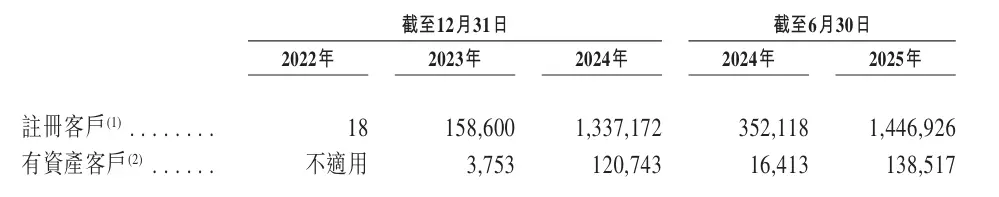

In terms of user base, the number of registered clients surged from 18 in 2022 to about 1.447 million as of June 30, 2025; among them, clients with assets jumped from 3,753 in 2023 to 120,700 in 2024, and reached 138,500 as of June 30, 2025. Against the backdrop of a temporary contraction in trading volume, both the number of registered and funded users on the platform expanded; the prospectus also disclosed that the platform’s client retention rate with assets is as high as99.9%.

In terms of equity, after listing, HashKey will be controlled by four parties as controlling shareholders: non-executive director Lu Weiding (referred to as “Mr. Lu” in the prospectus), GDZ International Limited, HashKey Fintech III, and Puxing Energy Limited (stock code: 00090). Mr. Lu also serves as chairman and actual controller of Wanxiang Group, which is one of China’s largest private auto parts suppliers.

Before the IPO, Mr. Lu holds 42.47% of HashKey’s shares through GDZ International, 0.7% through HashKey Fintech, and 0.02% through Puxing Energy Limited, for a total indirect control of about 43.19% of HashKey’s equity, and can exercise about 22.92% of the voting rights of the employee shareholding platform. In other words, the company’s controlling shareholders not only hold shares directly, but also indirectly lock in a considerable scale of voting rights through the employee shareholding platform, resulting in a highly concentrated control of the company.

In terms of client structure, the income share of the company’s top five clients quickly dropped from nearly 80% in 2022 to 18.5% in 2024, significantly reducing client concentration. However, early business was highly dependent on related parties; during the track record period, HashKey Fintech III, GDZ International Limited, and HashKey Fintech II were all among the company’s top five clients and were controlling shareholders or their affiliates.

On the supply side, Wanxiang Blockchain entities were among the top five suppliers in 2022, 2023, 2024, and the six months ended June 30, 2025, and are affiliates of one of the company’s shareholders. This means that in its early development, HashKey’s clients and suppliers were deeply tied to related parties, lacking a certain degree of independent commercialization capability.

3. Future Growth Story: Building a “Super App + Infrastructure Output”

According to the prospectus, HashKey’s future growth story is more about adding to the trading mainline, amplifying its existing matching business through a super app, infrastructure output, and self-built public chain.

On one hand, the company plans to build a SuperApp, gradually introducing more exchange products and services on top of its existing spot business, including derivatives, perpetual contracts, and tokenization and trading of stocks/bonds, to enhance market liquidity and expand exchange functions, enabling high-net-worth and institutional clients to complete more complex asset allocation and trading strategies on the same platform. Coupled with the planned launch of crypto bank cards and an institutional OTC marketplace, HashKey aims to lock users’ funds and trading needs within its own ecosystem as much as possible, increasing fund retention and turnover rates.

On the other hand, HashKey is packaging its compliance and technical capabilities for external infrastructure output. The company’s proposed Crypto-as-a-Service (CaaS) solution provides enterprise clients with a complete set of standardized tools such as API and smart contract protocols, allowing banks, brokers, or other platforms to directly access its matching, custody, and clearing capabilities. In theory, this can bring in technical service revenue and is also expected to introduce more institutional orders and trading volume, feeding back into the core matching business.

To support the above layout, HashKey has also launched a Layer 2 infrastructure for real-world assets (RWA)—the HashKey Chain, used to support asset on-chain and tokenized trading. As of September 30, 2025, the on-chain RWA scale was about HKD 1.7 billion. In the future, the company plans to monetize this infrastructure through Gas fees, staking, etc., while connecting on-chain assets with the trading platform to form a closed loop of “public chain + exchange + institutional services”, thereby adding a medium- to long-term growth curve for trading revenue.

4. Continuous Losses and Financial Leverage: Hidden Worries Behind Growth

Despite outstanding market share and revenue growth, HashKey’s financial statements also reveal structural challenges and potential risks faced during rapid expansion.

Profitability Dilemma and High-Cost Operations

In 2024, the company’s adjusted net loss expanded to HKD 545 million, mainly due to a significant increase in HSK token operating costs and expenses, rising from HKD 70.8 million in 2023 to HKD 177 million in 2024. In addition to HSK-related costs, the increasingly stringent regulatory environment, while constituting its competitive advantage, also brings high compliance costs. In the first half of 2025, the company’s compliance costs are estimated at about HKD 130 million, a rigid expenditure that is almost impossible to reduce in a complex, multi-jurisdiction regulatory environment.

It is worth mentioning that since the beginning of this year, the price of HSK tokens has experienced a significant decline. The company has promised to use 20% of net profit to repurchase and burn HSK on the market, but as the repurchase conditions have not yet been met, no repurchase was carried out during the reporting period. As of June 30, 2025, the HSK token usage rate was only 0.49%. This means that the vast majority of tokens have not yet been used for actual on-chain activities, and real on-chain demand is still at a very early exploratory stage. In other words, HSK currently appears more as a cost and burden in the financial statements, rather than a mature, profit-feeding ecosystem token.

High Debt and Financing Dependence

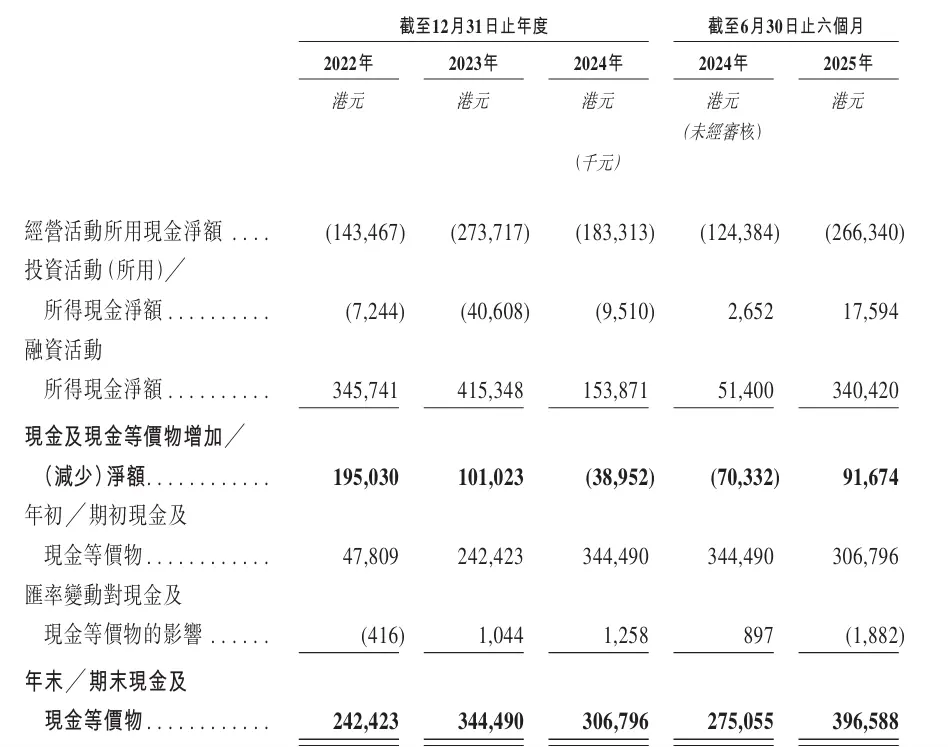

Looking at the cash flow statement, HashKey’s expansion is highly dependent on external funding. From 2022 to 2024, the net cash used in operating activities was approximately HKD 143 million, HKD 274 million, and HKD 183 million net outflow, respectively, with another HKD 266 million outflow in the first half of 2025. The main business has not yet achieved self-sustaining profitability. Correspondingly, there has been a continuous strong net cash inflow from financing activities: HKD 346 million, HKD 415 million, and HKD 154 million in 2022–2024, and as much as HKD 340 million in the six months ended June 30, 2025, mainly from the issuance of convertible bonds, preferred shares, and related party loans. As of June 30, 2025, the company’s net debt had risen to HKD 1.582 billion, with redeemable liabilities as high as HKD 1.725 billion, indicating that its business expansion remains highly dependent on external financing.

Business Highly Sensitive to Market Cycles, Gross Margin Continues to Decline

HashKey’s total revenue is highly correlated with platform trading volume, making its business extremely sensitive to digital asset price fluctuations and trading sentiment. Meanwhile, the company’s overall gross margin has continued to decline, from 97.2% in 2022 to 65.0% in the first half of 2025. The decline in gross margin is mainly due to the increasing proportion of trading facilitation service revenue, which has a relatively lower gross margin, thereby diluting overall profitability.

Conclusion

In terms of exchange valuations, Coinbase’s US stock market value is about $70 billions, Kraken’s latest valuation is about $20 billions, Upbit’s parent company is valued at $10.3 billions, and Gemini currently has a market value of about $1.16 billions. Placing HashKey on this valuation axis, it completed a round of strategic financing in February this year, with a valuation of about $1.5 billions.

Previous reports indicated that the HashKey IPO may plan to raise $500 millions, with an overall valuation expected to rise to about $2 billions. However, compliance dividends and high-growth narratives have pushed HashKey to the doorstep of the capital market, but whether it can obtain and maintain this valuation range in the future still depends on its fundamentals.

Passing the listing hearing is only the first step. Next, HashKey needs to complete post-hearing information disclosure, publish the prospectus, conduct public offering and international placement, book building and pricing, and other capital market processes. If all goes well, it usually takes several weeks before officially listing on the Hong Kong Stock Exchange.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

RootData launches exchange transparency evaluation system to promote new standards for information disclosure and compliance in the industry

Transparency has become the new battleground for compliance. RootData is joining forces with exchanges to build a trusted ecosystem, helping investors extend their lifecycle.

A well-known crypto KOL is embroiled in a "fraudulent donation scandal," accused of forging Hong Kong fire donation receipts, sparking a public outcry.

Using charity for false publicity is not unprecedented in the history of public figures.

Sample Cases of Crypto Losses: A Map of Wealth Traps from Exchange Runaways to Hacker Attacks