News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Market Research and Analysis of Layer1 Public Chain QUBIC

Bitget·2024/07/01 06:19

Layer3 Foundation: Introducing $L3

Layer3 Foundation·2024/06/29 07:13

An interesting research analysis of the SCRAT market

Bitget·2024/06/29 06:58

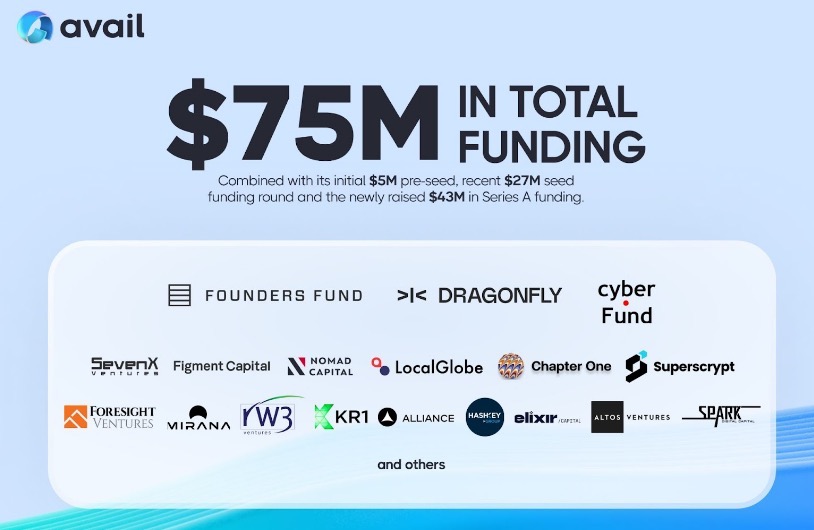

Modularization blockchain Avail market research analysis

Bitget·2024/06/28 10:11

Popular Bobo market research analysis

Bitget·2024/06/28 09:54

10 Reasons Why Bitcoin Could Fall to $55,000

Institutional Crypto Research Written by Experts

10xResearch·2024/06/28 07:00

BLASTUSDT is Now Available on Futures

Bitget launched BLASTUSDT futures on June 27, 2024 (UTC) with a maximum leverage of 50. Welcome to try futures trading via our official website (www.bitget.com) or Bitget APP. BLASTUSDT-M perpetual futures: Parameters Details Listing time June 27, 2024 12:00 (UTC) Underlying asset BLAST Settlement

Bitget Announcement·2024/06/27 12:00

SWGT: Creating blockchain scenarios between personal life and work

0x76·2024/06/27 11:14

Flash

14:07

DDC Enterprise increases its holdings by 200 BTC, bringing the total to 1,583 BTCDDC Enterprise purchased 200 bitcoin, bringing its total holdings to 1,583 BTC. (Cointelegraph)

14:05

Paradex Incident Investigation Report: Abnormal Liquidation Caused by Database Upgrade, $650,000 Already RefundedForesight News reported that Paradex has released an incident investigation report for January 19. During a database upgrade and maintenance on January 19, a race condition occurred when the service was restarted, resulting in data corruption that was published to the Paradex Chain. This triggered a reset of funding rate indices and abnormal liquidations in some markets. The official response was to roll back the chain state to a snapshot taken before the maintenance and to cancel all open orders except for take-profit and stop-loss (TP/SL) orders. Paradex completed an audit of affected accounts within 24 hours and refunded a total of $650,000 from the Liquidator Vault to 200 accounts. This incident marks the first time a rollback operation has been executed on the Paradex Chain. Enhanced service restart procedures, additional data validation safeguards, and price range protection measures during post-only periods have now been implemented. All data inconsistency issues on portfolio and Vault pages are expected to be resolved by January 26.

14:03

Data: If ETH breaks through $3,075, the cumulative short liquidation intensity on major CEXs will reach $1.05 billions.ChainCatcher news, according to Coinglass data, if ETH breaks through $3,075, the cumulative short liquidation intensity on major CEXs will reach $1.05 billion. Conversely, if ETH falls below $2,793, the cumulative long liquidation intensity on major CEXs will reach $1.024 billion.

News