Opinion: Explosive Bitcoin Surge to $50,000 Looms Large in January

Executive Summary:

We are expecting the SEC to approve Bitcoin Spot ETFs in January. This should lift Bitcoin prices above $50,000 by the end of January 2024. Many investors have bought shares in Bitcoin mining or related crypto stocks as a proxy.

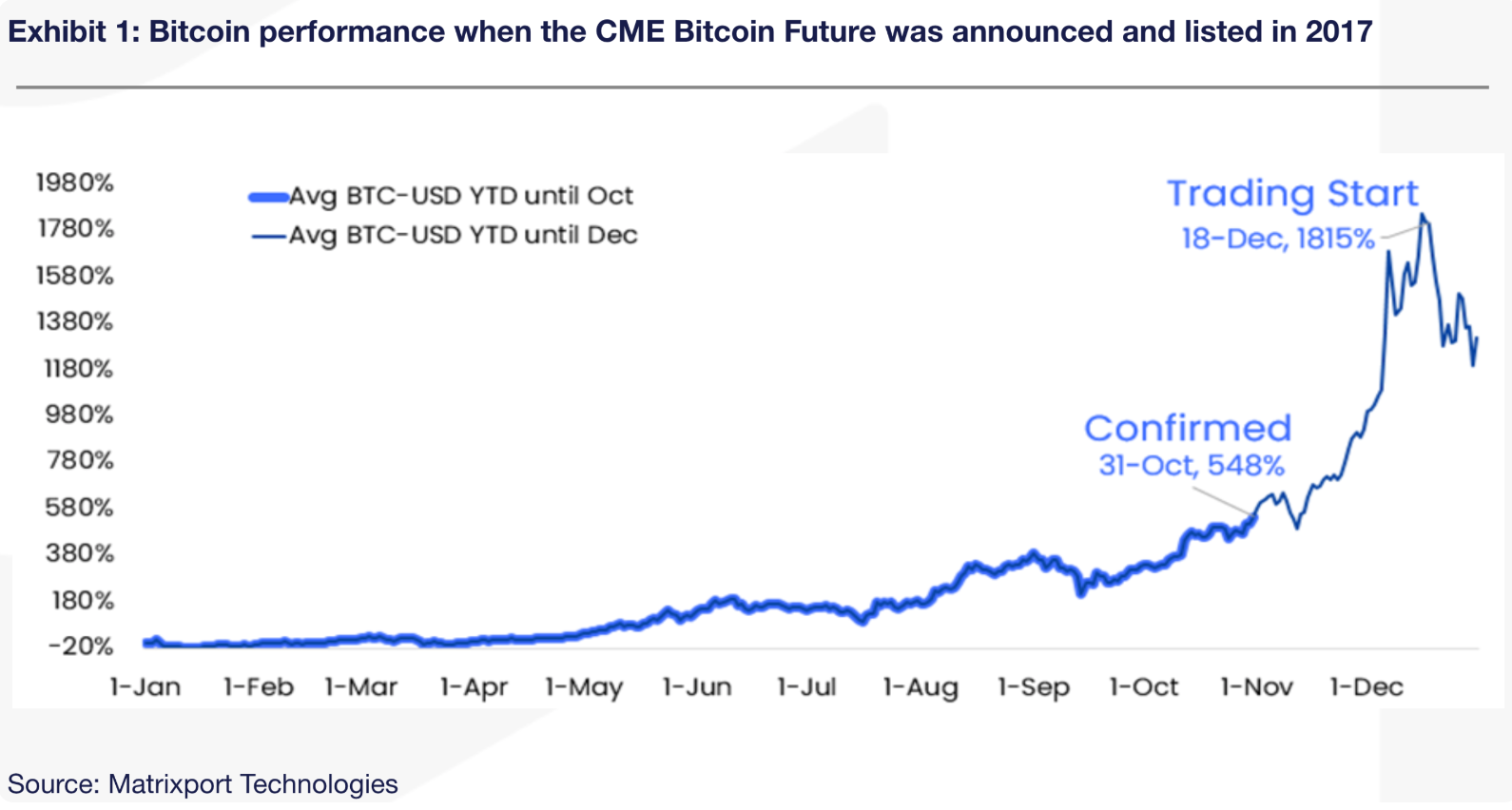

Parallels to historical instances, such as the CME Group's Bitcoin Futures launch in 2017, we note significanT price escalation preceding the event. From the moment the CME confirmed the launch of Bitcoin futures until traders could trade those futures, there was a window of six to seven weeks with prices rising by +196%.

While we foresaw a consolidation period from December 8 until potentially the end of the year, we now expect that Bitcoin could break out. Historically, Bitcoin gradually increased by +3% from Christmas to New Year (December 24 to December 31). Still, a few significant outliers have Bitcoin prices rising in three instances (2011, 2013, and 2020) – sometimes even as much as +22%.

As is typical of ETFs, TV commercials are being rolled out already from multiple ETF applicants, which will continue to support Bitcoin prices. These TV commercials will intensify over Christmas as there is a race to become the dominant ETF player. This also means that Bitcoin has a high chance of breaking higher during Christmas, and we firmly expect Bitcoin to reach $50,000 if Bitcoin Spot ETFs are approved by then.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Experiencing the 10.11 crypto black swan and the CS2 skin market crash, I discovered the death trap of "middlemen"

You think you're profiting from arbitrage, but in reality, you're paying for systemic risk.

PENGU Eyes $0.027 Breakout as Accumulation Phase Strengthens

Shiba Inu Whales Pile In as SHIB Targets $0.0000235 Breakout

Ripple Completes $1.25B Hidden Road Acquisition and Officially Launches Ripple Prime for Institutional Clients