- INJ sees a slight uptick, now at $34.61, hinting at a bullish reversal amidst $254M trading activity.

- Injective Protocol’s gas-free cross-chain trading fuels popularity, with market cap soaring over $3.2B.

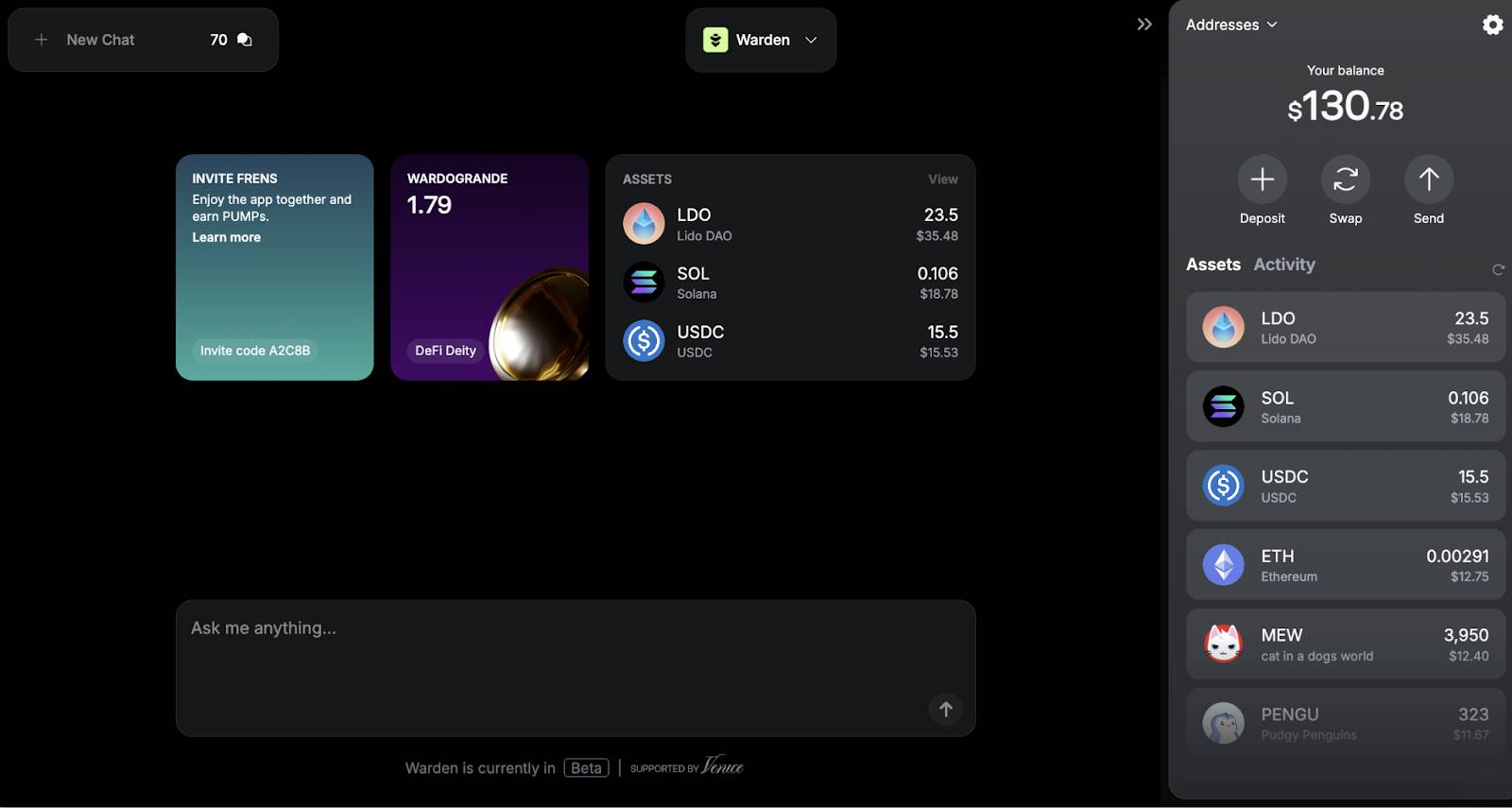

- AAVE eyes the $100 mark after a 0.44% increase, signaling substantial accumulation and potential breakout.

The bearish channel formation of the Injective Protocol (INJ) has been observed recently, attracting the attention of many investors and analysts. At the purchasing price of $34.61, the protocol has had a slight upward trend of 0.97% for the past 24 hours.

INJ/USD 24-hour price chart (source: CoinStats )

If the bullish surge breaks through the intra-day high of $35.87, the next resistance level to watch out for is around $38.50. However, if the bearish momentum persists, the price could return to the $32.00 support level. However, the community expects a bullish reversal, considering the robust framework of INJ and its ability to aid in decentralized finance (DeFi) transactions.

INJ Market Dynamics

INJ’s trading activity has been massive in the past day, getting well above $254 million. This is a strong interest and activity around the asset, which can be seen as a prelude to more volatile price movements in the upcoming period. With a market cap of over $3.2 billion, Injective Protocol is a critical DeFi player, ranked 33 by CoinMarketCap.

As a result, analysts are closely watching the created bearish channel, the breakout of which could result in a bullish trend. This trend would increase INJ’s worth and strengthen its position in the DeFi market. The protocol’s unique way of allowing cross-chain derivative trading without gas fees has been one of the primary reasons for its popularity and adoption.

Aave’s Position

Concurrently, Aave, another significant DeFi player, presents evidence of accumulation, signifying a possible breakout. Aave is now at $93.57, an increase of 0.44% in the last 24 hours. With a market capitalization of about $1.38 billion, Aave is strategically positioned in the lending sector, making it a crucial element to watch.

AAVE/USD 24-hour price chart (source: CoinStats )

If the bulls break above the resistance level of $94.94, Aave’s next target might be the psychological level of $100. This would not only strengthen its position as a significant player in the DeFi industry, but it would also attract other investors and drive additional expansion. If Aave fails to break past the resistance level, it may have a little retreat before attempting another breakout.

The fact that the platform can provide several DeFi products and services, including unique flash loans, among other innovations, keeps it interesting for investors and users. However, many consider this slight surge to lead to a major breakout since the asset shows signs of accumulation.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.