Chainlink ETF Eyes Imminent Debut —Will LINK Finally Break Its Slump?

Chainlink (LINK) is about to get its first-ever spot ETF as Grayscale’s GLNK begins trading on December 2 on NYSE Arca. However, after recent altcoin ETFs failed to lift prices, investors are left asking whether LINK will break the trend or become the next casualty of weak market sentiment. Grayscale Pushes Ahead With Third ETF

Chainlink (LINK) is about to get its first-ever spot ETF as Grayscale’s GLNK begins trading on December 2 on NYSE Arca.

However, after recent altcoin ETFs failed to lift prices, investors are left asking whether LINK will break the trend or become the next casualty of weak market sentiment.

Grayscale Pushes Ahead With Third ETF Launch in Two Weeks

The rollout marks Grayscale’s third ETF deployment in under 14 days, following GDOG and GXRP, with the Zcash (ZEC) ETF also in the pipeline.

It also reinforces the firm’s strategy of expanding beyond Bitcoin and Ethereum, targeting altcoins with strong institutional narratives.

Grayscale Chainlink Trust ETF (Ticker: $GLNK) offers investors direct exposure to $LINK. $GLNK starts trading on @NYSE Arca tomorrow.

— Grayscale (@Grayscale) December 2, 2025

The ticker for the prospective financial instrument is GLINK, with the notice already in.

Grayscale’s GLINK ETF.

Grayscale’s GLINK ETF.

However, the market backdrop is challenging as recent altcoin ETFs failed to life the prices of Solana and XRP.

Altcoin ETFs Are Not Rallying Prices—And Data Shows It

Despite initial excitement, recently launched altcoin ETFs have underperformed as market sentiment shifts to a risk-off stance.

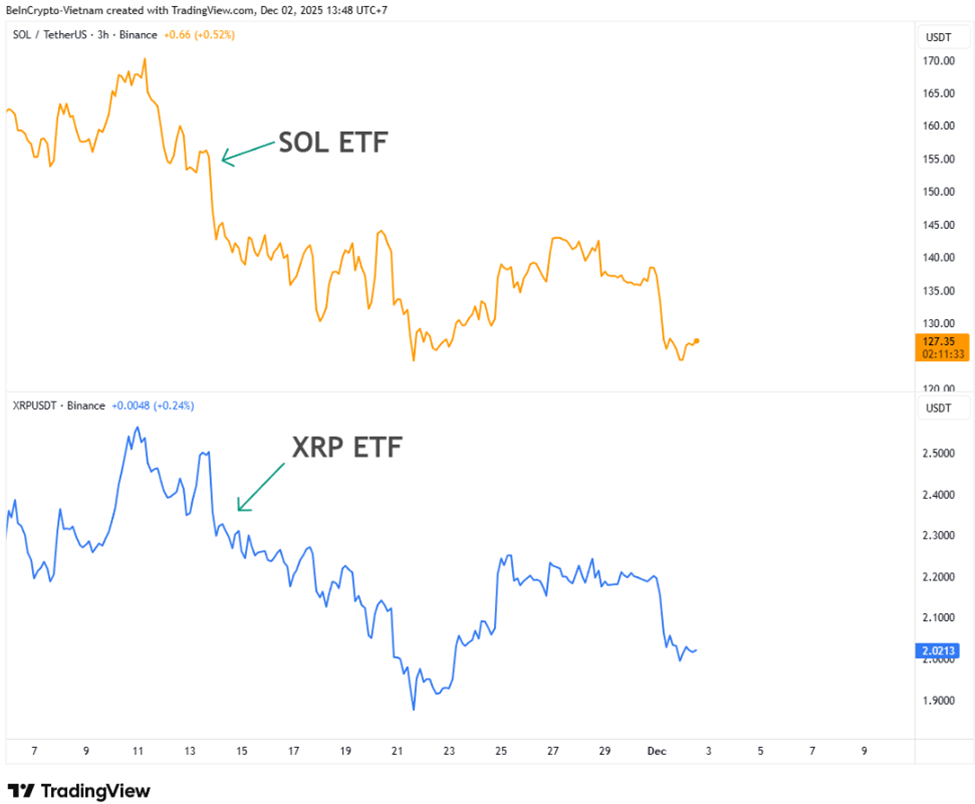

- The SOL ETF, launched November 13, is down 18%.

- The XRP ETF, launched November 14, is down over 10%.

Solana and XRP Price Performances Following Their Respective ETF Launches.

Solana and XRP Price Performances Following Their Respective ETF Launches.

The broader altcoin liquidity has weakened alongside fading ETF-driven inflows. This raises the key investor question: Will GLNK trigger a meaningful LINK price rally, or follow the same pattern of post-launch selloffs?

Chainlink (LINK) Price Performance.

Chainlink (LINK) Price Performance.

As of this writing, with only hours to the financial instrument’s debut, LINK was trading for $12.09, down by almost 1% in the last 24 hours.

Whale Accumulation Reveals Deep Losses Ahead of ETF Day

Meanwhile, Onchain Lens identified a major LINK whale who spent months accumulating the asset.

“A whale has been gradually accumulating LINK from OKX and Binance. Over the past 6 months, the whale has accumulated 2.33 million LINK for $38.86 million, currently valued at $28.38 million, facing a loss of $10.5 million,” they wrote.

The whale’s address, tracked via Nansen, highlights a significant unrealized loss heading into ETF debut day. Heavy underwater positions can increase the risk of short-term selling into any ETF-driven liquidity spike.

Yet not all signals are bearish.

Data from CryptoQuant shows that LINK’s circulating supply on exchanges just dropped to its lowest level since 2020.

LINK Supply on Exchanges.

LINK Supply on Exchanges.

Analysts note that every time this chart exhibits this behavior, the price does not remain low for long.

$LINK supply on exchanges just nuked to levels we haven’t seen since 2020.Every time this chart does this → price doesn’t stay cheap for long.Smart money has been quietly loading while CT argued about memes.If you know, you know.

— Ronnie M Green (@ronniemgreen) December 2, 2025

Historically, declining exchange balances have foreshadowed major Chainlink rallies, as reduced supply often tightens available liquidity during periods of high demand. The timing, just hours before GLNK launches, is notable.

Tomorrow’s Chainlink ETF debut creates a rare crossroad:

- Bearish forces: weak altcoin ETF performance, negative market sentiment, large underwater whale positions.

- Bullish forces: shrinking exchange supply, sustained long-term accumulation, and an upcoming influx of traditional-market exposure via GLNK.

For investors, the critical window will be the first 72 hours of ETF trading, when flows, volume, and sentiment will reveal whether GLNK is a catalyst, or simply another ETF launch overshadowed by macro pressure.

Either way, Chainlink enters this week as one of the most-watched altcoins in the market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DOGE rises 5.58% over 24 hours following Japan’s introduction of a reform unit focused on efficiency

- Japan launched its Department of Government Efficiency (DOGE) on Dec 2, 2025, to audit and eliminate inefficient tax breaks and subsidies. - The initiative, modeled on but distinct from the U.S. DOGE , emphasizes data-driven reviews and public feedback to redirect funds to priority areas. - Finance Minister Taro Aso stressed alignment with Bank of Japan's monetary policy and fiscal transparency, aiming to restore public trust amid economic challenges. - Reforms targeting outdated subsidies will begin in

LUNA drops 1.11% over the past month as market fluctuations persist

- LUNA rose 5.15% in 24 hours to $0.0712 but fell 1.11% monthly and 82.78% yearly. - Analysts highlight macroeconomic pressures, regulatory risks, and competition as key challenges for LUNA's long-term viability. - Recent market dynamics show mixed signals, with short-term stabilization contrasting ongoing bearish trends and uncertain recovery prospects. - Institutional adoption and structural improvements in scalability/governance are seen as critical for LUNA's potential market repositioning.

ZEC Rises 8.55% Over 24 Hours as Significant Short Covering and Position Flips Occur

- ZEC surged 8.55% in 24 hours to $346.59, but fell 23.78% in 7 days amid volatile swings. - A major ZEC short position turned $21M loss into $5M+ profit after price declines in late October. - The same address holds ETH and MON shorts, with ETH shorts generating $9.5M gains (643% profit). - ZEC's 1-year 563% rise contrasts recent declines, highlighting liquidity-driven market risks for leveraged positions. - Analysts remain cautious as short-term gains coexist with uncertain long-term volatility in crypto

ALGO Climbs 5.83% as Recent Gains Counteract Overall Downtrend

- ALGO surged 5.83% in 24 hours on Dec 2, 2025, but remains down 58.74% annually amid broader crypto market declines. - Short-term buying interest drove the rally, though analysts warn of continued volatility due to macroeconomic uncertainties. - The 24-hour rebound contrasts with a 4.37% seven-day loss, highlighting uneven recovery in the crypto sector. - Traders remain cautious as isolated buying pressure emerges, but long-term bearish trends persist despite temporary optimism.