Ethena (ENA) is showing signs of reaching a crucial inflection point after another day of heavy selling pushed the token to the lower end of its multi-month range.

Key Takeaways:

- ENA is retesting a crucial support level.

- December 2 unlock may fuel volatility .

- High trading volume shows strong market interest.

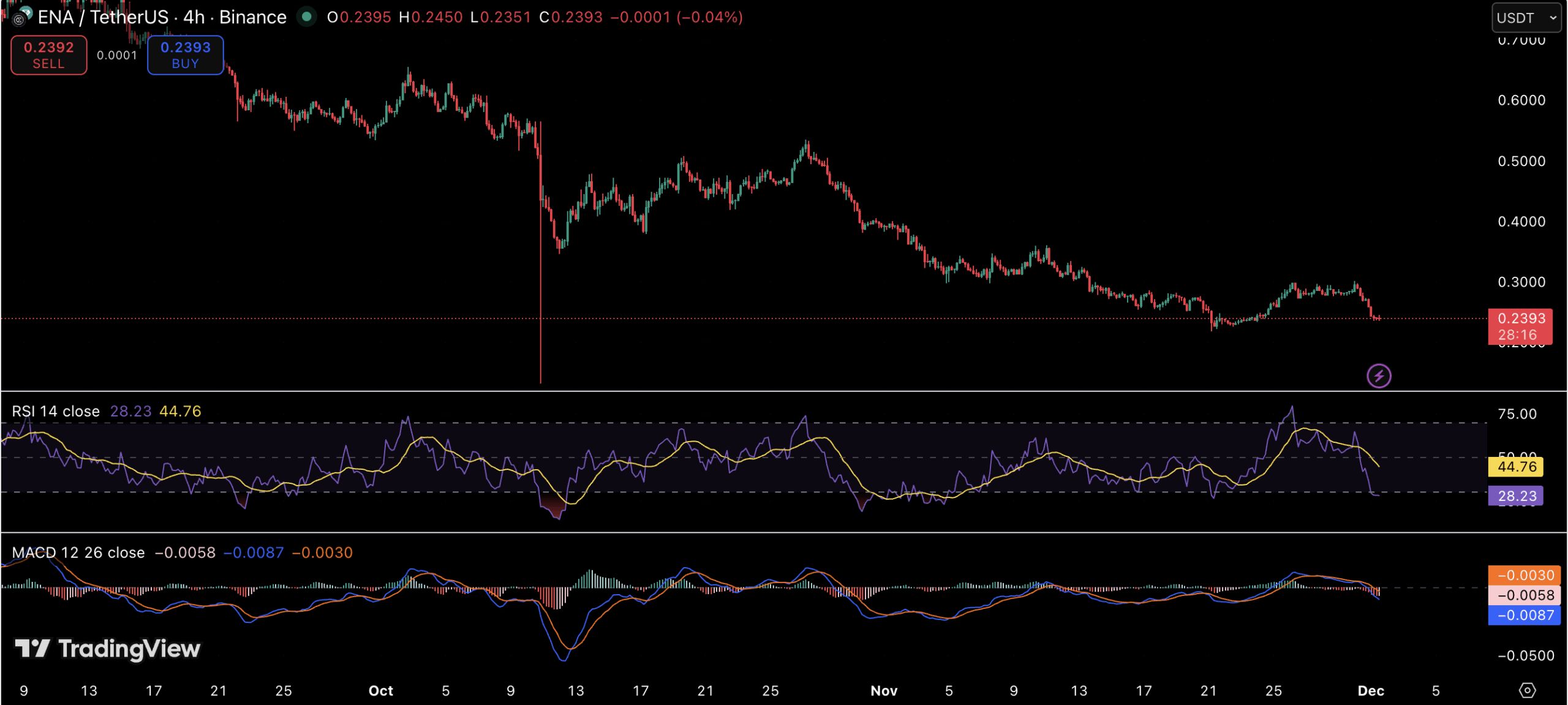

ENA is trading around $0.238, down nearly 14% in the last 24 hours, as traders brace for fresh supply entering the market.

Market analysts note that ENA is retesting the same support zone that previously triggered sharp reversals. If the level holds again, momentum traders believe the asset could stage a move back toward $0.50 in the coming weeks. Losing the support, however, could expose the chart to deeper losses.

Ethena $ENA is back at support. Holding this level could set up a move toward $0.50. pic.twitter.com/spH7M5fdy6

— Ali (@ali_charts) December 1, 2025

A Technical Turning Point Arrives

Multiple chartists highlight a repeating price pattern: every approach to the current support band has resulted in an aggressive bounce. The weekly structure remains bearish, yet a 2026 recovery path illustrated in some analyses outlines a potential W-shaped formation, provided demand strengthens at the current price floor.

On lower timeframes, the outlook is mixed. The RSI is hovering at 28, deep in oversold territory, which could entice dip-buyers. That optimism is tempered by the MACD trending downward, signaling that bearish pressure has not yet exhausted.

Unlock Event Intensifies Market Volatility

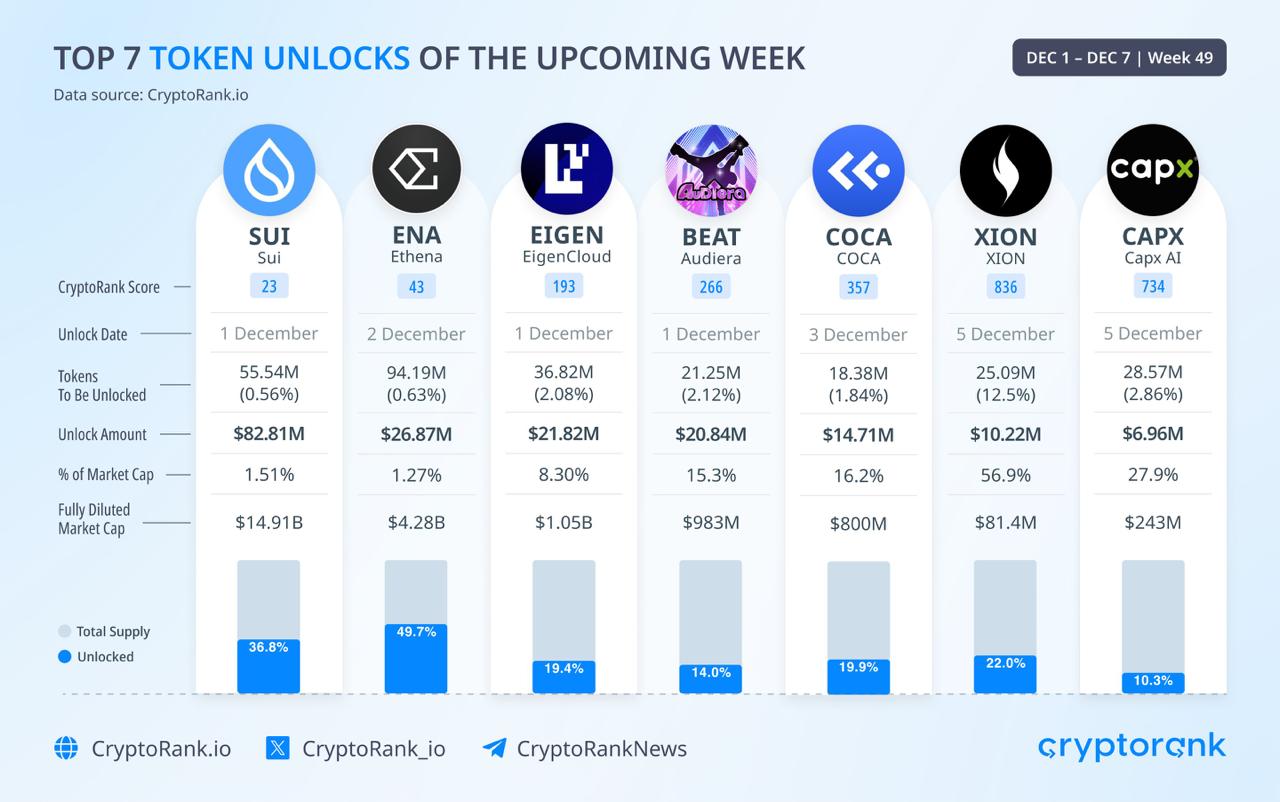

The caution among traders is amplified by a major supply expansion scheduled for December 2, when 94.19 million ENA tokens unlock. The release — worth roughly $26.87 million — accounts for 0.63% of ENA’s total supply. Nearly 50% of tokens are already circulating, meaning the unlock isn’t extreme but still large enough to influence short-term sentiment.

ENA ranks among the biggest unlocks of the week in the broader crypto market, alongside SUI, EigenCloud, and Audiera, all of which are expected to inject fresh supply into trading channels during the same period. As a result, short-term volatility remains elevated across the sector.

High Trading Activity Signals Strong Interest — Bulls or Bears?

Despite the price decline, market participation remains intense. ENA recorded $273 million in 24-hour trading volume, suggesting traders are positioning aggressively ahead of the unlock. Whether the order flow favors accumulation or exit liquidity will likely determine the token’s direction into early December.

If buyers defend the $0.23 range, analysts foresee a relief rally toward the $0.32–$0.37 region first, with $0.50 becoming a realistic target only if ENA breaks above resistance and maintains higher lows. But if the support collapses, technical structures point to a potential slide into the high-$0.10 zone.

Market Outlook

Ethena enters one of its most critical weeks of the year. The convergence of oversold indicators, a key historical support zone, and a large token unlock sets the stage for an explosive move — although the direction remains uncertain.

For now, all eyes are on whether the market decides to buy the dip or allow the selloff to deepen.