What Is BONK and Why Pump.fun Fueled the BONK Price Surge

BONK recorded an impressive 82% rally in the past two weeks, with prices now trading at $0.00003424 and daily volumes consistently topping $1 billion. This climb is not just a meme-driven jump: the structural shift in the meme coin landscape, particularly the stunning reversal against Pump.fun, has made BONK and the BonkFun ecosystem central to Solana’s renewed DeFi growth. This article explores what is bonk, why it flipped Pump.fun, the latest bonk price rally fundamentals, and future projections every prospective investor should know.

Source: CoinMarketCap

What is BONK, and Why It Flipped Pump.fun

BONK originated in late 2022 as Solana’s first community-driven meme coin, launching with strong grassroots support and rapidly establishing itself as a Solana mainstay. However, what is bonk today goes far beyond its initial joke currency status. As the key asset of the letsbonk movement, BONK sits at the center of a growing ecosystem: products like BONKSwap and especially BonkFun have become powerhouses that boost bonk price and utility.

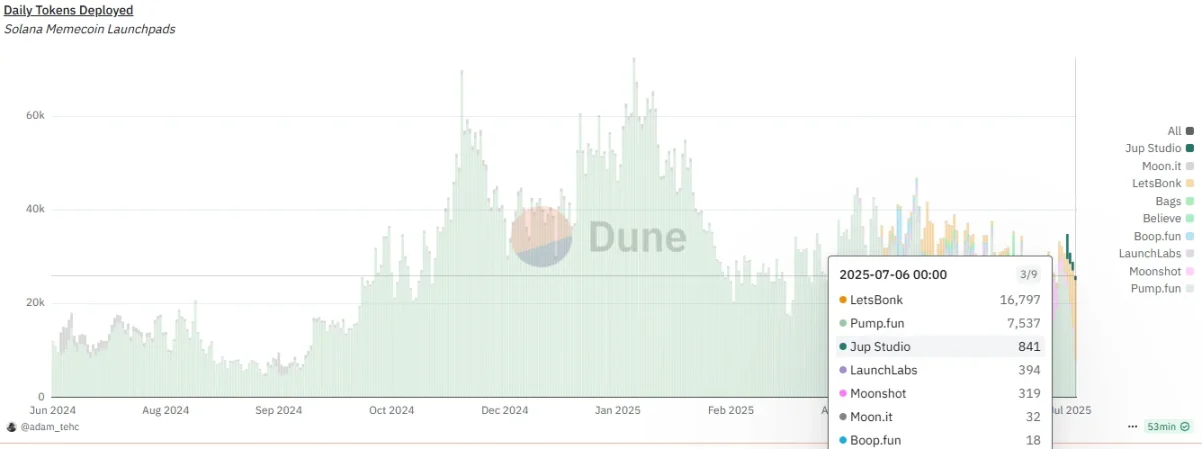

In early 2025, the meme coin sector’s attention pivoted to pump.fun, a token factory dApp that enabled rapid meme coin launches on Solana. While the market feared that pump.fun’s imminent token generation event (TGE) would drain liquidity from major coins like bonk, the outcome proved different. BonkFun, an ecosystem product directly interlinked with letsbonk, not only resisted TGE outflows but decisively flipped the narrative, outshining pump.fun at its own game.

Source: Dune

BonkFun’s breakthrough fee model recycles 58% of all trading fees into buying and burning BONK, generating relentless buy pressure. Additionally, 15% of fees are staked in SOL on validator nodes, contributing to Solana’s network strength while easing SOL sell pressure. This “bonkwheel” or “bonkcycle” ensures the ecosystem feeds back into BONK’s price support, creating a positive cycle for investors and speculators alike. In comparison, pump.fun’s unclear tokenomics and so-called “predatory” SOL selling model have made BONK—and the letsbonk community—the clear favorites for value-driven meme coin exposure. As BonkFun continued its dominance throughout pump.fun’s own TGE, even industry analysts now refer to BONK as structurally undervalued, with the real upside play shifting to Bonk and the broader letsbonk ecosystem.

How Pump.fun’s TGE Fueled Bonk Price and Letsbonk Growth

The approach of the pump.fun TGE was expected to threaten bonk price by attracting speculative capital to the $PUMP launch. Instead, BonkFun’s robust ecosystem design led to increased attention and capital inflow into bonk. Thanks to its direct integration with letsbonk and the feedback loop from constantly buying and burning BONK, BonkFun created a self-reinforcing cycle that not only preserved, but amplified, bonk price and its community’s dominance.

Pump.fun’s business model—marked by large-scale $SOL sales—was increasingly contrasted to BonkFun’s community-centric approach, making bonk price less vulnerable to major outflows. Instead, as BonkFun hit its stride, its ongoing buybacks and burns drove bonk to outperform, outperforming early pump.fun forecasts. Recent data shows BonkFun continues to command the majority of meme trading activity within Solana, making it a central value driver for bonk and the letsbonk trend alike.

Bonk Price Catalysts: ETF Buzz, Technical Breakout, and Record Volumes

One of the most significant drivers behind the recent bonk price rally is the ongoing buzz around a prospective Solana ETF, including speculation about a 2x leveraged ETF listing. This heightened institutional interest has been a clear tailwind for Solana ecosystem coins, and bonk directly benefits from this positive sentiment. As more traditional finance players eye Solana, the visibility and credibility of bonk and letsbonk only continues to increase, attracting new investors and sustaining bonk price momentum.

Additionally, bonk broke through key resistance levels this week, igniting technical momentum across trading desks. The move has set up bonk price targets around $0.000041—levels not seen in months—and renewed trading enthusiasm within the letsbonk community. This technical breakout, coupled with the fundamental ecosystem expansion, signals strong potential for additional bonk upside.

What’s more, bonk’s sustained above-average daily trading volume—consistently exceeding $1 billion—demonstrates robust organic demand and healthy market liquidity. This high-volume environment is a hallmark of both strong price support and investor confidence, key ingredients for continued bonk price appreciation over the coming weeks.

Bonk Price Outlook and Investment Takeaways

With the bonk price currently tracking strong technicals and enjoying structural buy pressure from letsbonk ecosystem products like BonkFun, short-term and medium-term prospects look promising. As Solana’s overall momentum is reinforced by ETF discussions and institutional flows, bonk remains the top meme coin story. However, investors should be mindful of rapid sentiment shifts typical in the meme sector. Proactive risk management is essential, as are frequent reviews of volume trends and ecosystem headlines tied to bonk, letsbonk, and pump.fun.

Conclusion: Why BONK and Letsbonk Lead Post-Pump.fun

BONK has become the face of Solana meme coins, not just through hype, but by building a sustainable and value-driven ecosystem. As pump.fun excitement fades and BonkFun’s flywheel spins faster, bonk price benefits from both organic demand and well-architected utility. For those seeking exposure to the next phase of Solana’s meme coin boom, following the letsbonk community—and monitoring bonk price and the evolution of the BonkFun ecosystem—may offer the best risk-reward in this rapidly evolving sector.