News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Near blessing, AI-driven, a glimpse of SenderAI's future prospects

远山洞见·2024/11/25 09:40

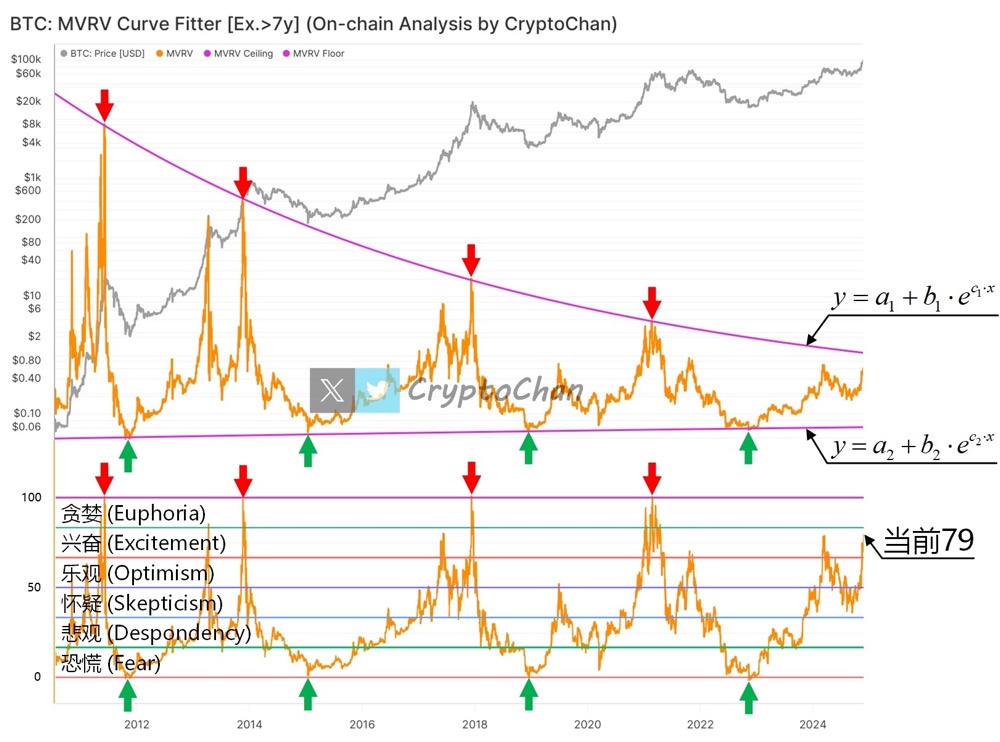

Precision tool for identifying market bottoms? Bitcoin MVRV indicator reappears, currently scoring 79

CryptoChan·2024/11/25 07:16

Zircuit Launches ZRC Token – Pioneering the Next Era of Decentralised Finance

Daily Hodl·2024/11/25 07:08

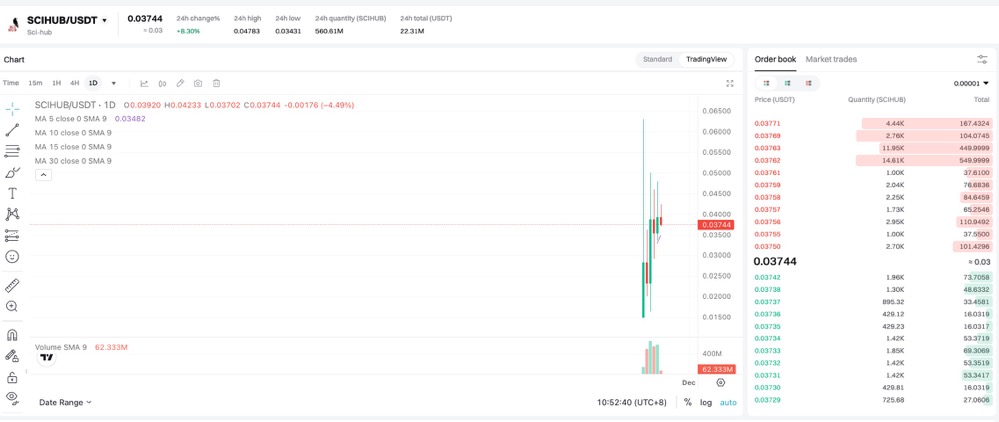

CryptoRock: Why I'm All in $scihub - Confessions of a Rebellious Hacker

推特观点精选·2024/11/23 03:09

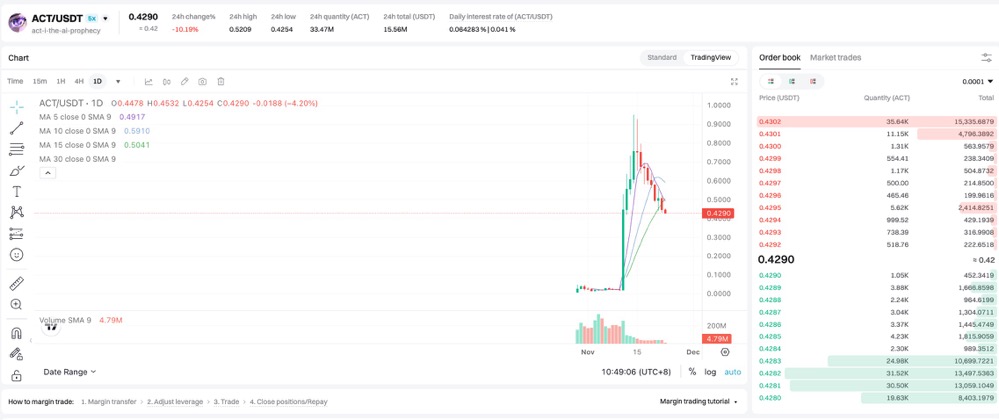

Meta Gorgonite: Why the potential of $ACT is far from exhausted

推特观点精选·2024/11/23 02:50

Zeus: Robust fundamentals of Aptos - Stripe and Circle support, promising future

Twitter Opinion Selection·2024/11/23 02:44

Yuyue: A Detailed Explanation of the Origin and New Narrative Leader of DeSci + Meme $RIF

推特观点精选·2024/11/23 02:43

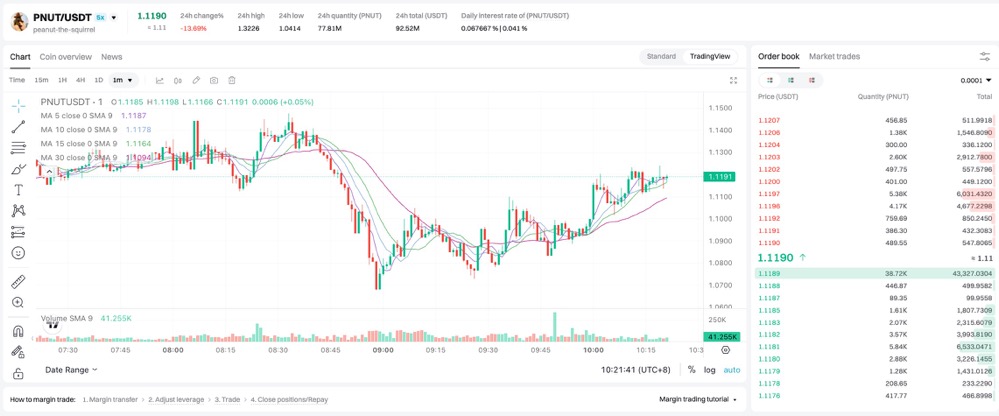

Sun and Moon Xiao Chu: Why do I continue to increase positions during the pullback of $PNUT and $ACT

Twitter Opinion Selection·2024/11/23 02:24

Flash

06:32

The address that profited millions of dollars from DONT is highly associated with DeFi Dev Corp, raising suspicions of insider trading.BlockBeats News, January 23, Kairos Research co-founder @Ian_Unsworth posted that the address starting with "z5m3Ja" bought DONT tokens during the internal trading phase and then sold them in batches, making a cumulative profit of nearly one million dollars. However, the funding source address of this address holds 30,000 DeFi Dev Corp's LST tokens. Furthermore, the next-level funding source address has a large amount of direct activity with the DeFi Dev Corp validator node and was the first address to send funds to the DeFi Dev Corp validator identity address. Based on this, Ian questioned whether there is insider holding suspicion regarding the DONT token.

06:27

"DASH's largest short" continues to reduce long positions in ETH and SOL, with an unrealized profit of $4 million in the accountBlockBeats News, January 23, according to HyperInsight monitoring, the "largest DASH short" whale (0x94d37) has started to continuously reduce long positions in ETH and SOL. Currently, they are still holding a 15x leveraged long position of 84,005.745 ETH, with an average entry price of $2,943.74 and an unrealized profit of $2.31 million; and a 20x leveraged long position of 534,596.6 SOL, with an average entry price of $127.63 and an unrealized profit of $680,000. In addition, this address is still the largest holder of DASH short positions on Hyperliquid, holding a 5x leveraged short position of 112,150.15 DASH.

06:27

PwC: Cryptocurrency Adoption Is "Unevenly Developed Across Different Regions"Jinse Finance reported that accounting firm PwC stated that the adoption speed of cryptocurrencies varies across the globe, with some regions developing much faster than others. In its "2026 Global Crypto Regulation Report," PwC pointed out: "Although crypto networks have no borders, their applications do. Use cases such as payments, remittances, savings, capital markets, and tokenization are developing unevenly in different regions." PwC stated that the adoption of cryptocurrencies still depends on economic conditions, financial inclusion, and existing financial infrastructure, resulting in a "fragmented" global ecosystem, and this technology is solving "completely different problems" in different markets.

News