Bitcoin ( BTC ) price witnessed only a 0.3% decline over the past week, but new data suggests there are a few positive catalysts for a potential rally.

Bitcoin has consolidated between the price range of $41,800 and $43,900. While the immediate direction for BTC price is uncertain, there are three factors pointing to a potentially positive short-term outcome.

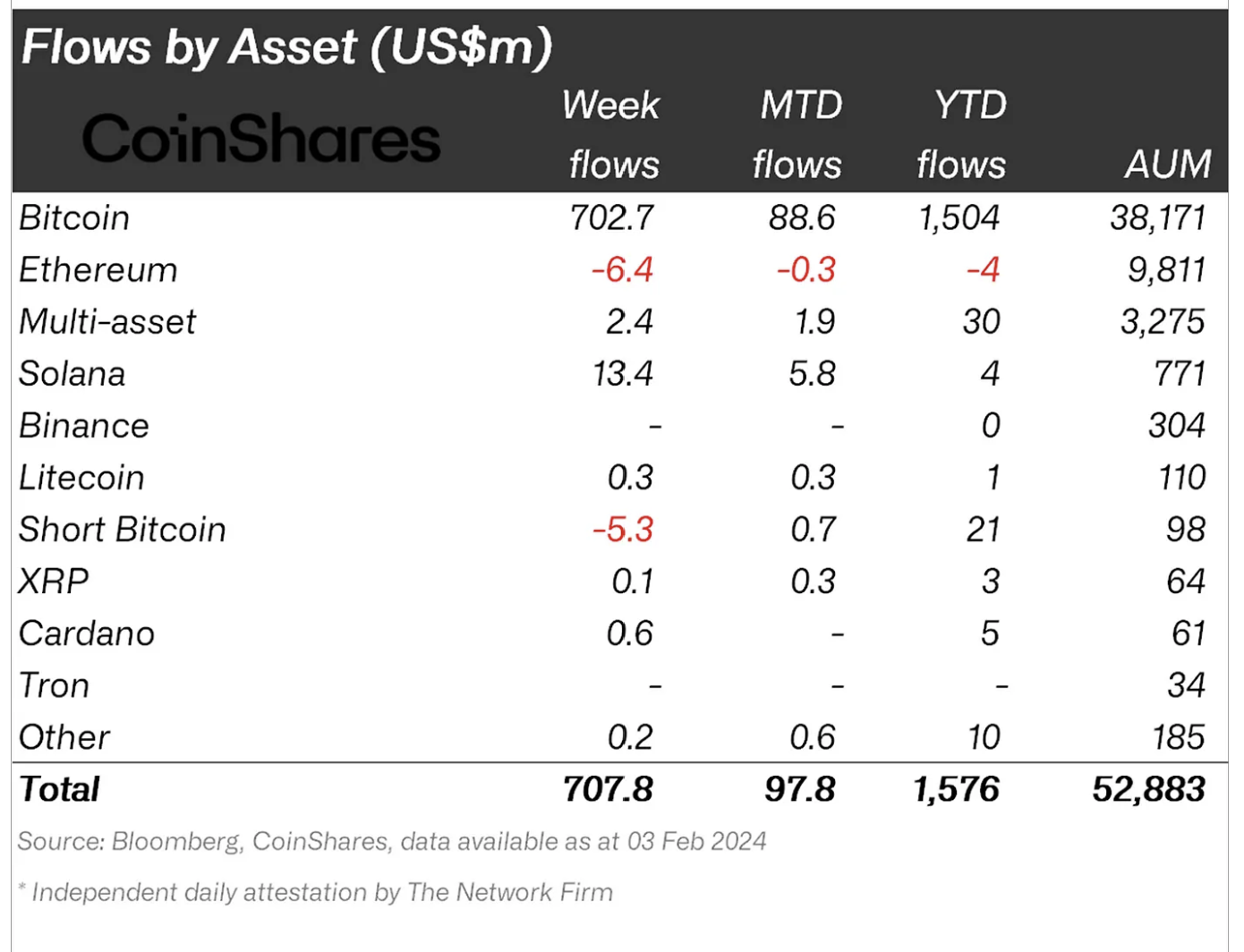

Bitcoin registers $702 million in inflows

According to CoinShares’ reporting, BTC investment products recorded 99% of all inflows. Bitcoin welcomed $703 million inflows, bringing the total global assets under management to $53 billion.

![]()

Crypto institutional asset inflows. Source: CoinShares

Additionally, Grayscale’s GBTC ETF outflows continued to slow down. On the other hand, short-Bitcoin investment vehicles, which make money on declining prices, witnessed minor outflows. It coincides with the reversal of negative sentiment.

It is important to note that BTC investment products faced an outflow of over $500 million at the end of January, and this and aggressive GBTC selling may have played a role in the market correction.

Bitcoin miner reserves increase

![]()

Bitcoin miners were on a selling spree toward the end of January. Miner Netflow Total on Feb. 1 was -13,542 BTC. The metric measures the difference between coins flowing into and out of the exchange. A negative number indicates a drop in miner reserves. However, at the time of publication, over the past 24 hours, more than 2,400 BTC have been added to the miners’ reserve. An increase in reserve means selling pressure from this cohort of

market participants is currently fading.

However, the Miner’s Position Index, or MPI, is still above 1, which means on a one-year average, miners are moderately selling right now. If miner reserve continue to rise over the next few weeks, the MPI index will undergo a decline. An MPI index below 1, indicates miners are moderately holding.

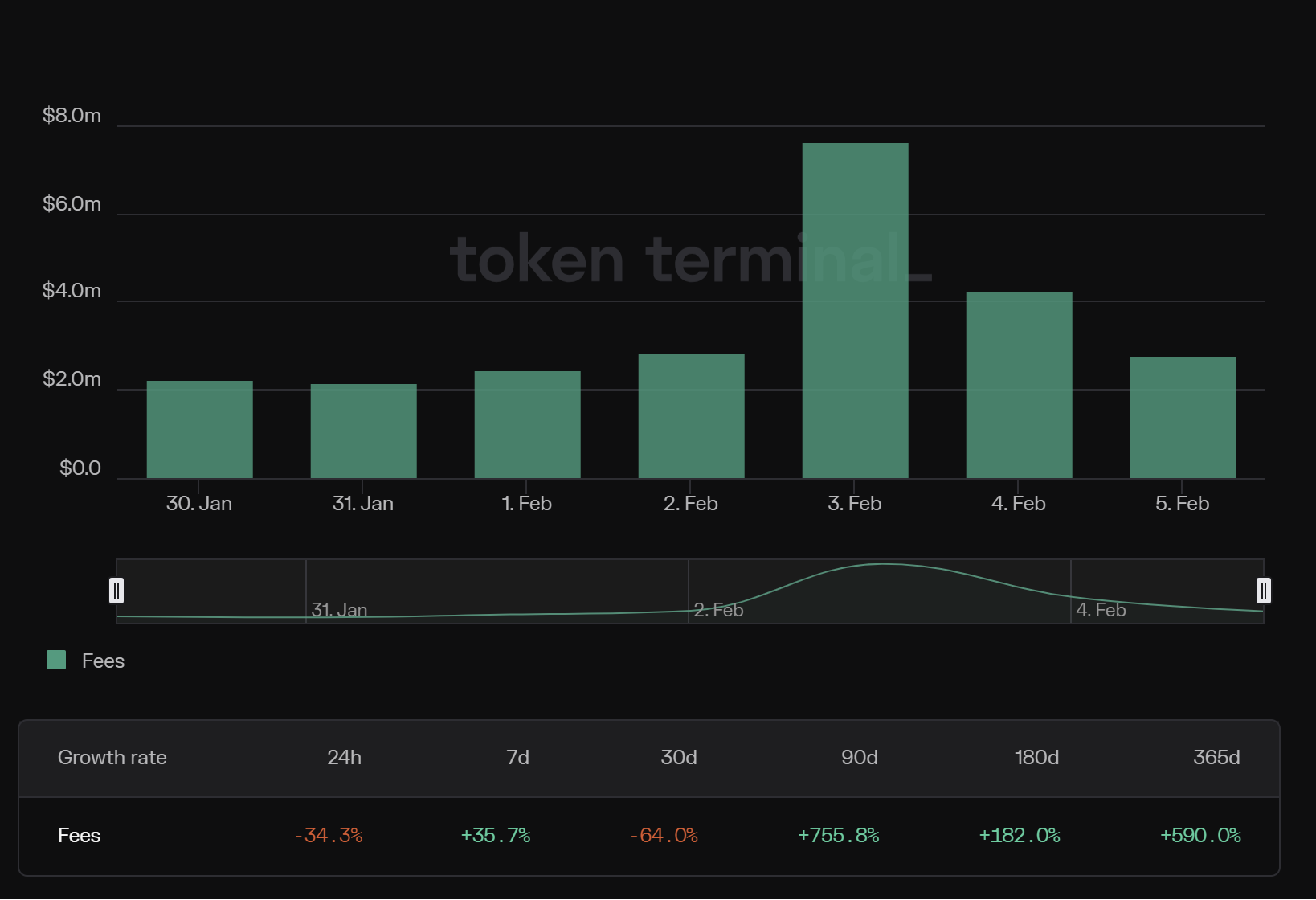

Bitcoin fees rise 35% in a week

The increase in on-chain revenue during a consolidating market is a sign of network demand. According to blockchain analytics provider, token terminal, Bitcoin fees generated over the past week are up by 35.71%.

Bitcoin network fees. Source: token terminal

Increasing utilization of the Bitcoin network can lead to user base expansion. These metrics collectively improve the user base, and price tends to follow a positive route.

If fees are increasing, it means there is a willingness from the users to pay a higher amount to be included in the next block. The current market dynamic indicates that narrative, which might generate positive momentum for BTC in the charts.

Related: BTC price sets new February high as Bitcoin buyers target faraway $25K

Bitcoin price reclaims the 50-EMA

![]()

BTC/USDT daily chart. Source:

TradingView

The daily chart above shows Bitcoin’s immediate resistance around $44,500. While BTC dropped down to $38,500 support on Jan. 23, it immediately recovered a position above its 50-exponential moving average. While the highest overhead resistance is positioned at Bitcoin’s swing high at $49,100, BTC may re-test $44,500 if the current bullish momentum sustains.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.