Terra Luna Classic (LUNC) Soars 100% After Viral T-Shirt Moment in Dubai

Terra Luna Classic rallied almost 100% after CoinDesk journalist Ian Allison sparked viral attention by wearing a vintage Terra logo shirt at Binance Blockchain Week Dubai. The surge coincides with a Binance-backed network upgrade, burn activity, and renewed interest in Terra’s legacy ahead of Do Kwon’s sentencing.

Terra Luna Classic (LUNC) jumped nearly 100% today, after CoinDesk journalist Ian Allison appeared at Binance Blockchain Week Dubai wearing a vintage Terra Luna logo t-shirt while moderating interviews with executives from Mastercard, Ripple, and TON.

The image circulated across X and Telegram within hours, triggering discussion that the moment felt like a nostalgic revival of one of crypto’s most notorious altcoins.

Journalist Ian Allison Wearing a Terra Luna T-shirt at the Binance Blockchain Week in Dubai

Journalist Ian Allison Wearing a Terra Luna T-shirt at the Binance Blockchain Week in Dubai

Terra Luna Is Back? Not Quite

Traders had already been rotating into LUNC ahead of a scheduled network upgrade supported by Binance.

The exchange confirmed it would pause deposits and withdrawals during the upgrade, signalling strong operational backing from the world’s biggest trading venue.

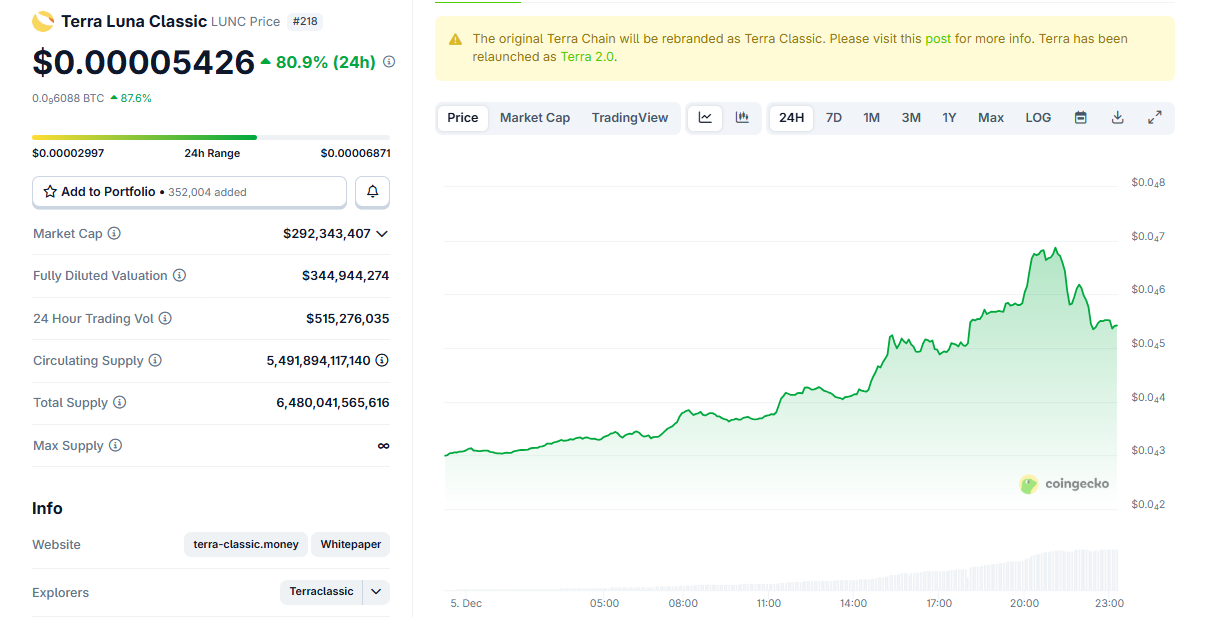

Terra Luna Classic (LUNC) Price Chart on December 5. Source:

CoinGecko

Terra Luna Classic (LUNC) Price Chart on December 5. Source:

CoinGecko

That announcement pushed volume sharply higher, setting the stage for fast speculative flows.

Token burn trackers reported aggressive supply reduction recently, including hundreds of millions of LUNC removed from circulation in the past week. Community messaging amplified the theme, reviving the idea of a shrinking float.

04 December 2025:Terra Classic $LUNC Max Supply: 6,480,742,753,204 Tokens Burned Previous Day: 83,945,886 (🔴-0.0013%)Terra Classic $LUNC Price: $0.00002834 (🟢+0.11%) pic.twitter.com/Gwppn0zHZH

— LUNC BURN UPDATE (@LuncBurnDaily) December 4, 2025

This narrative resurfaced at the same moment as Allison’s shirt went viral, reinforcing the perception of a coordinated cultural comeback.

The Do Kwon Effect

The rally also coincides with renewed attention on Do Kwon’s ongoing sentencing proceedings in the United States. Traders view developments toward legal conclusion as a potential reset point, allowing LUNC to trade like a legacy meme asset rather than a distressed one.

As volume spiked and spot markets tightened, the narrative gained traction quickly.

As expected, the DOJ wants a 12-year prison sentence for Do Kwon. Their sentencing submission suggests they don't buy Kwon's apologies, and they attack his attempts to evade blame and cast himself as a victim of Montenegrin officials. pic.twitter.com/Ub8MKk8iiP

— Alexander Osipovich (@aosipovich) December 5, 2025

Why the T-Shirt Moment Landed So Loudly

Terra’s collapse remains one of crypto’s most dramatic episodes, erasing billions in market value in 2022 and triggering regulatory crackdowns worldwide. Many in the industry still associate the logo with that moment — a symbol of excess, leverage, and systemic failure.

Seeing the design reappear on a main stage alongside established institutions added an unexpected emotional layer to the rally. It represented a strange throwback and also an emotional provocation.

$LUNC just went x2 and added 150 million to its market cap. Not because of some innovation, not because of fundamentals, but simply because a @IanAllison123 from CoinDesk wore a $LUNC t-shirt on camera. This is the reality of the market. People are not chasing technology,… pic.twitter.com/TpHeZwCWgm

— Cryptech Sam 𐤊 (@Cryptech_Sam) December 5, 2025

Terra’s Ghosts Are Still Here

Terra’s algorithmic stablecoin unraveled three years ago, triggering contagion that spread into lending platforms, hedge funds, and later exchanges. Millions of investors were left underwater, and it drove the biggest crypto winter to date.

Today’s rally simply shows that memory, speculation, and narrative still carry weight in crypto — sometimes more than fundamentals.

As LUNC surged, the sight of that shirt reminded markets how quickly sentiment can swing, even for a project once written off as irrecoverable.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Modern Monetary Theory and the Transformation of Crypto Markets: Fiscal Policy Stories in 2025

- Modern Monetary Theory (MMT) in 2025 reshaped crypto valuation frameworks, driving institutional adoption as 55% of hedge funds integrated digital assets amid clearer regulations like the U.S. CLARITY Act. - Fed rate cuts and MMT-aligned fiscal policies fueled Bitcoin’s 86.76% surge in late 2025, with firms like MicroStrategy and BlackRock leveraging crypto as a hedging tool against low-yield traditional assets. - CBDCs and regulated stablecoins gained traction under MMT, with 52% of hedge funds explorin

Ethereum tops 24-hour net inflows with $138.7M: Artemis

Robert Kiyosaki Says Ethereum Could Hit $60,000 by 2026

Quick Take Summary is AI generated, newsroom reviewed. Robert Kiyosaki predicts Ethereum will hit $60,000 by 2026. ETF approvals and the Dencun upgrade strengthen the bullish case. ETH trades near $3,037, implying a potential 20x surge. Critics cite Kiyosaki’s past overly optimistic predictions.References X Post Reference

XRP ETFs Hit a Massive 15-Day Inflow Streak

Quick Take Summary is AI generated, newsroom reviewed. U.S. spot XRP ETFs logged 15 straight days of net inflows. Total XRP ETF assets now approach $900 million. XRP traded at $2.02, down 7.9%, even as inflows rose. Institutional buyers continue to accumulate via OTC channels.References X Post Reference