XRP News Today: XRP ETFs Signal a Turning Point in Institutional Adoption of Cryptocurrency

- Bitwise XRP ETF launched on NYSE on Nov 20, 2025, offering regulated access to XRP Ledger's cross-border payment infrastructure. - The 0.34% fee ETF attracted $2.3M in seed capital, with four major firms launching XRP ETFs simultaneously, signaling institutional confidence. - XRP's 3-5 second settlement speed and $1.9B daily volume position it as a scalable solution for global financial infrastructure. - Market analysis shows 149M XRP withdrawn from exchanges, with price projections reaching $5-$10 by 20

The

The ETF comes with a 0.34% management fee,

XRP’s value bounced back from a 9% decline to reach $2.12,

Observers are also assessing the broader impact of these ETF introductions. The Bitwise XRP ETF does carry certain risks. As it is not a registered investment company, it does not provide the same regulatory protections as conventional ETFs and exposes investors to the volatility typical of cryptocurrencies

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: SoftBank's PayPay Connects Japan's Conventional Finance with the Crypto Sector

Adherence to regulations and rapid transaction speeds are driving the widespread adoption of cryptocurrency in mainstream business.

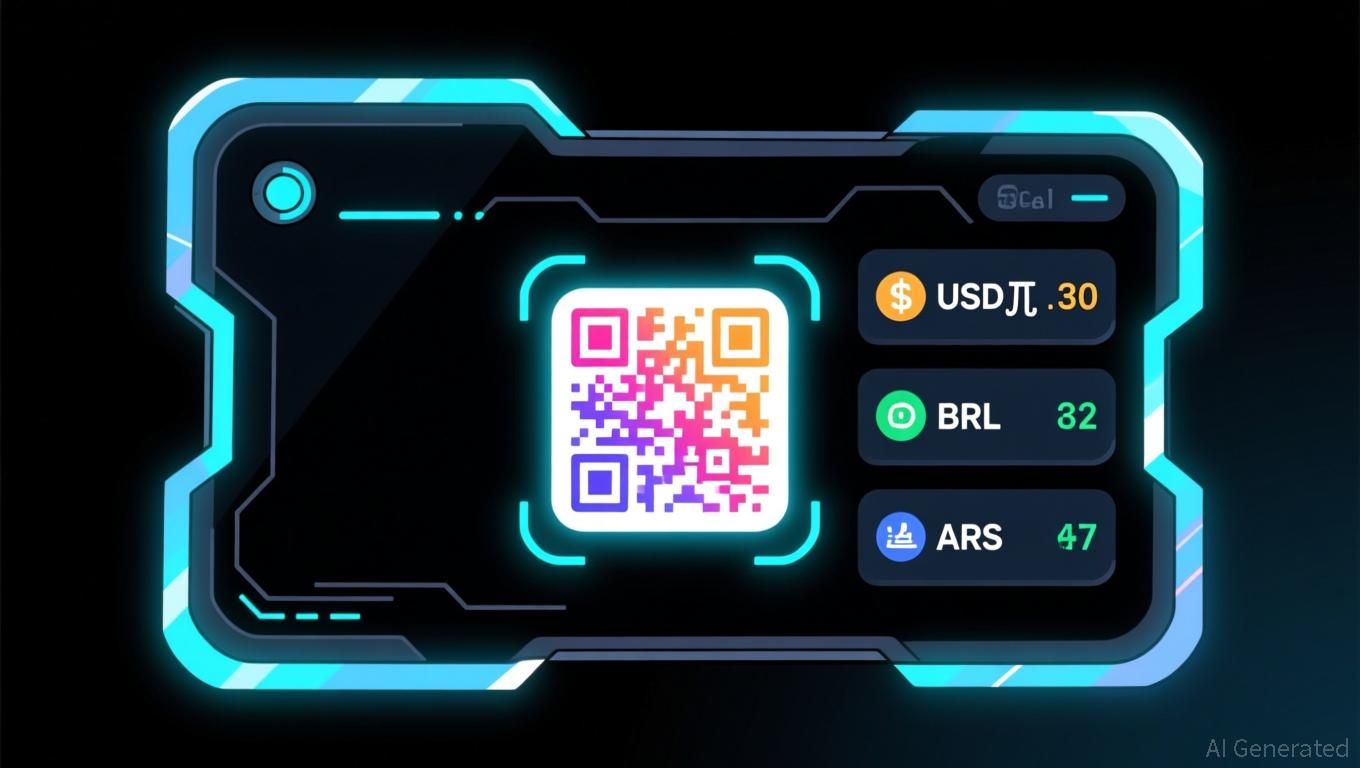

- OwlTing Group's "Invisible Rails" strategy enables rapid deployment of compliant crypto gateways via global licensing across Asia and Latin America. - Opera's MiniPay expands Latin American reach by integrating USD₮ stablecoins with local payment systems like PIX and Mercado Pago. - Grayscale rebrands XRP Trust as GXRP ETF, reflecting growing institutional demand for regulated crypto exposure in global markets. - Industry analysis highlights blockchain's convergence with AI data infrastructure, emphasizi

DASH Experiences a Rapid 150% Jump in Value: Unpacking the Causes Behind the Price Fluctuation

- DASH surged 150% in Q3 2025 after listing on Aster DEX, a hybrid AMM-CEX platform boosting liquidity and attracting institutional interest. - Dash Platform 2.0 upgrades, enhanced privacy features, and SEC regulatory clarity positioned DASH as a stable alternative to volatile DeFi assets. - On-chain metrics showed 50% higher transaction volume and 35% more active addresses, though privacy tools like PrivateSend obscured organic growth verification. - Cybersecurity breaches and whale-driven volatility in l

Vitalik Buterin's Advances in Zero-Knowledge Technology: Driving Ethereum's Growth and Enhancing Investor Profits

- Vitalik Buterin advances Ethereum's ZK innovations, prioritizing scalability and efficiency through Layer 2 upgrades like ZKsync's 15,000 TPS Atlas upgrade. - ZK Stack bridges Ethereum's security with off-chain efficiency, driving 150% token price growth and a projected $90B ZK Layer 2 market by 2031. - Modexp precompile removal increases gas costs but optimizes ZK proofs, reflecting Buterin's focus on long-term sustainability over short-term savings. - Investors face high-reward opportunities as ZK-cent