The Cook Capital: With the halving approaching, market volatility increasing, it may be considered to short sell June ATM volatility

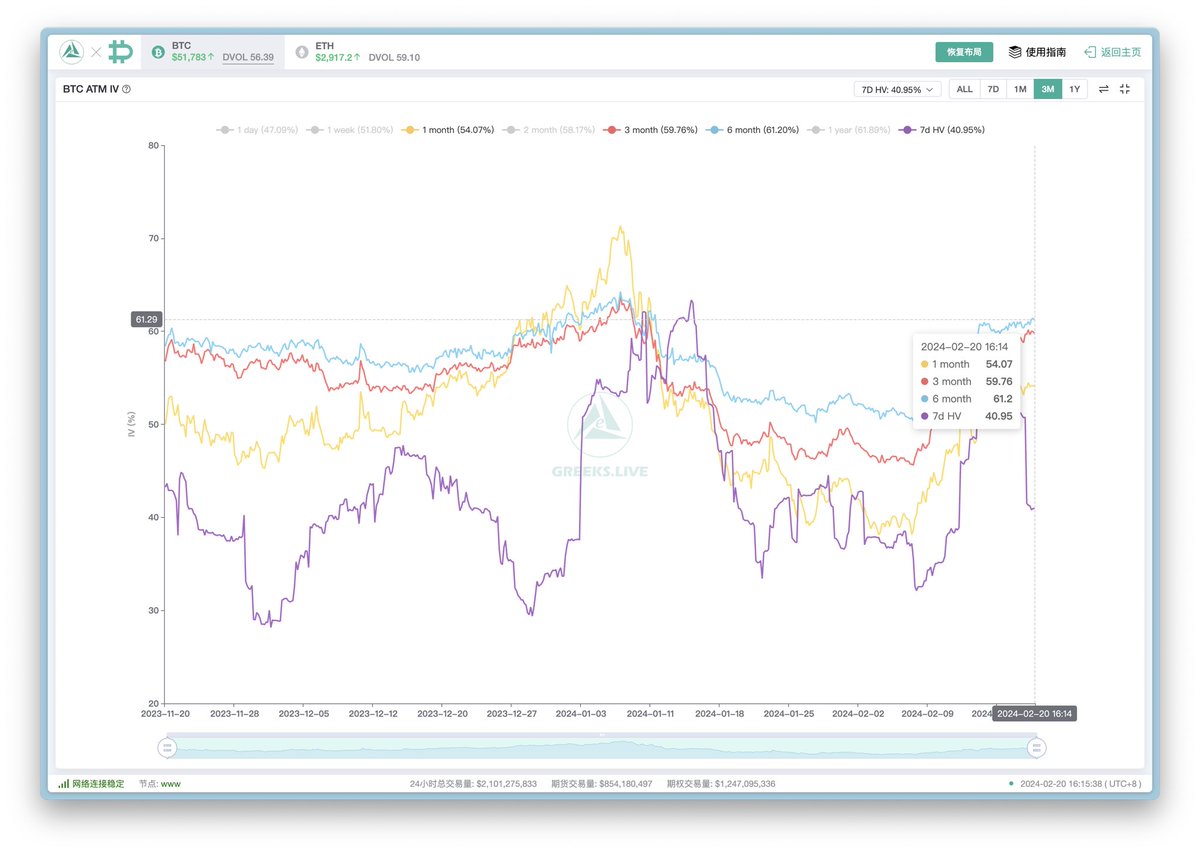

The Cook Capital tweeted: As the halving of BTC approaches in late April, market prices are gradually rising and market volatility is increasing. By the end of June, the volatility has reached 62%, almost the highest point in nearly a year (the last time was 63% on January 8, 2024), and IV at the end of March is also above 50%, with VRP rising across the board.

The last event-driven market movement was when ETFs were approved in January, and IV for June immediately dropped rapidly from its current level of over 60%.

Therefore, we suggest that it is possible to short ATM volatility for June now and dynamically hedge to recover costs. Another more conservative approach is to short ATM volatility for June while going long on OTM options for gamma tail protection in the near term one or two weeks to hedge some tail risks.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.