- Grayscale has launched the first US spot LINK ETF today.

- HYPE rallies after Sonnet shareholders authorize Hyperliquid DAT’s merger.

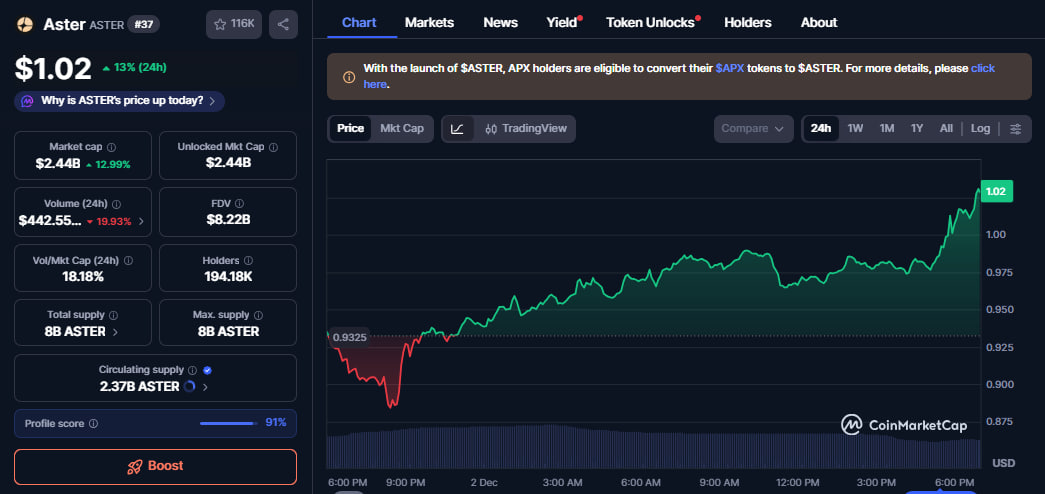

- ASTER gains more than 13% on a new collaboration with WLFI.

Cryptos rebounded on Tuesday as the value of all tokens increased by more than 6% to $3.06 trillion.

Bitcoin has reclaimed $90,000 as Ethereum trades above $3,000.

This article evaluates three altcoins, Chainlink, HYPE, and ASTER, that remained in the spotlight today for various reasons.

Grayscale’s spot Chainlink ETF goes live

Grayscale has officially converted its Chainlink Trust to an ETF today , introducing the first-ever US exchange-traded fund.

The debut has met considerable anticipation among the cryptocurrency community as many view Chainlink’s oracle infrastructure as crucial to tokenized real-world assets (RWA) and decentralized finance (DeFi).

Commenting on GLINK’s debut, Grayscale’s ETF official Inkoo Kand said :

Chainlink’s decentralized oracle network is setting the market standard for verifiable data and cross-chain connectivity that underpins tokenization and DeFi across public blockchains. With GLINK, investors can gain exposure to this foundational infrastructure in the familiar ETP wrapper.

Meanwhile, GLINK will simplify institutional access to Chainlink, allowing traditional investors to interact with crypto without directly handling the token.

LINK reacted positively to the ETF news, gaining more than 12% to trade at $13.32.

HYPE gains 10% after key milestone

HYPE soared more than 10% over the past 24 hours after Sonnet confirmed a crucial structural breakthrough.

According to today’s, December 2, press release , the company’s shareholders have approved the decision to introduce Hyperliquid Decentralized Autonomous Treasury (DAT).

Sonnet BioTherapeutics Holdings, Inc. Announces Stockholder Approval of Proposed Business Combination with Hyperliquid Strategies Inc

— Sonnet Bio (@SonnetBio) December 2, 2025

The plan involves Sonnet merging with Rorschach I LLC to form a unified entity called Hyperliquid Strategies.

Most importantly, the new firm plans to raise $1 billion to buy HYPE.

The massive bet signals unwavering institutional trust in the altcoin.

HYPE is hovering at $33.03 after gaining over 10% within the past 24 hours.

ASTER rallies after WLFI alliance

Aster’s native coin also recorded impressive price actions, gaining over 13% within the last 24 hours.

The upside momentum coincided with a strategic collaboration with Donald Trump-affiliated World Liberty Financial.

Aster founder and CEO Leonard announced the alliance at the fintech and crypto conference in Dubai.

Under this agreement, the decentralized exchange will integrate WLFI’s USD1 – a move designed to enrich the stablecoin’s adoption.

The altcoin is trading above the $1 psychological level after gaining over 13% on its daily price chart.

ASTER eyes further rallies, but declining 24-hour trading volumes highlight weakness.

Meanwhile, the broader crypto market remained elevated today, recovering from sharp dips in the past few sessions.

Bitcoin has gained over 7% on its daily price chart, while Ethereum increased by 10%.

Quantitative tightening ending and renewed ETFs interest fuel the current upside momentum.