Bitcoin ( BTC ) price rallied to a new 2024 high at $53,019 on Feb. 20, before abruptly selling off to $50,000 on some exchanges. Traders are citing consistent spot BTC ETF inflows and the upcoming supply halving event as major factors behind the price move, and at the time of publishing, BTC price trades above $52,100.

Bitcoin price rejects at $53K as futures open interest hits a 2-year high

Let’s take a look at the primary reasons why the Bitcoin price is volatile today.

Bitcoin futures open interest hit 26-month high

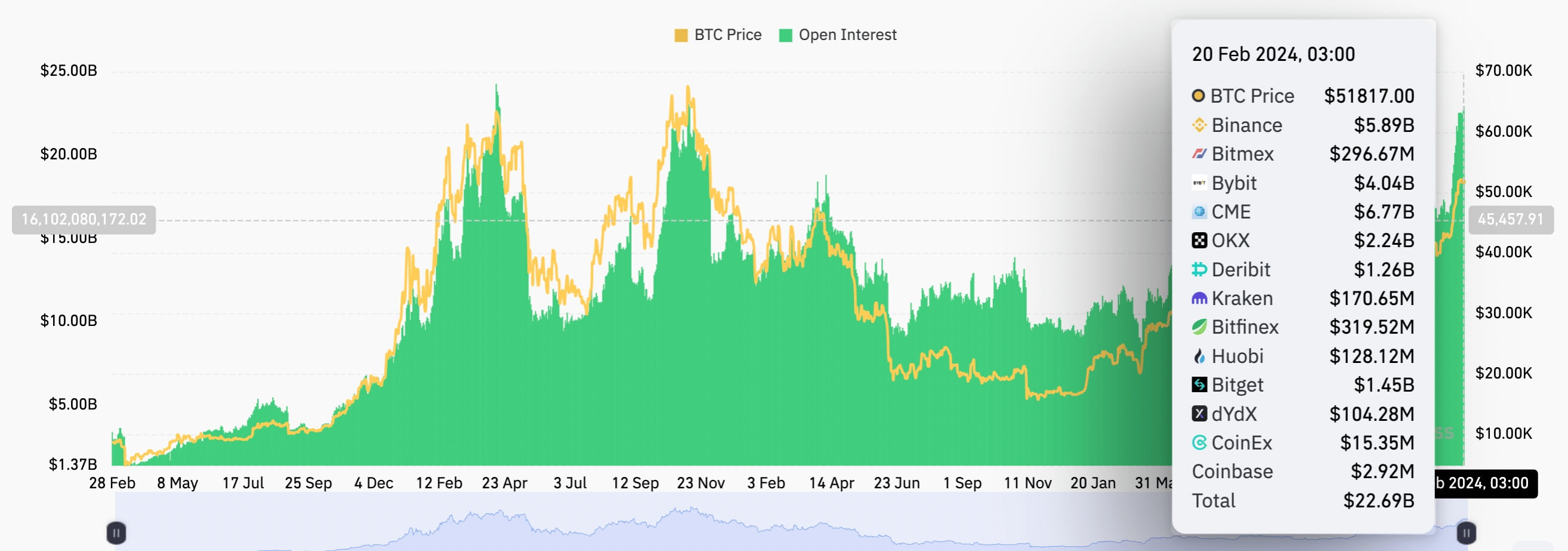

Bitcoin futures open interest (OI) has hit a new yearly high, reaching levels last seen in Number 2021. This indicates increased trading activity around the largest cryptocurrency by market capitalization.

Data from cryptocurrency futures trading and information platform Coinglass shows that the total OI for BTC futures reached $22.69 billion on Feb. 20, the highest since Nov. 11, 2021, closely approaching the peak of $23 billion recorded then.

Bitcoin futures OI increased by more than 30% in 2023, aligning with Bitcoin’s 23% year-to-date rally to $53,000, reaching levels last seen in December 2021.

Open interest reaching $22B, do you remember what happened last time at these levels?

— il Alejandro Of Crypto (@Alejandro_XBT) February 15, 2024

Study 12 Apr '21 and 8 Nov '21 #Bitcoin pic.twitter.com/5KwE2LlJt8

Open interest is a measure of the total value of all outstanding or “unsettled” Bitcoin futures contracts across exchanges, and an increasing value indicates increased market activity and trader sentiment around the pioneer cryptocurrency.

Spot Bitcoin ETF inflows increase

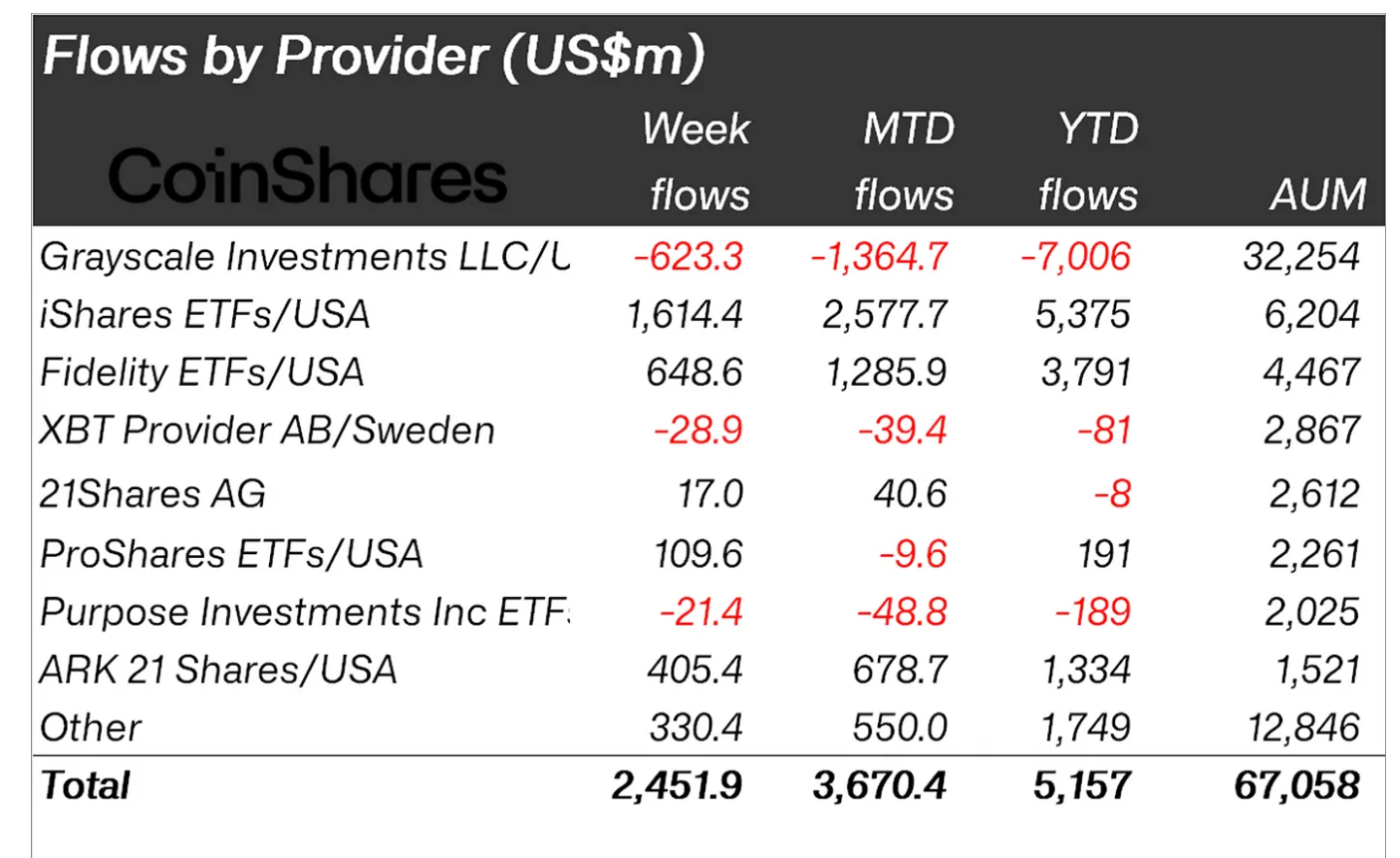

The continued bullish sentiment from investors appears driven by increasing inflows to the spot BTC ETFs even as outflows from gold ETFs increase. Bitcoin has surpassed the $49,000 high reached after the Jan. 10 approval of spot Bitcoin ETFs by the U.S. Securities and Exchange Commission.

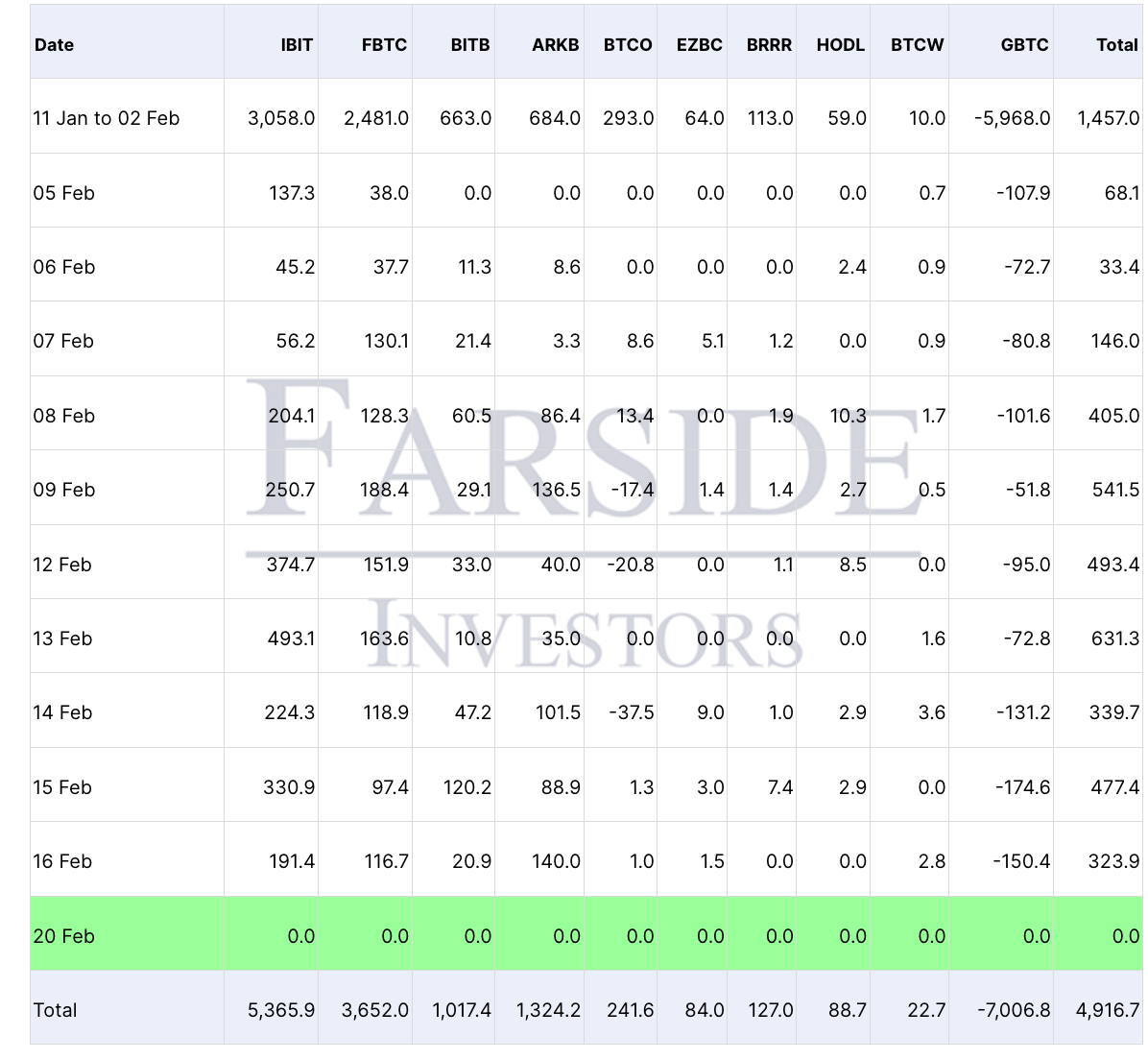

Data from Farside Investors shows that $4.91 billion have been poured into Bitcoin ETFs within six weeks since trading began on Jan. 11.

The total weekly inflows into the newly issued spot Bitcoin ETFs hit $2.5 billion last week, according to CoinShares Digital Asset Fund Flows Weekly Report .

CoinShares analyst James Butterfill said,

“These inflows, coupled with recent positive price moves, have elevated the total assets under management (AuM) to US$67 billion, marking the highest level since December 2021.”

On Feb. 17 financial commentator Tedtalks Macro highlighted the steady increase in net inflow to spot Bitcoin ETFs at an average of $182 million per day, adding, “Post-halving we only need ~$25M of net inflows to spot ETFs per day, to offset the miner production.”

The upcoming Bitcoin halving , which is expected to reduce the rewards given to miners by 50%, is also expected to play a significant part in further fueling investors’ interest in BTC. The halving event has, historically, preceded Bitcoin entering a parabolic uptrend in months after the event.

Related: Bitcoin holdings on Coinbase reach lowest level since 2015 as whales withdraw $1B BTC

Bitcoin traders focus on the next leg up

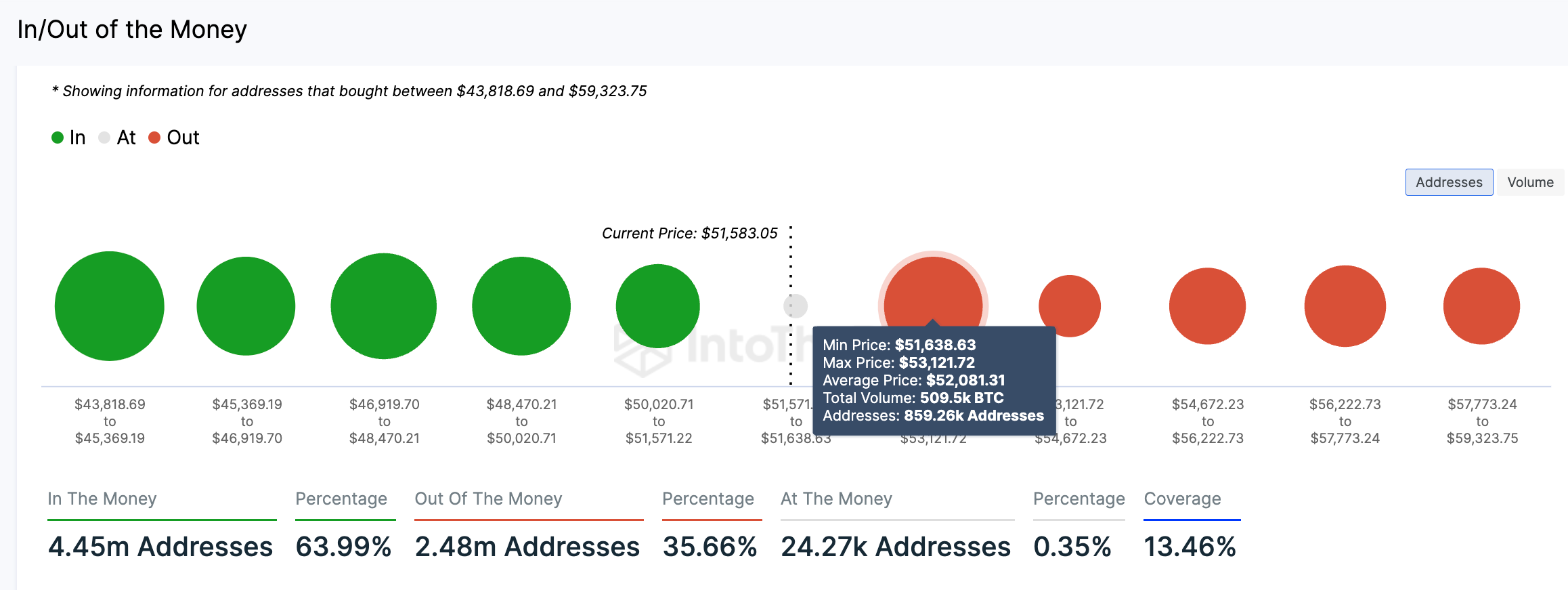

Data from IntoTheBlock show Bitcoin traders focused on the next leg of the current rally. The In/Out of the Money Around Price (IOMAP) model shows a large number of BTCs were previously acquired at an average cost of $52,081. Some of these may be liquidated as the investors break even, suggesting stiff resistance around this area.

What is clear is that traders are determined to see the price hold the price above $52,000. According to independent analyst Ali, the buyers are now bracing for a new battle to defend the support zone between $52,000 and $51,700, and a close above or below this area “will determine the direction of $BTC next move”

On #Bitcoin 10-mins chart, the TD Sequential’s support trendline sits at $51,700 while the resistance trendline is at $52,515. A sustained close outside of this zone will determine the direction of $BTC next move. pic.twitter.com/D0awMEQTxp

— Ali (@ali_charts) February 19, 2024

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Zcash Faces Vitalik Buterin’s Challenge: What Lies Ahead?

In Brief Vitalik Buterin warns Zcash against token-based governance. Zcash community is divided over future governance approach. ZEC Coin struggles with market negativity and volatile price movements.

70M$ inflows this week: Bitcoin ETFs rise again

BlackRock Downplays IBIT Outflows as Bitcoin ETF Market Shows Signs of Recovery