Crypto asset manager Grayscale has continued to see a slowdown in outflows from its spot Bitcoin ETF fund — though observers believe there's still room for further bleeding.

According to data from Bianco Research and Farside , the total outflow of funds from Grayscale’s GBTC since it converted to a spot Bitcoin ETF reached $7 billion as of Feb. 16. However, while the rate of outflow has slowed considerably , observers including ETF Store President Nate Geraci says the bleeding may not be over.

GBTC has $7bil outflows in past 5 weeks…

— Nate Geraci (@NateGeraci) February 19, 2024

What a chart.

Outflows clearly slowing.

Interested to see what happens moving forward.

Play for Grayscale IMO is to launch “mini-GBTC” (spot bitcoin ETF at significantly lower fee). SPDR did this w/ GLD GLDM.

via @biancoresearch pic.twitter.com/NrZnqzUiAi

While January saw the largest portion of the exodus, with $5.64 billion leaving GBTC by the end of the month, February, so far, has only seen $1.37 billion in outflow.

However, while the rate of outflow has slowed considerably , observers including ETF Store President Nate Geraci, believe there could be more bleeding ahead.

In a Feb. 18 post on X, Bianco Research founder and former Wall Street analyst and commentator Jim Bianco believes that much of the outflow is due to investors rebalancing their portfolios and shifting to spot Bitcoin ETFs with lower fees.

He added that the newly launched batch of ETFs has cut their fees to 0 to 12 bps, whereas Grayscale still charges 150 bps.

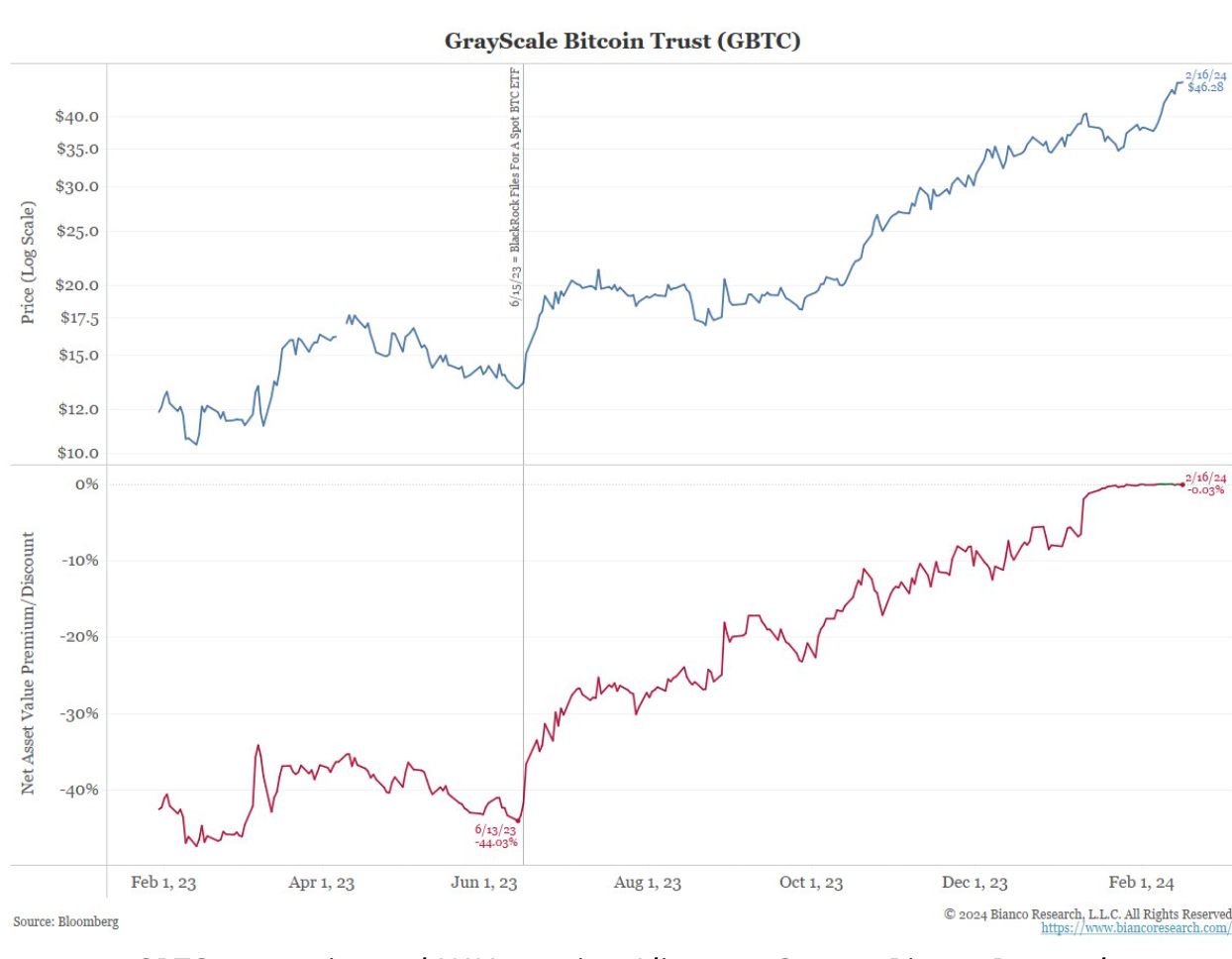

Bianco offered another reason for the continued outflow from Grayscale. The fund traded at a substantial discount to the BTC market price, around a 44% discount to Bitcoin, when BlackRock filed for its spot ETF in June 2023.

“A lot of money flows into ‘cheap’ BTC,” he said before adding:

“When it [Grayscale] converted to an ETF on January 11, 2024, they began to close this ‘arbitrage-type’ trade as their goals were accomplished.”