BlackRock, Nasdaq and the U.S. SEC held a meeting on Bitcoin ETF spot trading

According to a published memorandum, representatives from BlackRock, Nasdaq, and the U.S. Securities and Exchange Commission (SEC) met for the second time within a month to discuss rule changes required for the listing of spot Bitcoin ETFs. The meeting discussed rule changes proposed by Nasdaq Stock Market LLC under Nasdaq Rule 5711(d) for the listing and trading of iShares Bitcoin Trust shares. Nasdaq Rule 5711(d) sets out specific standards and regulatory guidelines for commodity trust shares to be listed and traded on the Nasdaq exchange, detailing requirements for initial listings as well as ongoing listings, along with oversight measures ensuring market integrity and preventing fraudulent activities.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Cathie Wood: The crypto market may have bottomed out, Bitcoin remains the top choice for institutions

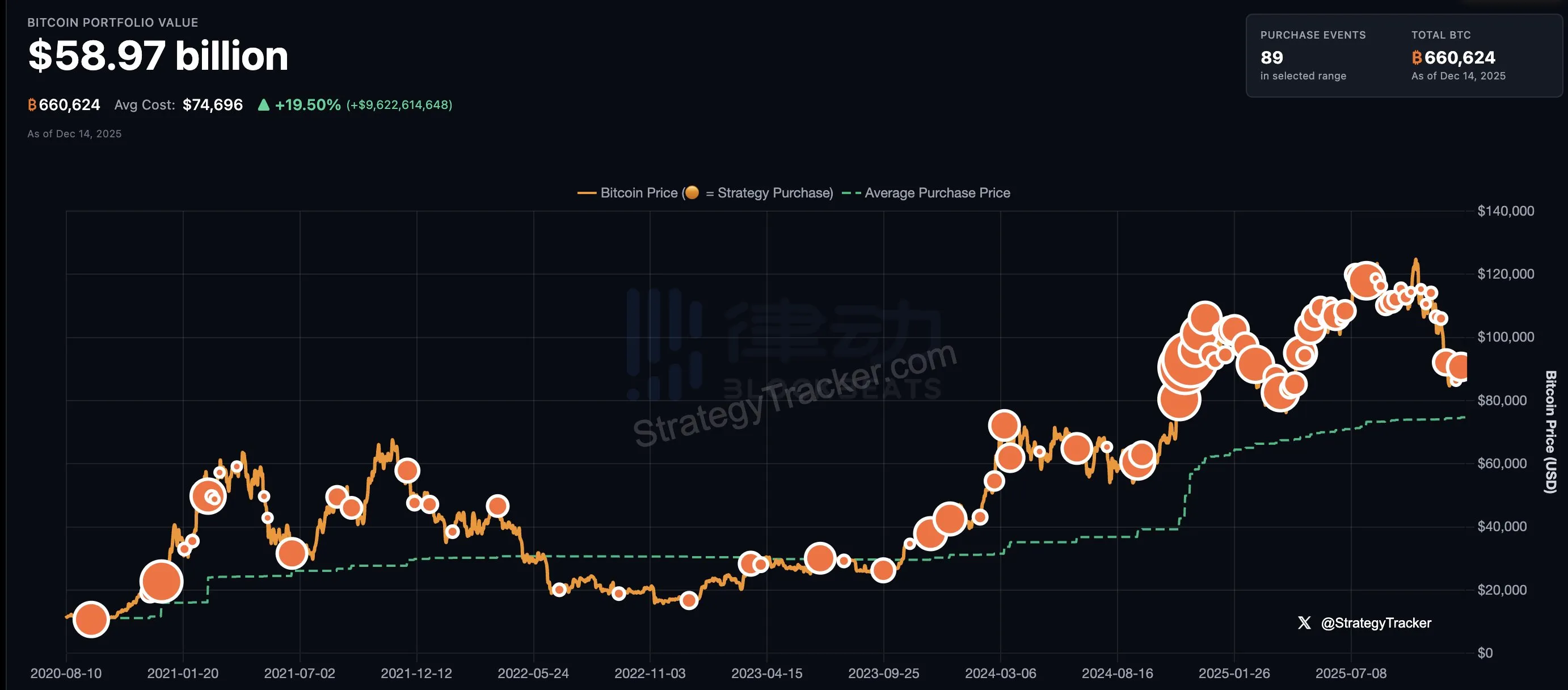

Michael Saylor releases Bitcoin Tracker information again, possibly hinting at another BTC accumulation

Analyst: Bitcoin’s key support level is at $86,000; a breach could trigger a deeper correction

Aevo confirms that the old Ribbon DOV vaults were attacked and lost $2.7 million, and will compensate active users.