Fartcoin price prediction: Momentum builds, but breakout pending

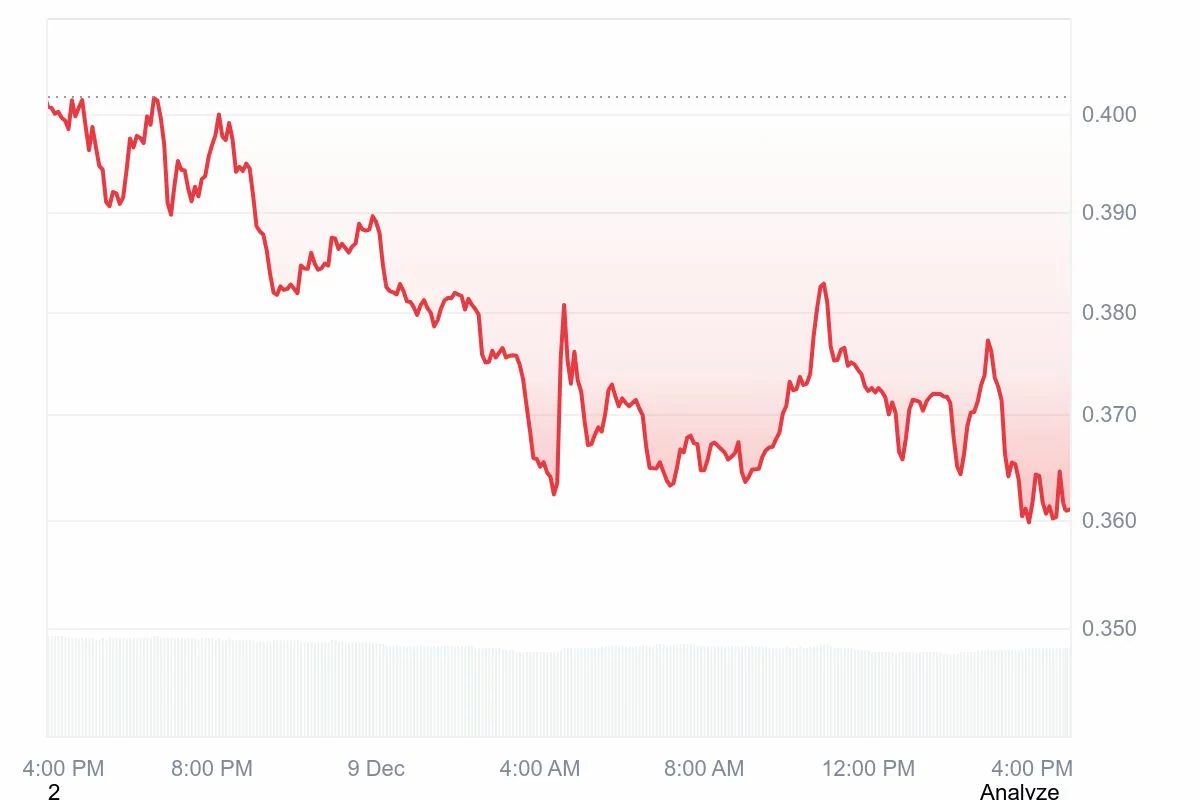

The Fartcoin price has been stuck in a narrow range today, trading between $0.3619 and $0.4035. It’s currently sitting at $0.3616 — more than a 10% drop for the day. Even so, the overall trend hasn’t broken, since Fartcoin is still up 4.3% this week and nearly 15% for the month. What we’re seeing is basically dips being bought while short-term traders take profits at the top.

So, with all that going on, let’s break down the chart and see what the Fartcoin price prediction could be in the short term.

Table of Contents

- Current market scenario

- Upside outlook

- Downside risks

- Fartcoin price prediction based on current levels

- Fartcoin is trading in a narrow range between $0.36 and $0.40, with support holding around $0.36–$0.37.

- Short-term dips are being bought while traders take profits at resistance, keeping the overall weekly and monthly trend positive.

- A breakout above $0.40–$0.42 could trigger a stronger bullish move toward $0.45.

- A drop below $0.36 could lead to a correction toward $0.32–$0.30.

- The market is at a key decision point, with buyers currently in control but no decisive breakout yet.

Current market scenario

Fartcoin ($FARTCOIN) is managing to protect its $0.36–$0.37 support zone, and every dip into that area has sparked a nice recovery, showing buyers are still active. But higher resistance levels continue to push the price back down, which means the bulls aren’t totally dominating yet.

The price is basically getting squeezed between support and resistance, and that kind of compression usually leads to a strong breakout. The side that wins this battle will set the tone for the Fartcoin outlook.

Upside outlook

From a bullish perspective, things still look pretty promising. As long as the $0.36–$0.37 support holds, the price has space to gather momentum for another upward move. If buyers step up and take back the short-term moving averages, the next target is $0.40–$0.42 — a resistance zone Fartcoin has hit trouble with before.

A solid daily close above that zone would flip sentiment in a big way and support a stronger Fartcoin forecast. With hype building across social platforms and memecoin money moving around, bulls have a realistic chance of heading back to those levels soon.

Downside risks

Even so, sellers still carry some weight here. A clean break below $0.36 would undermine the current support setup and open the door for a deeper correction. If that happens, the price may drift back toward the $0.30 imbalance area that’s still waiting to be filled.

Hitting that zone could shake out the weaker hands and trigger stop-losses, pushing volatility up. It’s a secondary scenario for now, but still worth keeping an eye on — especially if the broader crypto market weakens or Bitcoin drops sharply.

Fartcoin price prediction based on current levels

Considering the recent swings, Fartcoin is sitting at an important decision point. Either direction is still possible.

Bullish scenario: If buyers lift the price above $0.39, targets at $0.42 and possibly $0.45 open up, matching an optimistic Fartcoin price prediction.

Bearish scenario: Losing $0.36 would hand control to sellers, likely dragging the price toward $0.32 or $0.30.

Bulls are in charge for the time being, but a decisive breakout hasn’t happened yet.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Growing Influence of Artificial Intelligence on Universities and Preparing Tomorrow’s Workforce

- AI integration in higher education drives academic program expansion, with 2.5% undergraduate and 3% graduate enrollment growth in 2024. - Universities invest $33.9B in generative AI to modernize curricula and partner with industries , addressing 58% workforce readiness gaps. - AI-driven tools boost student retention (52% adoption) and project 1.5% U.S. GDP growth by 2035 through automation in key sectors. - Challenges persist: 71% academic integrity concerns and 52% training gaps highlight risks in AI a

The CFTC-Sanctioned Transformation in Clean Energy Trading

- CFTC's 2025 withdrawal of carbon credit derivatives guidance creates regulatory uncertainty but sparks innovation in blockchain/AI solutions. - OBBBA's 2026 construction deadline accelerates solar/wind project cancellations while preserving tax credit transferability mechanisms. - Battery storage, geothermal, and hydrogen emerge as resilient sectors amid market shifts, supported by IRA tax credits and OZ modernization. - Investors prioritizing domestic supply chains and third-party certified projects gai

Aligning university programs with new technology sectors to pinpoint areas with strong investment potential

- Higher education is redefining curricula to align with AI, quantum computing, green energy, and biotech sectors, addressing urgent talent gaps. - Green energy apprenticeships (e.g., ACE Network) and biotech-AI hybrid training programs are scaling rapidly to meet workforce demands. - Quantum computing initiatives like Connecticut's $1B QuantumCT plan highlight trillion-dollar investment potential in talent development and infrastructure. - AI ethics integration and edtech platforms for real-time labor mar

Tight Range Emerges: PEPE Trades at $0.054368 With 4.1% Weekly Decline and Key Levels in Focus