What Is Toncoin (TON)? The Blockchain Behind Telegram’s Web3 Vision

When most cryptocurrencies struggle to find real users, Toncoin (TON) has an advantage many projects can only dream of: direct integration with Telegram, one of the world’s most popular messaging apps. Imagine a blockchain that could instantly connect with nearly a billion people worldwide, powering payments, applications, and digital ownership inside the very platform where millions of crypto conversations already happen every day. That is the vision behind TON.

Born from Telegram’s ambition to bring Web3 to the masses, Toncoin is not just another Layer-1 token. It is the fuel for a blockchain ecosystem designed to be fast, scalable, and user-friendly enough to blend into everyday chat experiences. For investors, TON represents a rare intersection of strong technology, trusted branding, and the potential for mass adoption on a global scale.

What Is Toncoin (TON)?

Toncoin is the native cryptocurrency of The Open Network (TON), a Layer-1 blockchain designed to deliver speed, scalability, and ease of use. The project was originally introduced by Telegram in 2018 under the name Telegram Open Network, with the ambition of bringing blockchain technology directly to its massive global user base. After regulatory challenges forced Telegram to step back, the community continued its development under the rebranded name The Open Network.

Unlike many blockchains that struggle to find a real user base, TON benefits from its close connection to Telegram, one of the world’s most popular messaging platforms. This link positions Toncoin as more than just a cryptocurrency; it is a gateway to blockchain adoption on a scale that could reach hundreds of millions of people.

Within the ecosystem, Toncoin plays multiple roles. It is used to pay transaction fees, secure the network through staking, enable governance, and power smart contracts and decentralized applications. The long-term vision is to make blockchain features feel as seamless as everyday chat functions—sending Toncoin could one day be as easy as sending a sticker in Telegram.

How Toncoin Works

The Open Network is built to solve one of the biggest problems in blockchain: scalability. Most blockchains struggle with congestion and high fees as they grow, but TON was designed from the ground up to process massive amounts of activity without slowing down. It achieves this through a unique architecture that adapts to demand in real time.

● Dynamic Sharding: The blockchain can split into smaller “shards” that process transactions in parallel, then seamlessly reconnect. This allows TON to handle millions of transactions per second.

● Low Fees and Fast Settlements: Transfers cost only fractions of a cent and settle in seconds, making Toncoin practical for everyday use and micropayments.

● Validator System: Validators secure the network by verifying transactions, earning Toncoin rewards for their role.

● Governance: Toncoin holders can vote on network upgrades and changes, giving the community a voice in its evolution.

● Smart Contracts and dApps: Developers can build decentralized applications, marketplaces, and financial tools powered by Toncoin.

With wallets and dApps being developed for direct use inside the messaging app, sending Toncoin could one day be as natural as sharing a photo or a sticker. This combination of speed, low cost, and real-world accessibility positions Toncoin as a strong contender in the Web3 race.

The Story Behind Toncoin

Toncoin’s story began in 2018 as the Telegram Open Network (TON), an ambitious project by Telegram’s founders, Pavel and Nikolai Durov. Telegram raised around $1.7 billion through private token sales (the “Gram” ICO) to fund the development of a new blockchain that would support payments, apps, and decentralized services.

Regulatory hurdles quickly disrupted these plans. In late 2019, the U.S. SEC sued Telegram, claiming the Gram token sale was an unregistered securities offering. By 2020, Telegram agreed to shut down the project, refund investors, and open-source the code. The Gram token was never launched.

From there, the community took over. Two developer groups emerged:

● TON Labs created a fork called Free TON (later rebranded as Everscale ).

● Another group built directly on Telegram’s original code, making minimal changes.

In 2021, this second group founded the TON Foundation in Switzerland and relaunched the blockchain as The Open Network. They renamed the token from Gram to Toncoin and launched the mainnet in May 2021. Since then, TON has grown as a fully independent project, with Telegram’s founders no longer directly involved.

Today, the TON Foundation guides development while the ecosystem expands with features like TON DNS (decentralized .ton domains) and TON Storage (a blockchain-based file storage layer). Meanwhile, Telegram has acknowledged TON by enabling Toncoin payments and supporting mini-apps, creating new opportunities for Web3 adoption among its huge global user base.

Use Cases of Toncoin

Toncoin is designed to power a broad ecosystem within The Open Network (TON) and its integration with Telegram. Its use cases go beyond payments, extending into services that make the blockchain a full-fledged Web3 platform.

Key Use Cases:

● Transactions & Payments: Fast, low-cost peer-to-peer transfers across the TON blockchain and directly inside Telegram wallets.

● Decentralized Applications (dApps): Developers can build and deploy smart contracts, games, DeFi protocols, and other apps on TON.

● TON DNS: A decentralized domain service that lets users replace long wallet addresses with simple names like alice.ton.

● TON Storage: A decentralized file storage solution, similar to IPFS, for hosting and sharing data securely.

● Staking & Validation: Users can stake Toncoin to help secure the network and earn rewards by supporting validators.

● Cross-Border Payments: With Telegram’s massive global reach, Toncoin could become a tool for remittances and international transfers.

● NFTs & Digital Assets: TON supports the creation and trading of NFTs , digital collectibles, and tokenized assets.

● Telegram Mini-Apps & Web3 Integration: Businesses and developers can integrate Toncoin into mini-apps inside Telegram, enabling seamless payments and new user experiences.

Toncoin powers Telegram’s Web3 ecosystem, turning everyday chats into opportunities for payments, apps, and digital interactions.

Toncoin (TON) Price Prediction for 2025, 2026–2030

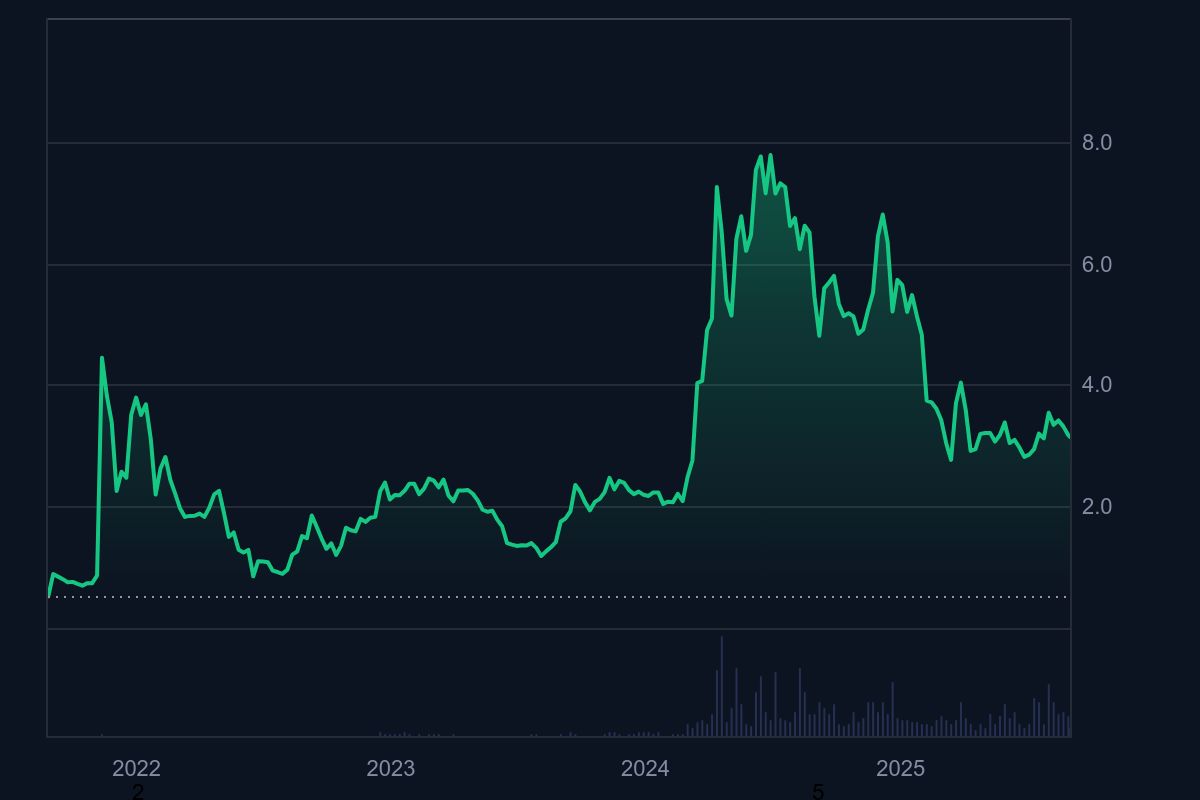

Toncoin (TON) Price

Source: CoinMarketCap

As of this writing, Toncoin (TON) is trading at approximately $3.13, reflecting its current market position and investor sentiment.

● 2025: Toncoin could range from $3 to $7 depending on adoption and ecosystem growth. In a bullish scenario, it might reach up to $12 if Telegram mini-apps gain traction.

● 2026: Continued integration of dApps and mini-apps could push Toncoin to $8–$15. Increased user engagement and ecosystem expansion will be key drivers.

● 2027: With broader DeFi adoption and more active users, Toncoin may rise to $12–$20. Partnerships and platform updates could further boost its value.

● 2028: Wider adoption and expanded services could lift Toncoin to $18–$30. Growth in decentralized applications and digital payments will support this trend.

● 2029: Mass adoption across Telegram and external integrations could take Toncoin to $25–$40. The token’s value will be increasingly tied to real-world usage.

● 2030: In a highly optimistic scenario, Toncoin could reach $30–$50. A fully developed ecosystem and global user engagement would be necessary to achieve this.

Factors that could influence Toncoin’s price include:

● User Adoption: The more Telegram users transact in Toncoin, the greater the network effect and demand.

● Ecosystem Expansion: Growth of dApps, NFTs, and mini-apps could increase Toncoin usage.

● Institutional Investment: Partnerships and capital inflows could stabilize and boost market confidence.

● Market Volatility: Crypto markets are inherently volatile, and Toncoin’s price can fluctuate with broader trends.

While short-term price movement may be modest, Toncoin’s long-term growth largely depends on real-world adoption and how effectively Telegram integrates blockchain features into everyday use.

Can TON Hit $100?

Reaching a $100 price for Toncoin (TON) would require significant adoption and deep integration across Telegram’s massive user base. For Toncoin to reach $100, it would need to become a primary medium for payments, decentralized applications, and digital services within Telegram.

Several factors would influence this potential. Mass adoption within the Telegram ecosystem would drive demand, while expansion of decentralized applications, DeFi platforms, and NFTs could increase Toncoin’s utility and value. Institutional investment and partnerships with major financial entities could boost credibility and liquidity, and broader cryptocurrency market trends would also affect price growth.

Even with strong adoption, reaching $100 per Toncoin is considered highly optimistic by most analysts, as it would imply a market capitalization comparable to top-tier cryptocurrencies like Bitcoin or Ethereum . While technically possible, achieving this would require sustained ecosystem growth, continuous innovation, and widespread user engagement over many years. Toncoin’s long-term potential ultimately depends on its real-world adoption and Telegram’s ability to integrate blockchain seamlessly into everyday communication.

Conclusion

Toncoin (TON) represents a unique intersection of blockchain technology and a global messaging platform. With fast transactions, low fees, and a scalable ecosystem for decentralized applications, TON is shaping the way millions of users could interact with Web3 in their everyday chats.

The big question remains. Could TON become a dominant digital currency within Telegram’s global user base or even reshape how we think about payments and digital services? For investors and crypto enthusiasts alike, Toncoin is a project to watch closely, as its next moves could reveal the future of mainstream blockchain adoption.

Follow Bitget X Now & Win 1 BTC – Don’t Miss Out!

Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.