Solana marketing ploy leads to proliferation of scams

Promise of a token airdrop to reward heavy users of Ethereum if they try Solana, becomes fertile ground for fraud

Solana advocates like to drive home the merits of relatively cheap transaction fees on the blockchain, especially in relation to gas paid in ether, on Ethereum mainnet.

A new marketing campaign tokenizes that narrative in the form of LFG, or LessFnGas, which launched on New Year’s Day.

The project targets Ethereum users who have spent at least 2 ether ( ETH ) in gas fees, offering them LFG tokens through an airdrop. Holders of eligible wallets can specify a Solana address to receive the newly created token.

As of 9 am ET, the project said on X that more than 45,000 wallets had claimed the LFG token.

But while the airdrop itself was promoted by Solana co-founder Anatoly Yakovenko, scammers quickly sprung into action, setting up fake versions of the legitimate domain and seeking to phish unsuspecting claimants, often via replies in related threads on X.

Read more: The 5 biggest DeFi hacks of 2023

Bill Lou, co-founder of Nest wallet, reported linking to a Medium post which led him to inadvertently sign a transaction that drained 52 stETH (approximately $125,000).

Each post on X from the official account has scam account replies seeking to take advantage of inattentive airdrop hunters.

LFG, which currently has no utility, was trading at around $0.00007 as of 12 pm ET, making a successful claim worth around $30.

While overtly pitched as a way to onboard some Ethereum users, the dismissive tone of the campaign has alienated others.

“We understand that ETH has led the way for many years,” LessFnGas wrote. “The fact of the matter is, the tech is outdated and for things to move forward, something must be left behind.”

Read more: The 3 biggest DeFi innovations of 2023

The team of 10, which is not disclosed, has reserved for itself 10% of the 1 trillion tokens created (currently worth about $7 million), and promises a second airdrop for those claimants who supply liquidity for the token on decentralized exchanges.

Don’t miss the next big story – join our free daily newsletter .

- airdrop

- Ethereum

- exploit

- Solana

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Is the DA war coming to an end? Deconstructing PeerDAS: How can it help Ethereum reclaim "data sovereignty"?

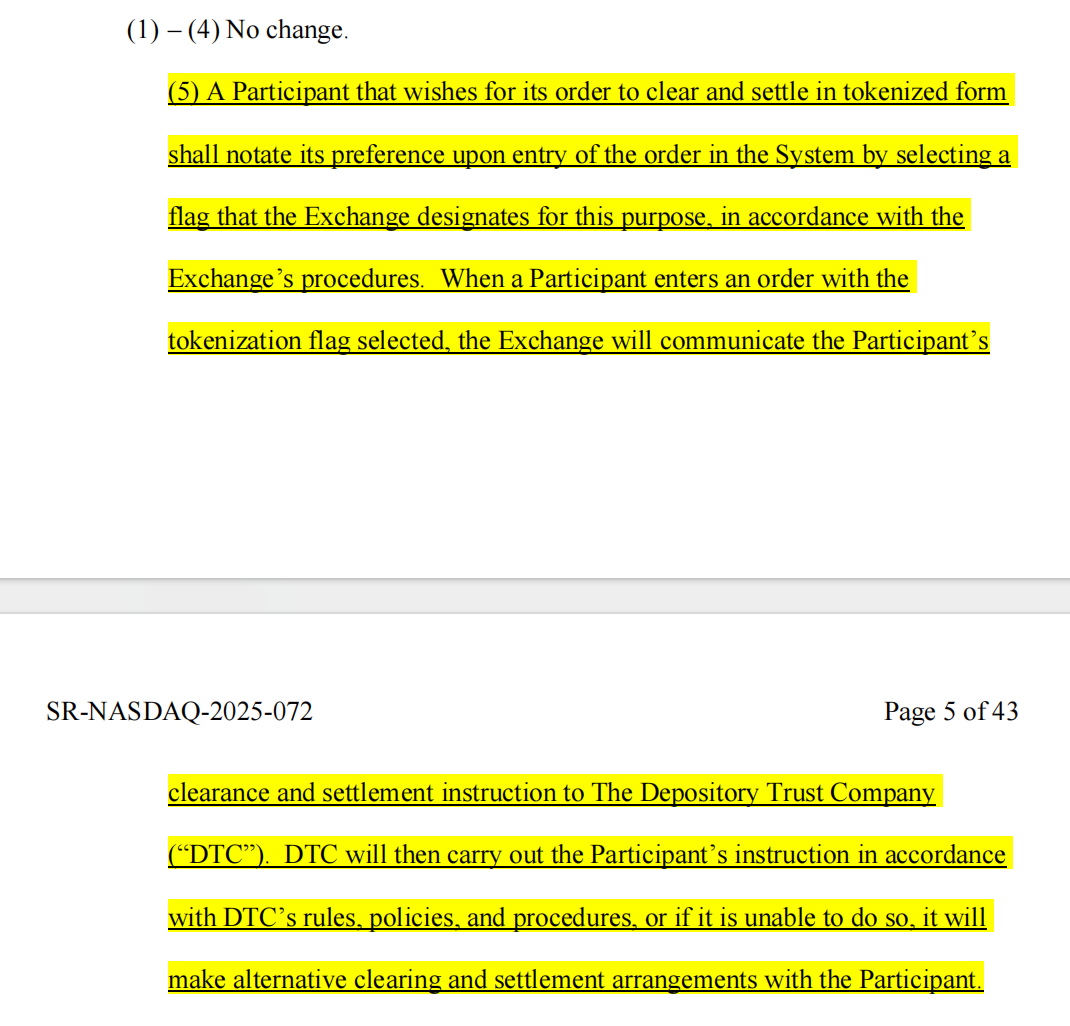

Frontline Report | Web3 Lawyers Interpret the Latest Developments in US Stock Tokenization

Why did the "Insider King" fall into his own trap on October 11?

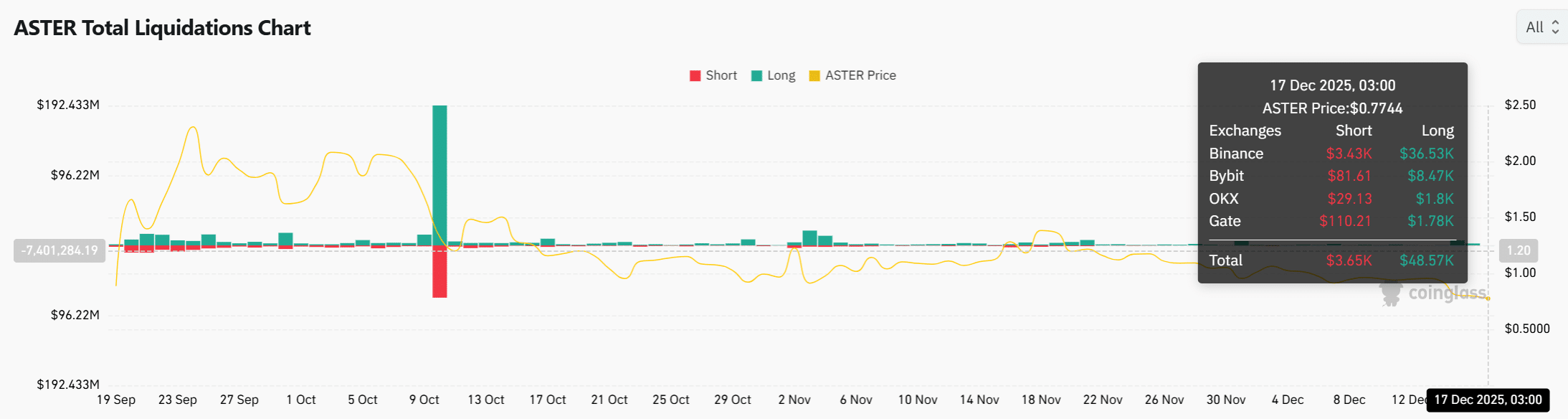

ASTER price sinks as whale losses deepen – Is $0.6 next?