News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

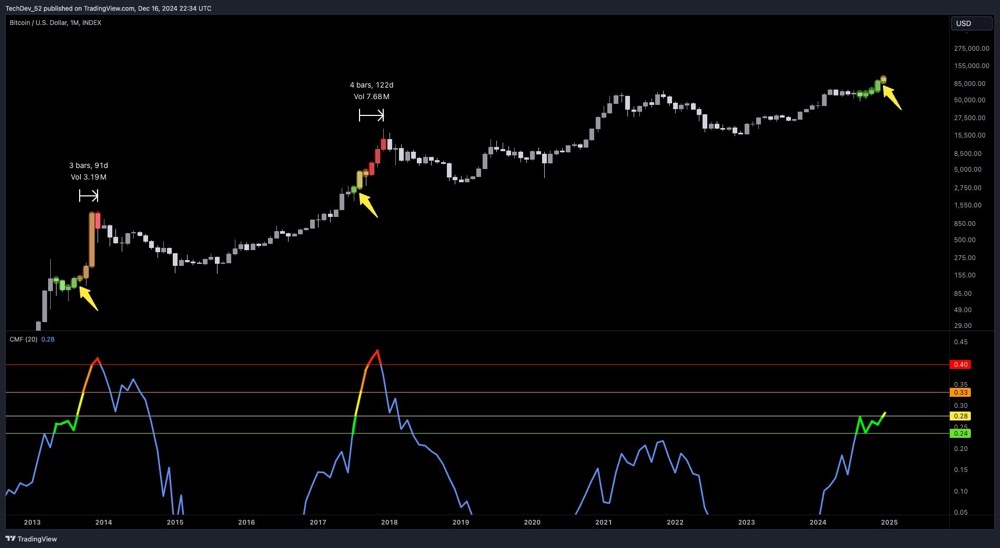

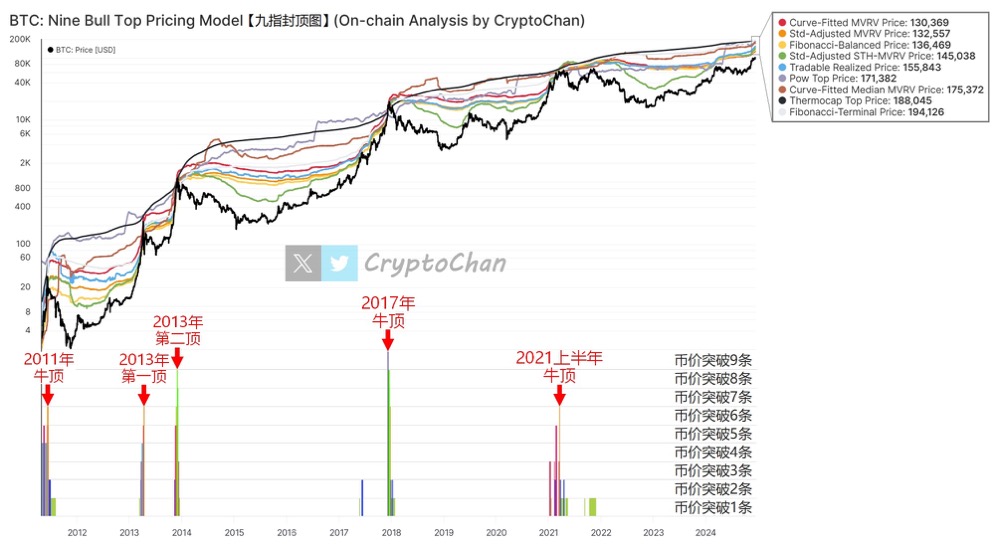

Bitcoin's key signal flashes: historical data suggests a sharp rise in 3-4 months

TechDev·2024/12/17 09:59

Analysis of $arc: Is it hype or a revolution in AI infrastructure based on Rust

西格玛学长·2024/12/16 09:36

Flash

17:51

Spot gold breaks through a historical high of $4,900 per ounceOn January 23, the spot gold price surged strongly past $4,900 per ounce, rebounding nearly $130 from the day's low. Since the beginning of this month, spot gold has risen by about $600, an increase of 13%.

17:22

World Liberty Financial partners with Spacecoin to advance satellite-supported DeFi projectWorld Liberty Financial has reached a partnership with Spacecoin. Spacecoin plans to provide permissionless internet access through a satellite constellation, aiming to cover remote and underserved communities.

17:02

Data: A total of 60,000 addresses have claimed the SKR token, with an average airdrop amount of $1400.BlockBeats News, January 23rd, Bubblemaps data reveal that since the launch of the Solana Mobile token SKR, a total of 60,000 wallet addresses have claimed a token worth $70 million, with an average airdrop amount of $1,400.

News